JP Morgan & Chase Co. (JPM) Elliott Wave technical analysis [Video]

![JP Morgan & Chase Co. (JPM) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Chartism/stock-market-chart-with-pen-23290418_XtraLarge.jpg)

JPM Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minor wave 5.

Direction: Upside within wave 5.

Details: Looking at the possibility of a wave {i} of 5 completed as we reached 220$ and we could not be looking for a pullbackn in wave {ii} before turning higher. 0.618 wave 5 vs. 1 stands at 254$.

JPM Elliott Wave technical analysis – Daily chart

On the daily chart, JPM is progressing in Minor wave 5, with the first leg, wave {i}, potentially completed after reaching the $220 level. The current outlook suggests a possible pullback in wave {ii} before resuming higher in wave {iii}. A potential upside target for wave 5, assuming it follows the 0.618 extension of the earlier waves, could be around $254.

JPM Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {i} of 5.

Direction: Top in wave {i}.

Details: Here’s a little alternate suggesting we could still be within wave {i}, specifically in wave (iv) of {i}, ready to resume higher.

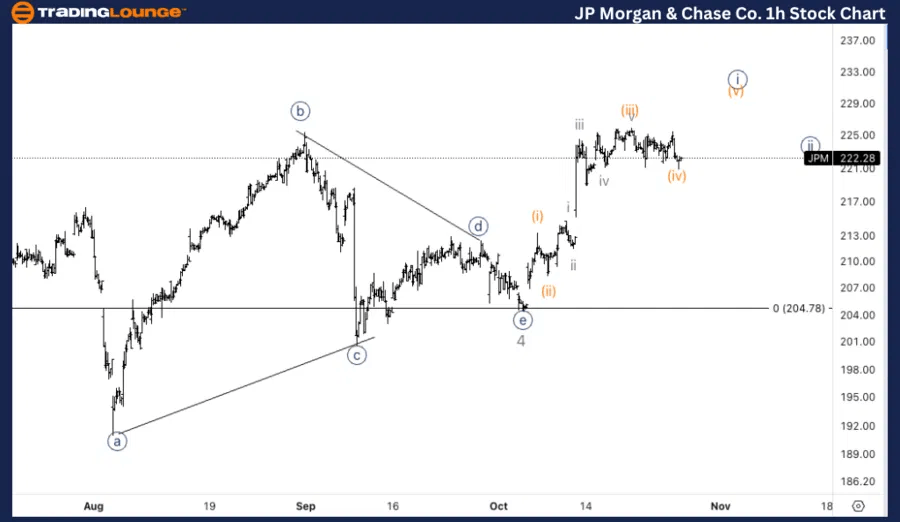

JPM Elliott Wave technical analysis – One-hour chart

The 1-hour chart shows the potential for wave {i} of 5 still being incomplete, with an alternate count suggesting that the current price action may be in wave (iv) of {i}. Once this corrective phase is over, the chart indicates a likely continuation to the upside in wave (v) of {i} to complete the first leg of Minor wave 5.

This Elliott Wave analysis for JP Morgan & Chase Co., (JPM) examines both the daily and 1-hour charts to assess its current market trend, utilizing Elliott Wave Theory to anticipate potential future movements.

JP Morgan & Chase Co. (JPM) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.