JPM Elliott Wave technical analysis [Video]

![JPM Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/curved-stock-exchange-ticker-numbers-and-arrows-on-black-58549212_XtraLarge.jpg)

JPM Elliott Wave Analysis Trading Lounge Daily Chart,

JP Morgan & Chase Co., (JPM) Daily Chart.

JPM Elliott Wave technical analysis

FUNCTION: Trend.

MODE: Impulsive.

STRUCTURE: Motive.

POSITION: Minor wave 5.

DIRECTION: Potential top in place.

DETAILS: In the daily chart we explore the possibility of having a top in place and we’d be expecting a larger correction on the horizon. We’d need TL 200$ to turn into resistance.

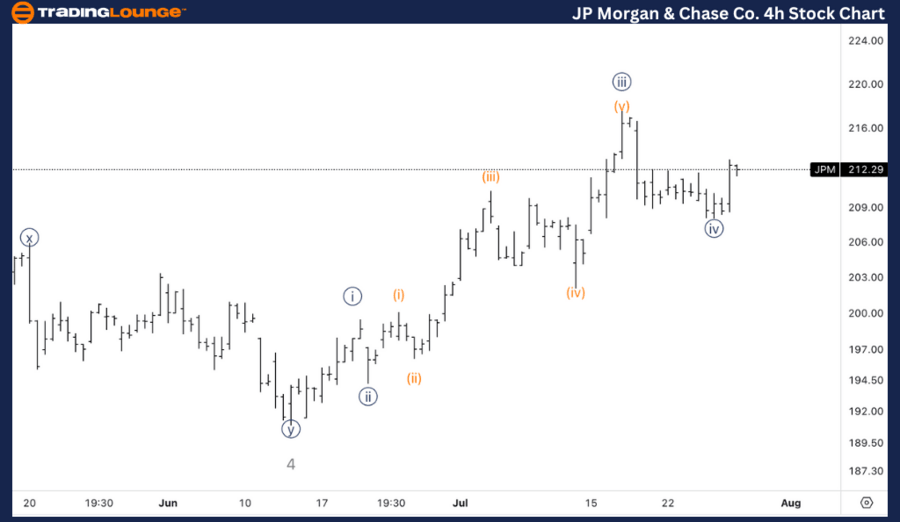

JPM Elliott Wave Analysis Trading Lounge 4H Chart,

JP Morgan & Chase Co., (JPM) 4H Chart

JPM Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minor wave 5.

Direction: Completion of wave 5.

Details: Here we take a look at the alternate count, suggesting one more leg higher could be due.

Welcome to our latest Elliott Wave analysis for JP Morgan & Chase Co. (JPM) as of July 29, 2024. This analysis provides an in-depth look at JPM's price movements using the Elliott Wave Theory, helping traders identify potential opportunities based on current trends and market structure. We will cover insights from both the daily and 4-hour charts to offer a comprehensive perspective on JPM's market behavior.

JPM Elliott Wave technical analysis – Daily chart

The daily chart indicates that JPM might have reached a significant top in Minor wave 5. If this is the case, a larger correction could be on the horizon. Traders should monitor the $200 level closely; if it turns into resistance, it would strengthen the case for a top being in place and the start of a corrective phase.

JPM Elliott Wave technical analysis – Four-hour chart

The 4 - hour chart provides an alternate count, suggesting that one more leg higher could still be due before completing Minor wave 5.

This alternate scenario should be considered, as it indicates the potential for a final push upwards before a significant correction sets in.

Technical analyst: Alessio Barretta.

JPM Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.