- NASDAQ:LCID extended its advance on a positive market's mood.

- Production Preview Week kicks off on Monday as Lucid inches closer to deliveries.

- Tesla CEO Elon Musk believes the chip shortage is coming to an end.

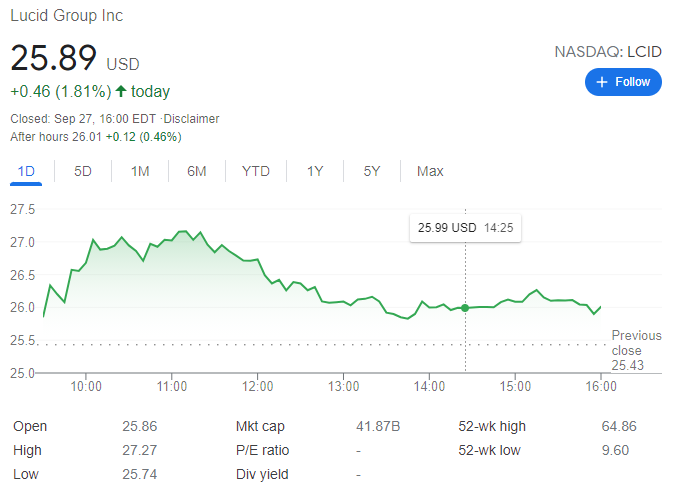

Update September 28: NASDAQ: LCID retreated sharply from multi-day tops of $27.27 but managed to end Monday with 1.81% gains at $25.89. The negative close on the Nasdaq Composite failed to deter Lucid group optimists, as they preserved a part of the daily gains. The shares of LCID rally heading into its production preview events at its Advanced Manufacturing Plant (AMP-1) factory in Casa Grande.

NASDAQ:LCID dropped lower out of the open today, but thanks to a late day surge, the stock managed to post back to back positive sessions. Lucid shares eked out a small gain as the stock rose by 0.04% on Friday, and closed the trading day at $25.43. The electric vehicle maker outpaced the NASDAQ index, which was the only major index to close the session lower. It was a mixed day for EV stocks, as Tesla (NASDAQ:TSLA) jumped higher by 2.75%, while major Chinese EV makers including Nio (NYSE:NIO), XPeng (NYSE:XPEV), and Li Auto (NASDAQ:LI) all closed the week in the red.

Stay up to speed with hot stocks' news!

Next week marks the start of Lucid’s Production Preview Event, where investors, media, and customers will be able to get an indepth look at Lucid’s Arizona facility. For the first time, Lucid Air sedans will be available to the public for test driving, and many investors are hoping that a delivery date will be announced by CEO Peter Rawlinson. With over 10,000 reservations in the queue, investors and customers will be anxiously waiting to hear about Lucid’s delivery program.

LCID stock price forecast

Tesla CEO Elon Musk had some interesting comments on Friday about the ongoing global chip shortage that has affected multiple EV makers around the world. Musk stated that he believes with the production of chip fabrication plants around the world, the chip shortage should be over by 2022. Tesla itself recently entered discussions with Samsung to produce the next generation Full Self Driving chips for its vehicles.

Previous updates

Update: NASDAQ:LCID ended Monday up 1.81% at $25.89 per share. Despite up, it ended the day far from its intraday high of $27.26 as optimism among Wall Street's traders faded throughout the day. The Nasdaq Composite finished the day in the red, down 77 points of 0.52%, while the S&P 500 lost 6 points. The Dow Jones Industrial Average managed to settle in the green, up 73 points.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD languishes near multi-year low after RBA meeting minutes

AUD/USD remains depressed after the December RBA meeting minutes reiterated that upside inflation risks had diminished, which reaffirms bets for a rate cut in early 2025. This, along with concerns about China's fragile economic recovery and US-China trade war, undermines the Aussie and weighs on the currency pair.

USD/JPY sticks to positive bias after BoJ meeting minutes

USD/JPY holds steady above the 157.00 mark and moves little following the release of the October BoJ meeting minutes, emphasising a cautious approach to monetary policy amid domestic and global uncertainties. Adding to this, doubts over when the BoJ will hike interest rates again, which, along with a positive risk tone, undermines the safe-haven JPY.

Gold flat lines above $2,600 ahead of holiday trading week

Gold price trades flat around $2,610 during the early Asian session on Tuesday. Markets face a relatively quiet trading session ahead of the holiday trading week. The US Richmond Fed Manufacturing Index for December is due later on Tuesday.

Ethereum risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.