NZD/USD: Kiwi stuck near 0.5900 as bullish momentum proves fickle

- Kiwi holding near the middle, set to finish Friday near where it started.

- Market flows are firmly in the hands of the US Dollar.

- Risk sentiment getting limited knock-on positive support from upbeat China outlook.

The NZD/USD is set to finish Friday on a slight downstep, trading into the 0.5900 level and unable to find some lift.

With little meaningful momentum coming from the Kiwi (NZD) side of things, the NZD is fully exposed to broader market flows, leaving the Greenback (USD) to dictate the direction of the pair.

China data beats bolstering beleaguered Kiwi

Risk appetite is being supported by additional stimulus from China, bolstering the Antipodeans and putting a floor beneath any major declines. Official Chinese data showed that industrial production and retail sales figures rose faster than expected, providing further support for market sentiment heading into the weekend.

Market flows for the NZD/USD are notably leaning into the US Dollar side, and the direction is following the broader Dollar Index. The USD saw some hesitation after the University of Michigan (UoM) Sentiment Index missed expectations, slipping more than expected to 67.7 from 69.5. Inflation expectations also slid from 3.0% to 2.7%.

The USD is now catching some bids across the board as markets ease into the week's market close.

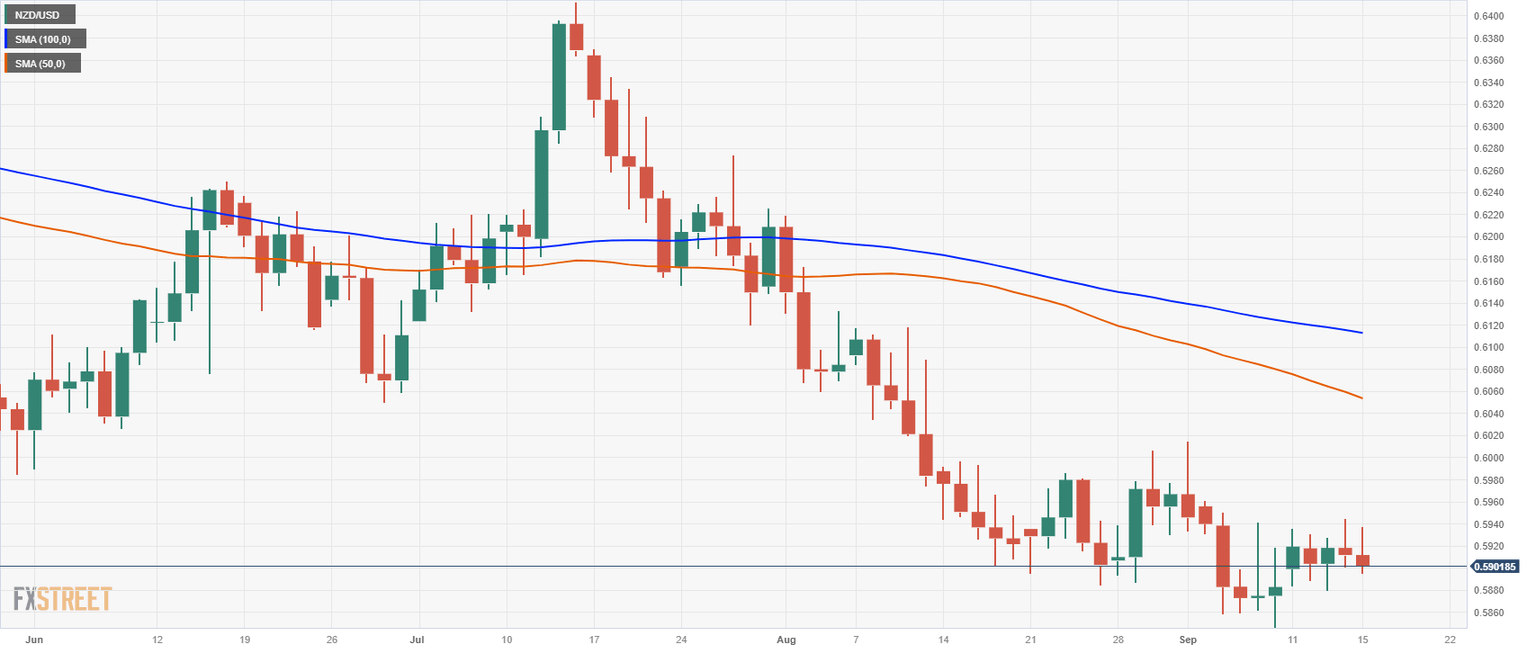

NZD/USD technical outlook

The Kiwi is constrained near the middle of price congestion that has become familiar territory for this trading week, caught in a rough near-term range between 0.5930 and 0.5890.

Upside momentum will be constrained by the last swing high near 0.5980 on the daily candlesticks, which show the pair decidedly on the low end. Support is coming from September’s lows near 0.5860, and a further break to the downside sees little in the way of additional technical support.

The 50- and 100-day Simple Moving Averages (SMAs) are in a bearish decline, piled up at 0.6060 and 0.6120 respectively, and breaks above the 100-day SMA have struggled to sustain for some time in the NZD/USD pair.

NZD/USD daily chart

NZD/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.