Japanese Yen extends its steady intraday descent against USD; USD/JPY retakes 150.00

- The Japanese Yen struggles to capitalize on its Asian session gains against a stronger USD.

- Firming expectations for more BoJ rate hikes this year should help limit losses for the JPY.

- Traders now look forward to the release of the crucial US PCE data for a fresh impetus.

The Japanese Yen (JPY) continues losing ground against the broadly stronger US Dollar (USD), pushing the USD/JPY pair above the 150.00 psychological mark during the early European session on Friday. Japanese government bond (JGB) yields drifted lower after Prime Minister Shigeru Ishiba’s government reduced the FY25/26 budget plan to ¥115.2 trillion and new bond issuance to ¥28.6 trillion. This, in turn, is seen as a key factor undermining the JPY.

Any meaningful JPY depreciation, however, seems elusive in the wake of the growing acceptance that the Bank of Japan (BoJ) will continue raising interest rates this year. The bets were reaffirmed by BoJ Deputy Governor Shinichi Uchida's remarks, saying that the underlying inflation rate is gradually rising toward the 2% target. This offsets the softer Tokyo Consumer Price Index (CPI) print, which, along with the risk-off mood, should limit losses for the safe-haven JPY.

Furthermore, the USD bulls might refrain from placing aggressive bets and opt to wait for the release of the US Personal Consumption Expenditure (PCE) Price Index for cues about the Federal Reserve's (Fed) rate cut path. This further warrants caution before positioning for any further appreciating move for the USD/JPY pair, which has been oscillating in a range since the beginning of this week and remains close to a multi-month low touched earlier this week.

Japanese Yen slides back closer to weekly low against broadly stronger USD

- Japanese Prime Minister Shigeru Ishiba’s government announced that it reduced its FY25/26 Budget plan to ¥115.2 trillion. The government also said they will cut the new bond issuance to JPY28.6 trillion.

- Bank of Japan Deputy Governor Shinichi Uchida said this Friday that Japan's inflation rate is gradually rising towards the central bank's 2% target as the economy sustains a moderate recovery path.

- The Statistics Bureau of Japan reported that the headline Consumer Price Index (CPI) in Tokyo – Japan's capital city – decelerated from 3.4% in the previous month to the 2.9% YoY rate in February.

- Meanwhile, core CPI – which excludes volatile fresh food prices – eased more than expected, from an 11-month high of 2.5% touched in January to the 2.2% YoY rate during the reported month.

- Furthermore, a core gauge that excludes both fresh food and energy prices, and is watched as a gauge of underlying inflation by the BoJ, came in at 1.9%, matching the previous month's reading.

- Separately, Japan's Industrial Production fell by 1.1% MoM in January. This follows a 0.2% decrease in the previous month and marks the third consecutive month of decline in industrial output.

- Investors, however, seem convinced that the BoJ will hike interest rates further, which, along with the risk-off mood, boosts the safe-haven Japanese Yen during the Asian session on Friday.

- The US Dollar stands firm near the weekly top in the wake of Thursday's data, showing that inflationary pressures continue to rise and backing the case for the Federal Reserve to hold steady.

- The second reading of the US Gross Domestic Product showed that the economy expanded by a 2.3% annualized pace during the final quarter of 2024, matching the original estimate.

- Additional details of the report published by the US Bureau of Economic Analysis revealed that the GDP Price Index rose 2.4% compared to the initial estimate of 2.2%.

- This comes on top of worries that US President Donald Trump's policies would reignite inflation and put additional pressure on the Federal Reserve to stick to its hawkish stance.

- Kansas City Fed President Jeff Schmid said that recent surveys indicate a rise in consumer inflation expectations and that the central bank must stay focused on fully containing price pressures.

- Cleveland Fed President Beth Hammack noted on Thursday that interest rates are likely on hold for the time being as inflation data starts to pose a growing problem for central policymakers.

- Philadelphia Fed President Patrick Harker noted that progress toward the 2% inflation target has slowed and that the policy rate remains restrictive to continue putting downward pressure on inflation.

- Investors now look forward to the release of the US Personal Consumption Expenditure (PCE) Price Index for cues about the Fed's rate-cut path, which will drive the buck and the USD/JPY pair.

