LCID Stock News: Lucid Group Inc advances as Tesla's shareholder meeting looms

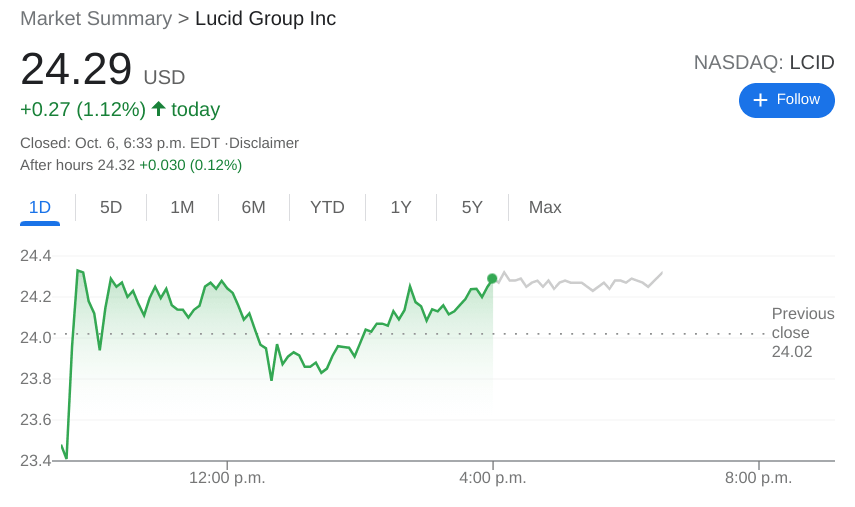

- NASDAQ:LCID gained 1.12% during Wednesday’s session.

- More reviews pour in for the Air sedan including from Car and Driver.

- General Motors has its targets set on Tesla in the U.S. EV race.

Update October 7: Lucid Group Inc (NASDAQ: LCID) has been extending its gains, trading at around $24.50 at the time of writing. The electric vehicle world is focused on Tesla and its celebrity founder Elon Musk. The industry leader is holding its closely watched annual shareholders meeting, and that is grabbing attention from other EV-makers – allowing Lucid to shoot higher.

NASDAQ:LCID has been showered with praise from the automotive industry, and the company has yet to even announce a delivery date for its vehicles. Shares of Lucid gained 1.12% on Wednesday, and closed the tumultuous trading session at $24.29. Growth stocks saw a nice rebound into the closing bell as the looming debt ceiling deadline was extended until December by Senate GOP leader Mitch McConnell. The electric vehicle sector traded mostly flat though with Tesla (NASDAQ:TSLA), XPeng (NYSE:XPEV), and Li Auto (NASDAQ:LI) edging higher, and Nio (NYSE:NIO) and Fisker (NYSE:FSR) closing the day lower.

Stay up to speed with hot stocks' news!

More reviews are pouring in for the Lucid Air Dream sedan, its flagship EV model. A key automotive publication, Car and Driver, posted a sparkling review for Lucid, calling the vehicle ‘brilliance’ and an impressive debut effort from the company. Familiar praise for features like the record-breaking range per charge, smooth driving experience, and roomy interior were echoed by the site. Most of the reviews have been stunningly positive so far, which has made anticipation for the official release and delivery of the Lucid Air grow to an all-time high.

LCID stock price forecast

General Motors (NYSE:GM) is taking aim at Tesla according to a report on Wednesday. The legacy automaker is pushing to increase its annual revenue to $280 billion by 2030, and is making major changes to its digital footprint to be more like Tesla. Part of its plans include releasing a $30,000 EV crossover that will appeal to the masses. More of its plans will be unveiled at an Investor Day event that will be scheduled sometime in the near future.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet