KOSPI composite index Elliott Wave technical analysis [Video]

![KOSPI composite index Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/bloomberg-app-on-iphone-4-with-market-data-17118657_XtraLarge.jpg)

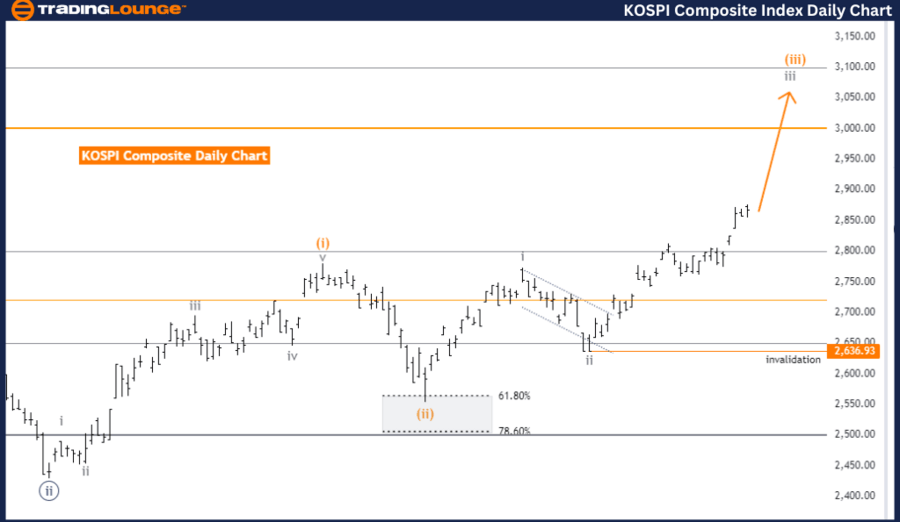

KOSPI composite Elliott Wave analysis - Day chart

Overview

-

Function: Trend.

-

Mode: Impulsive.

-

Current Wave Structure: Gray wave 3.

-

Position: Orange wave 3.

-

Next lower degree direction: Gray wave 4.

-

Wave cancel invalid level: 2636.93.

Detailed Analysis

The KOSPI Composite Elliott Wave Analysis on the day chart provides a comprehensive view of the current trend and wave structure of the KOSPI index. The analysis identifies the market as being in a clear, directional trend, with the mode being impulsive, indicating a strong market movement.

-

Current Wave Structure: The market is currently in gray wave 3, which suggests a significant and forceful move. Within this structure, the position is orange wave 3, part of the larger gray wave 3, indicating a robust and pronounced wave within the broader impulsive wave.

-

Next Lower Degree Direction: After the completion of the current wave, the market is expected to transition into gray wave 4, a corrective phase. This phase will likely follow the completion of the ongoing impulsive wave.

-

Details: Gray wave 2 has completed, marking the end of the previous corrective phase. Now, gray wave 3 of 3 is active, indicating a strong upward movement. The wave cancel invalid level is set at 2636.93, meaning if the index falls below this level, the current wave analysis becomes invalid.

Summary

The KOSPI Composite index is in an impulsive trend on the day chart, with gray wave 3 currently active. Following the completion of gray wave 2, the index has entered gray wave 3 of 3, indicating a significant upward movement. Traders and analysts use this information to predict market behavior and make informed trading decisions. They anticipate the transition to gray wave 4 after the current wave completes. The critical point for validating the current wave analysis is the wave cancel invalid level at 2636.93.

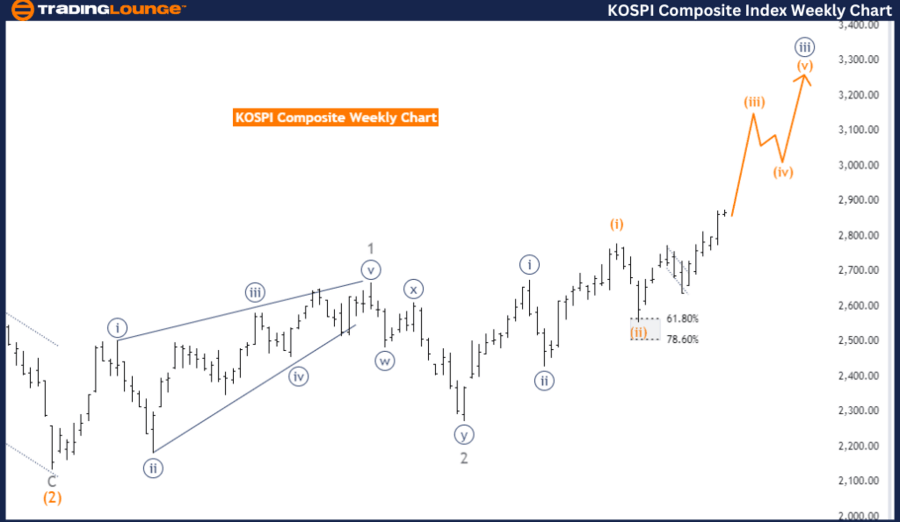

KOSPI composite Elliott Wave analysis - Weekly chart

Overview

-

Function: Trend.

-

Mode: Impulsive.

-

Current wave structure: Orange wave 3.

-

Position: Navy Blue Wave 3.

-

Next lower degree direction: Orange wave 4.

-

Wave cancel invalid level: 2636.93.

Detailed Analysis

The KOSPI Composite Elliott Wave Analysis on the weekly chart provides a comprehensive view of the current trend and wave structure of the KOSPI index. The analysis identifies the market as being in a clear, directional trend, with the mode being impulsive, indicating a strong market movement.

-

Current Wave Structure: The market is currently in orange wave 3, signifying a dynamic and forceful phase. Within this structure, the position is navy blue wave 3, part of the larger orange wave 3, indicating a vigorous and pronounced upward movement within the broader impulsive wave.

-

Next Lower Degree Direction: After the completion of the current wave, the market is expected to transition into orange wave 4, a corrective phase. This phase will likely follow the completion of the ongoing impulsive wave.

-

Details: Orange wave 2 has completed, marking the end of the previous corrective phase. Now, orange wave 3 of 3 is active, indicating a strong upward movement. The wave cancel invalid level is set at 2636.93, meaning if the index falls below this level, the current wave analysis becomes invalid.

Summary

The KOSPI Composite index is in an impulsive trend on the weekly chart, with orange wave 3 currently active. Following the completion of orange wave 2, the index has entered orange wave 3 of 3, indicating significant upward momentum. Traders and analysts use this information to predict market behavior and make informed trading decisions. They anticipate the transition to orange wave 4 after the current wave completes. The critical point for validating the current wave analysis is the wave cancel invalid level at 2636.93.

Technical analyst: Malik Awais.

KOSPI composite Elliott Wave analysis - Weekly chart [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.