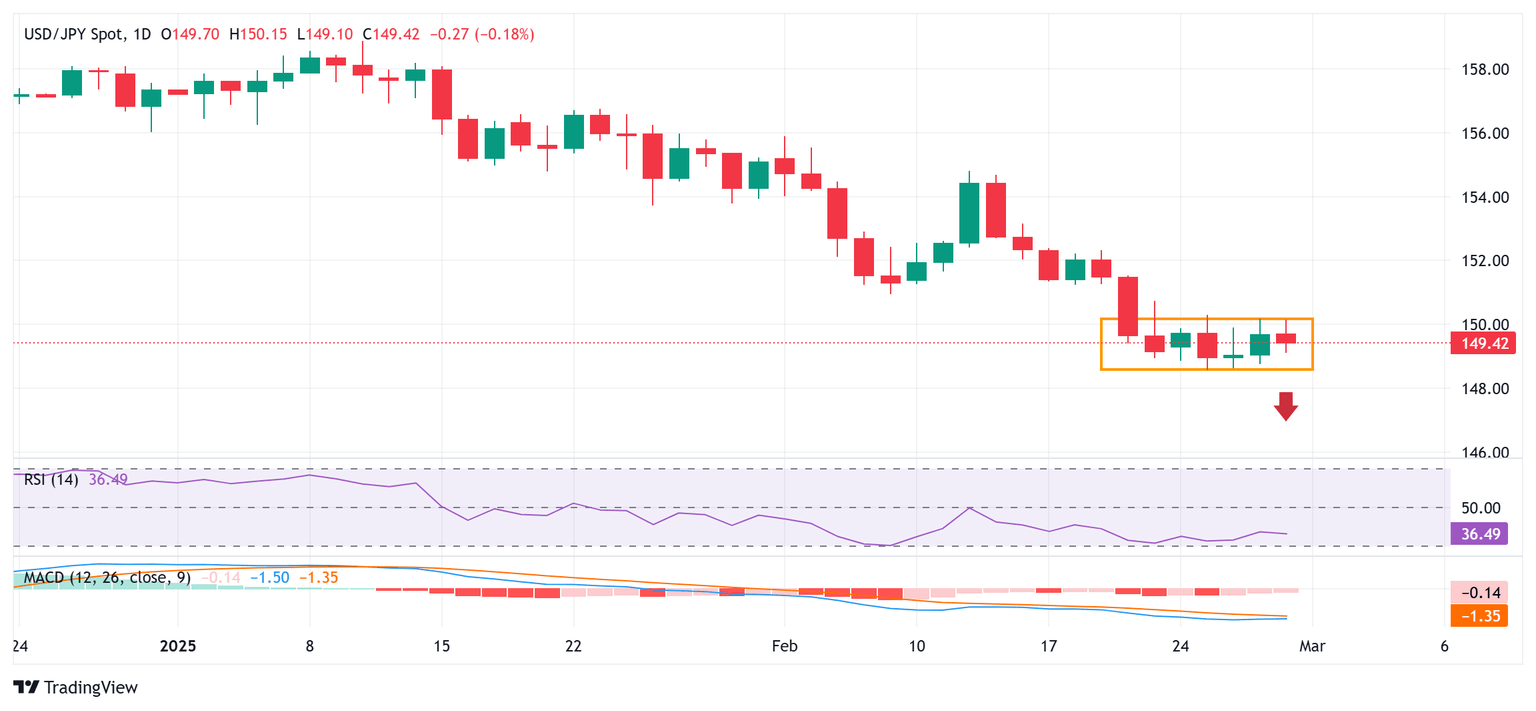

USD/JPY is likely to face stiff resistance near 150.15-150.30, weekly high

From a technical perspective, spot prices remain confined in a familiar range held since the beginning of this week. Against the backdrop of the recent decline from the vicinity of the 159.00 mark, or the year-to-date high touched in January, the range-bound price action might still be categorized as a bearish consolidation phase. The negative outlook is reinforced by the fact that oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. This, in turn, suggests that the path of least resistance for the USD/JPY pair is to the downside and supports prospects for deeper losses.

In the meanwhile, the 149.00 round figure now seems to protect the immediate downside ahead of the 148.60-148.55 region, or the multi-month low touched on Tuesday. Some follow-through selling will be seen as a fresh trigger for bearish traders and drag the USD/JPY pair to the 148.00 mark en route to the next relevant support near the 147.35-147.30 area and the 147.00 round figure.

On the flip side, the 148.80 region, followed by the 150.00 psychological mark and the weekly high, around the 150.30 area, might continue to act as an immediate hurdle. A sustained strength beyond the latter, however, could trigger a short-covering rally and lift the USD/JPY pair further towards the 150.90-151.00 horizontal support breakpoint, now turned strong barrier. The momentum could extend further towards the 151.45 region en route to the 152.00 mark, though it is more likely to remain capped near the 152.40 zone. The latter represents the very important 200-day Simple Moving Average (SMA) and should act as a key pivotal point.

Economic Indicator

Personal Consumption Expenditures - Price Index (YoY)

The Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The YoY reading compares prices in the reference month to a year earlier. Price changes may cause consumers to switch from buying one good to another and the PCE Deflator can account for such substitutions. This makes it the preferred measure of inflation for the Federal Reserve. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Feb 28, 2025 13:30

Frequency: Monthly

Consensus: 2.5%

Previous: 2.6%

Source: US Bureau of Economic Analysis

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.