Key level on DAX under attack: Are we heading for a bearish correction?

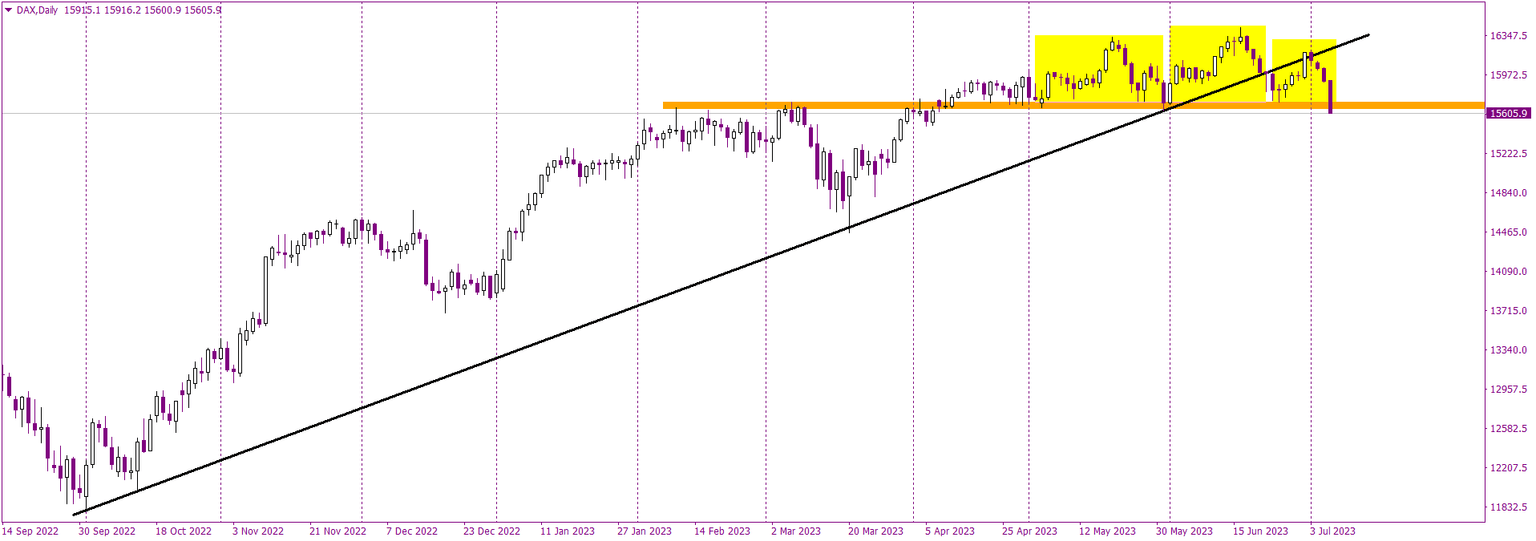

The German stock index DAX is presently engaged in a critical battle that may trigger a significant long-term sell signal at the conclusion of today's trading session. Since the start of May, the DAX has been forming a head and shoulders pattern, denoted in yellow on the chart. Today's movements suggest that the formation of the right shoulder of this pattern may be complete, as the price is currently challenging and breaching the neckline of the formation, shown in orange.

This neckline concurrently serves as a key support level dating back to April and a significant resistance level from March and February, making it a pivotal point for the DAX. Furthermore, in mid-June, the price broke below the long-term upward trend line, marked in black on the chart, and tested it as resistance at the beginning of July, adding another bearish element to the situation.

Therefore, if the price closes below the orange zone today, it could pave the way for a more substantial mid-term bearish correction. However, as this level acts as a critical support, the price could potentially bounce back, and if a hammer pattern forms at this orange area, it might signal a buying opportunity. At the moment, the bearish scenario seems slightly more likely.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.