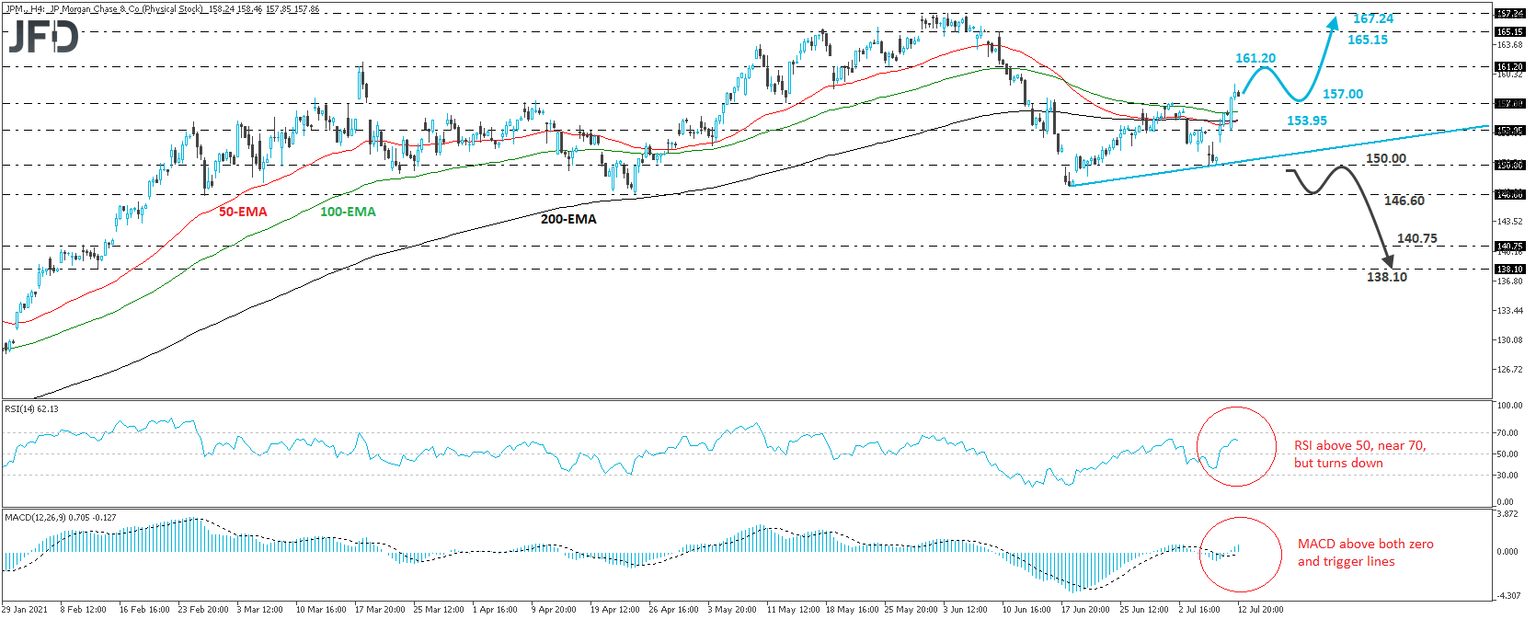

JPMorgan (JPM Stock) breaks above 157.00 ahead of earnings

The JPMorgan Chase & Co. stock (NYSE: JPM) traded higher on Monday, breaking above the peak of July 1st, at 157.00, thereby confirming a forthcoming higher high. Besides that, the stock has already started forming lower highs, as marked by the upside line taken from the low of June 18th, and thus, we would consider the short-term picture to be positive.

Today, ahead of the US opening bell, the bank reports its second-quarter earnings, and decent results may encourage further buying for the next few days. We believe that the break above 157.00 may have opened the way towards the 161.20 zones, defined as resistance by the high of June 11th and the inside swing low of May 26th. If investors are not willing to stop there, then we could see the advance extending towards the 165.15 area, marked by the high of June 10th. Slightly higher lies the stock’s record high, at 167.24, hit on June 3rd, which could also get tested.

Shifting attention to our short-term oscillators, we see that the RSI lies above 50, near 70, but it has already turned down, while the MACD stands above both its zero and trigger lines. Both indicators detect upside speed, but the fact that the RSI has turned down makes us careful over a possible corrective setback before the next leg north. Perhaps such a retreat may occur in the aftermath of the earnings on potential sell-the-fact market response.

Nonetheless, in order to abandon the bullish case, we would like to see a drop below the round figure of 150.00, also marked by last Thursday’s low. This will confirm a forthcoming lower low on both the 4-hour and daily charts, and may initially target the 146.60 zones, which provided support on February 26th and April 23rd. If investors are not willing to jump into the action near that zone this time around, then we could see the slide extending towards the 140.75 area, or the 138.10 hurdle, marked by the inside swing high of February 10th and the low of the day after, respectively.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

JFD Team

JFD