JP Morgan Chase and Co. (JPM) analysis Elliott Wave technical forecast [Video]

![JP Morgan Chase and Co. (JPM) analysis Elliott Wave technical forecast [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/DowJones_frontbuilding_XtraLarge.jpg)

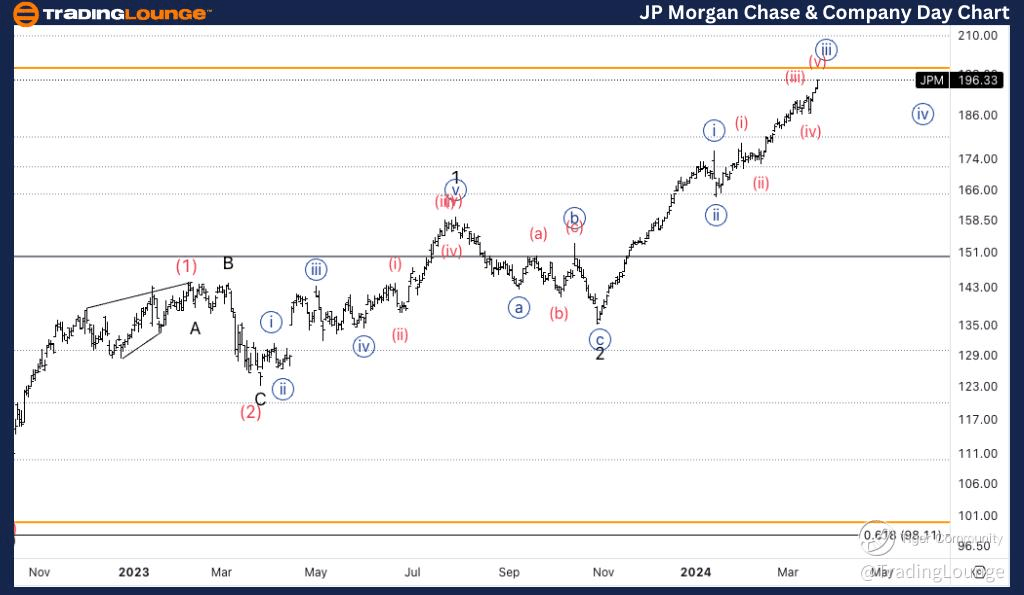

JPM Elliott Wave analysis trading lounge daily chart

JP Morgan Chase & Co., (JPM) Daily Chart.

JPM Elliott Wave Technical Analysis.

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave 3 of (3).

Direction: Upside in wave 3.

Details: We are looking at a 1-2-1-2 from the 100$ lows, which seems to be confirmed by the steepness of the upside into what is now wave 3. Alternatively we had a flat correction in wave (2) and it ends where Minor wave 2 currently is.

UNH Elliott Wave technical analysis – Daily chart

Our analysis indicates a trending function characterized by impulsive mode and motive structure, positioned in Wave 3 of (3). The direction points to upside momentum in wave 3. We observe a potential 1-2-1-2 pattern originating from the $100 lows, supported by the steepness of the upside movement into the current wave 3. Alternatively, we consider the possibility of a flat correction in wave (2), ending at the level of Minor wave 2.

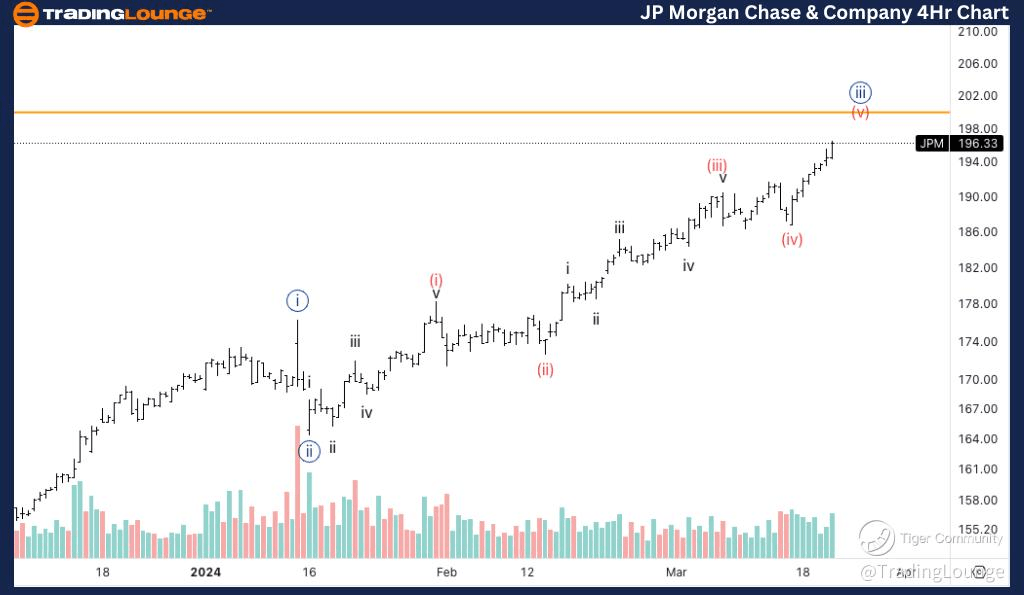

JPM Elliott Wave analysis trading lounge four-hour chart

JP Morgan Chase & Co., (JPM) 4Hr Chart.

JPM Elliott Wave Technical Analysis.

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minute wave {iii}.

Direction: Looking for upside in wave (v).

Details: We are targeting TL2 at 200$ as a wave {iii} target, the increasing volume could suggest sellers are entering the market, looking for 200$ to be reached first.

UNH Elliott Wave technical analysis – Four-hour chart

Here, we identify a trending function marked by impulsive mode and motive structure, positioned in Minute wave {iii}. The direction suggests anticipation of upside movement in wave (v). We set our sights on TL2 at $200 as the target for wave {iii}, with increasing volume indicating potential seller activity entering the market. We anticipate the $200 level to be reached first before assessing further market developments.

Welcome to our JPM Elliott Wave Analysis Trading Lounge, your go-to source for insights into JP Morgan Chase & Co. (JPM) using Elliott Wave Technical Analysis. Let's dive into the market dynamics as of the Daily Chart on 21st March 2024.

Technical Analyst: Alessio Barretta.

JPM Elliott Wave analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.