Lemonade (LMND Stock) – Worth a shot?

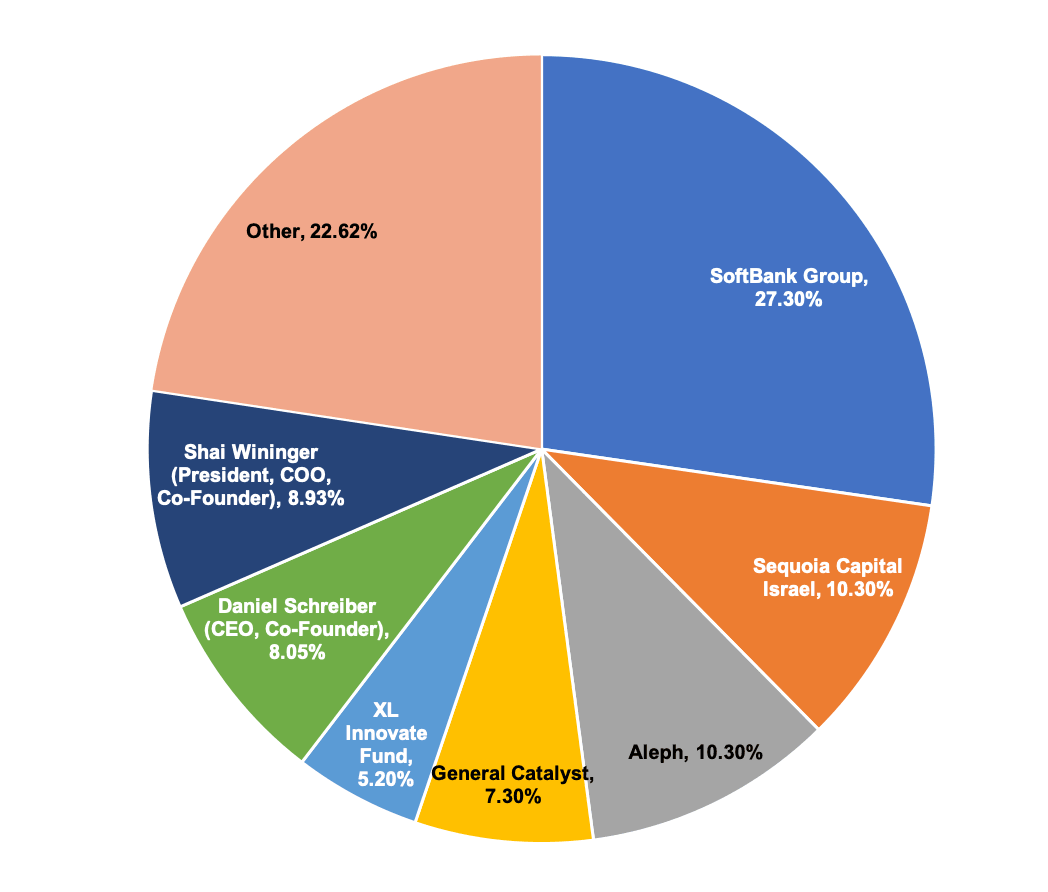

Lemonade is a company that provides insurance products and insurance agency services in the US and Europe. The company was founded in 2015 and has received investments from numerous high-profile investment management firms, including SoftBank, Allianz, and Sound Ventures. The company covers everything from property to personal liability. However, it has had trouble reducing expenditures and becoming profitable, and it doesn’t seem like things will change anytime soon.

A small fish in a large pond

It is widely agreed upon that consolidation is the next step once an industry has reached maturation. The insurance industry matured decades ago, which places any new entrant in a very challenging position. Consolidation in the US began sometime in the middle of the last decade and has slowly spread to other parts of the world. Now, even developing countries such as India are beginning to consolidate.

We see this problem with Lemonade, as the company struggles to make money. It has yet to have a profitable year. However, the company did decide to list on the stock exchange in July 2020. The share price more than doubled during the first day of trading. While the price went as high as $70.80 during the first day, it would rise to over $145 during the next few months, but it has been falling since then and is now trading at below $50.

While this may seem like a problem, especially considering the state of the insurance industry, Lemonade does have a weapon up its sleeve: Its technology.

