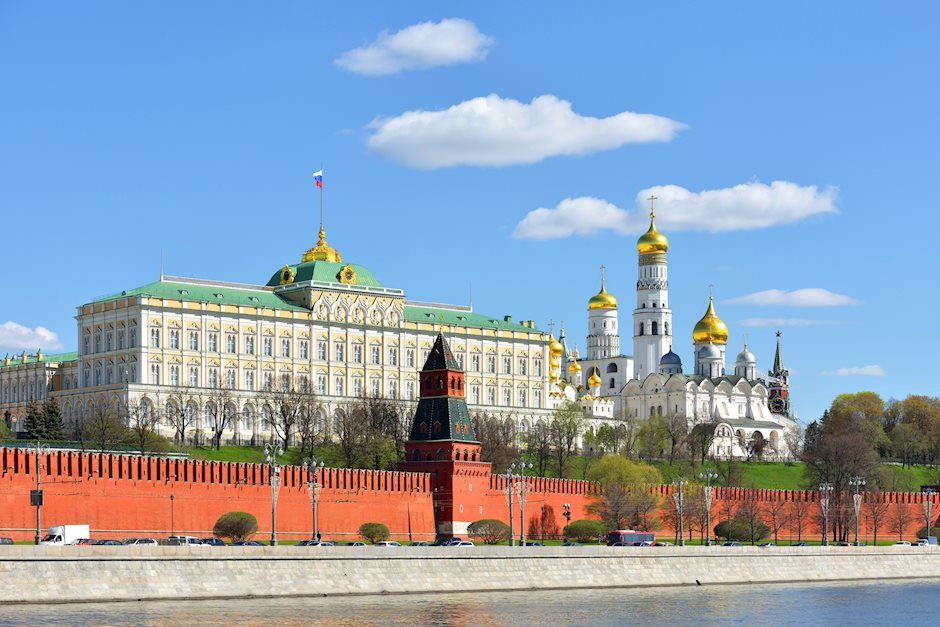

Kremlin declines to comment on Bucha allegations and how they will affect peace talks

The Kremlin, in a statement on Monday, declined to comment on Bucha allegations and how they will affect the talks.

The Russian government office said it condemns comments by the leader of Poland's ruling party saying Warsaw would be open to having US nuclear weapons on its soil.

“Such action would only lead to heightened tensions,” the Kremlin added.

On Sunday, Ukraine accused Russia of genocide after mass graves and 20 bodies in civilian clothes were recovered from Bucha town on the outskirts of the capital city of Kyiv, per AFP.

World leaders condemned those atrocities in Bucha while Russia denied the allegations, calling it a ‘provocation’ by Ukraine.

In light of the Russian attacks on innocent civilians, the European Union (EU) is preparing further sanctions against Moscow.

Polish Prime Minister Mateusz Morawiecki responded by saying, "The crimes Russia has committed on close to 300 inhabitants of Bucha and other towns outside Kyiv must be called acts of genocide and be dealt with as such.”

"Everyone responsible - directly or indirectly- must be severely punished by an international tribunal,” he added.

Market reaction

The S&P 500 futures are seen recovering after a brief pullback in the last hour while the European stocks are also clawing back early losses. Despite a better mood, investors will remain on the edge ahead of another round of peace talks between Russia and Ukraine.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.