JNJ Elliott Wave technical analysis [Video]

![JNJ Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/dow-jones-stock-indexes-7184580_XtraLarge.jpg)

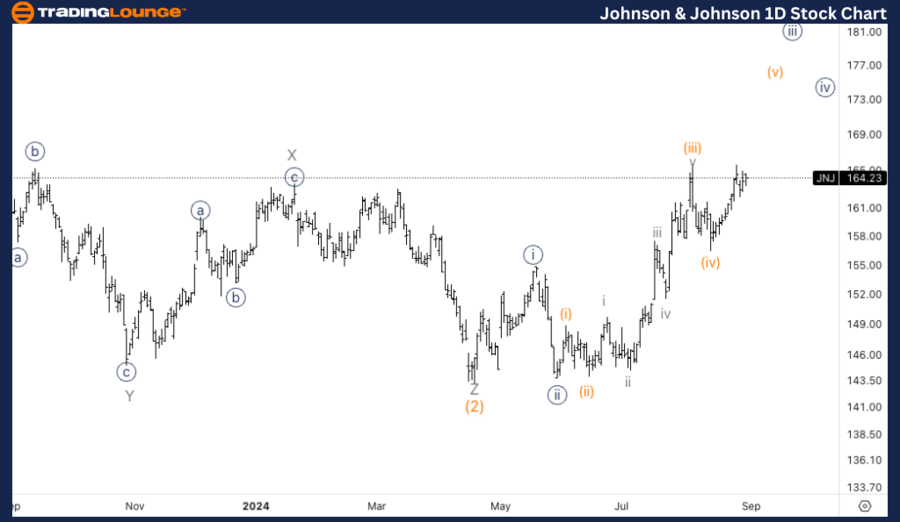

JNJ Elliott Wave Analysis Trading Lounge Daily Chart,

Johnson & Johnson, (JNJ) Daily Chart.

JNJ Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Structure: Wave {iii} of 1.

Direction: Upside into wave 1.

Details: Looking for a top in wave {iii} soon as the subdivision seems to have provided us with a five wave move within {iii}.

JNJ Elliott Wave Analysis Trading Lounge 1H Chart,

Johnson & Johnson, (JNJ) 1H Chart

JNJ Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave (v) of {iii}.

Direction: Upside in wave v of (v).

Details: We seem to have a triangle in wave iv, which means we could see upside within wave v during today’s session, as it has also been developing just below 165$.

This Elliott Wave analysis for Johnson & Johnson (JNJ), provides insights into the stock's trend direction and potential price movements on both the daily and 1-hour charts. The analysis helps traders understand the market structure and potential trading opportunities.

JNJ Elliott Wave technical analysis – Daily chart

JNJ appears to be in the latter stages of wave {iii} of 1. The structure shows a five-wave subdivision within wave {iii}, indicating that the wave might be nearing its top. A completion of wave {iii} will likely be followed by a corrective wave {iv} before further upside in wave {v}.

JNJ Elliott Wave technical analysis – One-hour chart

The 1-hour chart suggests that JNJ is within wave (v) of {iii}. There appears to be a triangle pattern forming in wave iv, which typically indicates a consolidation before the final move upward. This pattern suggests that JNJ could see further upside in wave v of (v), potentially breaking above the 165$ level during today's trading session.

Technical analyst: Alessio Barretta.

JNJ Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.