Kiwi holding on at the top end, NZD/USD looking to make a meaningful break of 0.6020

- NZD/USD trying to hold onto territory north of 0.6000 as Kiwi catches a Monday bid.

- Further upside likely to remain constrained as investors await further input from RBNZ.

- US Dollar flows to dictate directional momentum with little meaningful data on the economic calendar for the Kiwi.

The NZD/USD caught an early morning bid on Monday, getting lifted into the 0.6000 handle, pushing the pair back into the top end of recent consolidation.

The Kiwi (NZD) has largely avoided broad-market safe haven flows for Monday, with the US Dollar seeing gains against the majority of the board.

Forex Today: Safe-haven flows dominate as geopolitical tensions escalate on Israel-Hamas conflict

The Reserve Bank of New Zealand (RBNZ) was last seen holding steady on interest rates, but with a "higher-for-longer" narrative lean to the RBNZ's latest showings, investors will be looking ahead to more inflation figures from New Zealand, as well as the Kiwi's central bank next showing due in November.

It's a thin week for the Kiwi on the economic calendar, with Visitor Arrivals on Tuesday, final Food Price Index figures on Wednesday, and Business NZ's Purchasing Manager Index (PMI) slated for Thursday.

The US data docket is likely to be the main driver for the NZD/USD this week, with Wednesday bringing Producer Price Index (PPI) figures along with the latest Federal Reserve's (Fed) meeting minutes publishing; Thursday will follow up with a Consumer Price Index (CPI) release, and Friday will cap off the week with the Michigan Consumer Sentiment Index for October.

The US PPI is expected to tick upwards to 2.3% from 2.2%, while CPI is seen stepping down from 3.7% to 3.6%, and the Michigan sentiment index is expected to decline from 68.1 to 67.4.

NZD/USD Technical Outlook

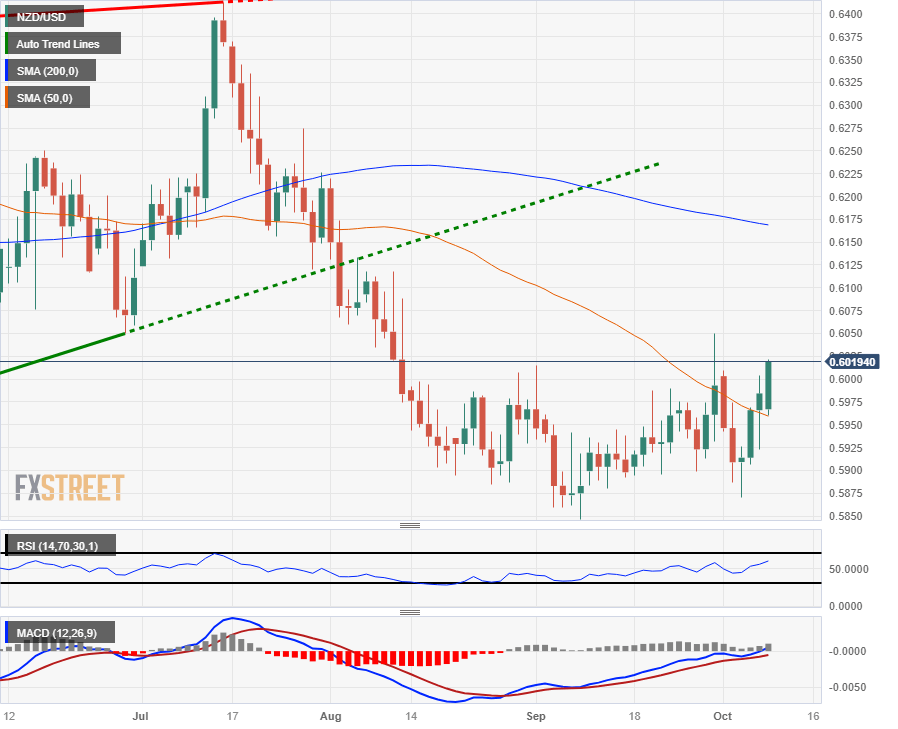

The Kiwi is getting pushed into the top end for Monday, pinning into the 0.6020 level after the day's opening bids near 0.5967.

Monday's bullish push is seeing the Kiwi tapping into the ceiling of recent consolidation on the daily candlesticks, and NZD/USD bidders will be looking for a decisive break of late September's peak at 0.6050.

There's nowhere to go but up for the NZD/USD, with the pair still well off July's swing high into 0.6413, with the 200-day Simple Moving Average (SMA) far above current price action near 0.6175.

NZD/USD Daily Chart

NZD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.