It’s all online now

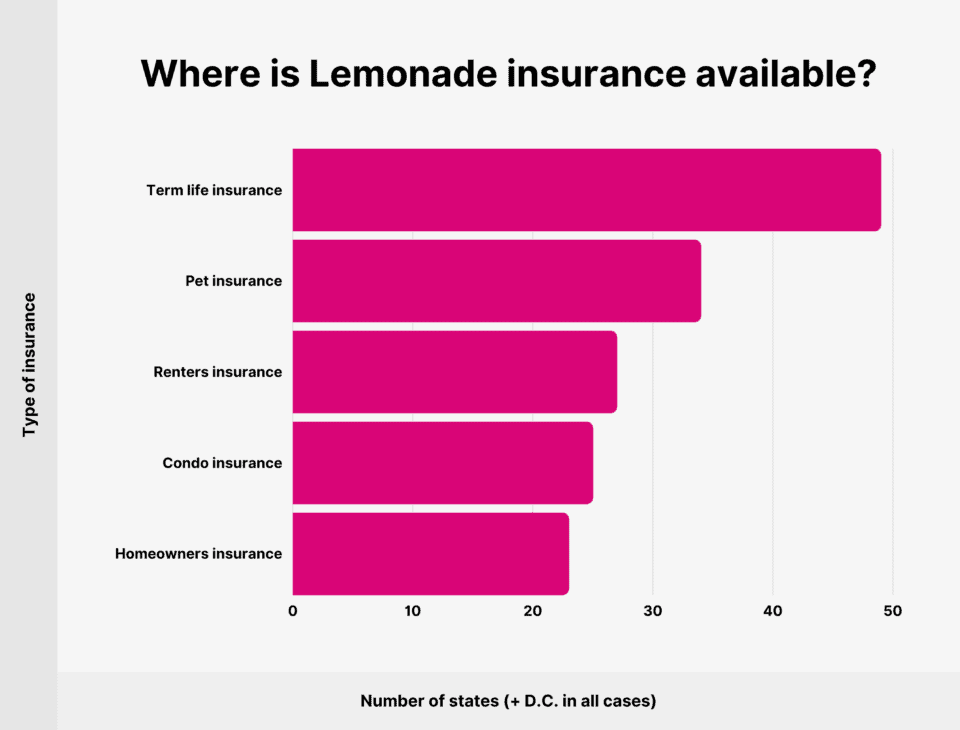

The central selling point of Lemonade is its use of the internet to sell its products. It tries to make the process as simple as possible, allowing people to sign up, pay, and file claims using the app on their phones.

It also tries to be charitable and contribute to society. Lemonade charges a flat fee, and pledges to donate all the funds that remain after paying claims to charity. However, the problem is obvious: No matter how good your intentions are, a company needs to make money.

Lemonade generated a revenue of $94.4m in FY20. By FY23, the revenue is expected to be $334m. This is monstrous growth. However, the company’s net income is also expected to go from a loss of $122m in FY20 to a loss of $260m in FY23. This makes analyzing when the company will be profitable challenging.

The easiest way to determine this is through the net margin. Over the same period, the figure is expected to decline from -130% to -78%. The most straightforward conclusion to draw from this is that while Lemonade will grow rapidly and lose a smaller amount of money in the years to come, it is still a long way away from profitability.

Lemonade is trying to speed up the process of becoming profitable. It is currently in the process of acquiring Metromile. Metromile is another tech-based insurance company specifically focusing on car insurance and can offer both collision and comprehensive car insurance. Both businesses are currently operating at a loss, but it is expected that a merger will lead to increased efficiency.

Lemonade must be approached differently

Lemonade Aspires to be considered among the best car insurance companies in the US and launched its own car insurance platform, Lemonade Car, in November 2021. Analysts expect it to be a huge revenue stream for the company in the years to come, and acquiring Metromile will only aid in this regard.

While Lemonade is difficult to value properly due to its disruptive nature and the fact that it is competing against extremely large conglomerates, the company’s current growth trajectory is expected to continue for the foreseeable future.

Investors should understand that Lemonade is a risky investment that could continue to fall for the foreseeable future. A lot of people certainly hold this belief, as Lemonade is one of the most heavily shorted stocks currently trading. The short position as a percentage of the total float is over 35% and has grown by over 7.5% during the month of December.

However, this could be an ideal opportunity for investors that want to take excessive risks that could pay off really well down the line. There are also rumors of Lemonade being the next meme stock that will be short-squeezed, so that is also something that investors should keep in mind.

Overall, it is challenging to justify Lemonade as an investment based on its fundamentals. However, it has enough going for it that it might be a good idea to have it as a small part of your portfolio, especially considering that it is trading at extremely low valuations relative to its historical price.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Baruch Silvermann

The Smart Investor

Baruch Silvermann is a personal finance expert, investor for more than 15 years, digital marketer and founder of The Smart Investor.