Kamala Harris faces uphill battle according to US elections betting odds

As Americans head to the polls to elect the 47th President of the United States, betting odds suggest that Vice President Kamala Harris is facing an uphill battle against former President Donald Trump.

Over the weekend, one of the major betting platforms, PredictIt, showed that Harris became the slight favorite to win the US presidential election, surpassing Trump for the first time since early October. This lead, however, remained short-lived as Trump moved to the top again on the platform, albeit with a small margin.

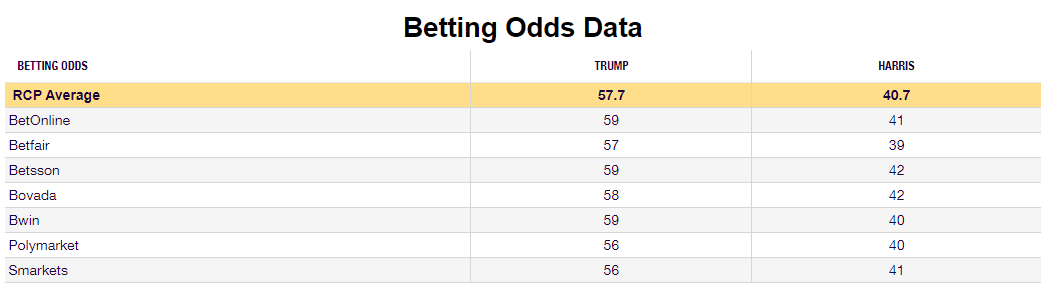

Although US presidential election betting odds should not be taken as a representative view of US voters, they might still trigger a reaction in financial markets. Unlike PredictIt, RealCelarPolling's average for betting odds currently has Trump with at a comfortable lead against Harris, 57.7 vs 40.7.

Source: RealClearPolling.com

In the meantime, election polls point to a much tighter race than what betting odds suggest. The TIPP poll has Trump and Harris tied at 48 in nationwide, the Ipsos poll has Harris leading by two points, 50 vs 48, and the Atlas Intel poll has Trump having a one point lead, 50 vs 49, as per RealClearPolling. In some swing states, such as Arizona and North Carolina, Trump seems to be staying on top, while Harris seems to have closed the gap in others, such as Nevada, Georgia and Pennsylvania.

Author

FXStreet Team

FXStreet