- NYSE: KODK has consolidated its gains after a probe reportedly found no misconduct.

- Government funds to promote coronavirus-related products may boost the stock.

- A relatively low valuation may also provide room for gains.

Is it a Kodak moment for investors? Those old enough to remember the glory days of the Eastman Kodak Company (NYSE: KODK) and everybody else, may brace for gains. The veteran of analog photography succumbed to the emergence of digital cameras and later smartphone cameras but has reemerged in the medical field.

Kodak's shares leaped in the summer when the US government awarded it a loan of $765 million for making materials needed for COVID-19 drugs. Anything related to curing the disease that grips the world received investors' attention.

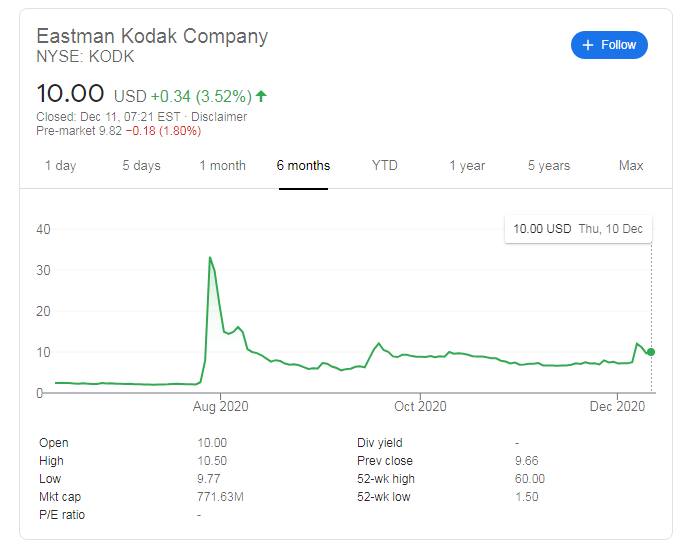

However, KODK tumbled after it was revealed that the firm was under investigation by the International Development Finance Corp for misconduct. The former film firm rose once again from the ashes after the Wall Street Journal reported that the probe found no misconduct.

Where next for the firm?

Kodak stock price

Covid is far from being resolved, as yet another day with more than 3,000 US deaths reminds investors. With the federal loan now back in play, Kodak may have more room to rise while id deploys the funds toward sales of these materials.

Another positive factor for the stock is that despite its recent bounce, market capitalization remains a minuscule $771 million. That comes against total revenue of $1.242 billion in 2019. It is enough to compare the valuation of the firm to the government grant to see that – if the government aid is successfully deployed – there is an upside for the stock.

After closing at $10 on Thursday, NYSE: KODK still trades below the weekly peak of $12.04 and under the August high above $16. Reaching the late July close of $33.20 or the 52-week high of $60 seems like a tall order at this point. Support awaits at $7.53, the pre-relief-rally high.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stuck around 1.0500 as investors await fresh catalysts

EUR/USD seesaws around the 1.0500 level, unable to find a clear directional path. EU PMI data came in better than expected but still indicate contraction in the Union. United States PMIs show a steeper contraction in the manufacturing sector yet upbeat services output in December.

Gold stuck around $2,650 ahead of fresh clues

Gold opens the week on a moderately positive tone and trades above $2,650, favored by a mild US Dollar (USD) reversal amid lower US Treasury yields. The precious metal, however, is still close to recent lows following a 2.5% sell-off late last week.

Crypto Today: MicroStrategy drives BTC to $107K as Fed cut hype sparks Ondo, Chainlink rallies

The global crypto market snapped out of a tepid start to the month after hotter-than-expected consumer inflation data sparked hopes of a third consecutive US Fed rate cut.

Five fundamentals for the week: Fed dominates the last full and busy trading week of the year Premium

Christmas is coming – but there's a high likelihood of wild price action before the holiday season begins. Central banks take center stage, and there is enough data to keep traders busy outside these critical decisions.

Five fundamentals for the week: Fed dominates the last full and busy trading week of the year Premium

Christmas is coming – but there's a high likelihood of wild price action before the holiday season begins. Central banks take center stage, and there is enough data to keep traders busy outside these critical decisions.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.