Japanese Yen maintains its strong bid tone; USD/JPY struggles below mid-154.00s

- The Japanese Yen continues to be underpinned by bets on more BoJ rate hikes.

- The narrowing US-Japan yield differential further benefits the lower-yielding JPY.

- The Fed’s hawkish pause underpins the USD and could lend support to USD/JPY.

The Japanese Yen (JPY) retains its bullish bias through the early European session on Thursday, with the USD/JPY pair sliding further below mid-154.00s and moving back closer to over a one-month low touched earlier this week. The growing market conviction that the Bank of Japan (BoJ) will hike interest rates again by the end of this year continues to underpin the JPY. Apart from this, a fresh leg down in the US Treasury bond yields, resulting in a further narrowing of the US-Japan yield differential, turns out to be another factor lending support to the lower-yielding JPY.

That said, concerns about the potential economic fallout from US President Donald Trump's trade policies might hold back the JPY bulls from placing aggressive bets. Furthermore, the Federal Reserve's (Fed) hawkish pause on Wednesday is seen acting as a tailwind for the US Dollar (USD), which, in turn, could offer some support to the USD/JPY pair. Traders now look to the European Central Bank (ECB) meeting, which could elevate volatility and drive the safe-haven JPY. Apart from this, the Advance US Q4 GDP print should produce short-term opportunities.

Japanese Yen sticks to strong intraday gains amid hawkish BoJ expectations

- Minutes of the December Bank of Japan meeting showed on Wednesday that board members discussed how to use estimates on the economy's neutral interest rate to determine further hikes in borrowing costs.

- Former BoJ board member Makoto Sakurai said on Tuesday that broadening wage hikes, prospects of sustained price rises and solid economic growth give the central bank scope to continue raising rates steadily.

- The Federal Reserve, as was widely expected, decided to keep rates steady at the end of a two-day meeting on Wednesday and struck a hawkish stance, signaling no immediate plans for further rate reductions.

- In the post-meeting press conference, Fed Chair Jerome Powell said that we do not need to be in a hurry to adjust our policy stance and that monetary policy is well positioned for the challenges at hand.

- Powell's remarks reaffirmed the notion that rates will remain higher for longer amid caution over US President Donald Trump's protectionist policies, which could boost inflation and act as a tailwind for the US Dollar.

- The yield on the benchmark 10-year US government bond struggles to capitalize on the post-FOMC bounce from over a one-month trough amid the uncertainty over the Trump administration's trade policies.

- The Asahi newspaper reported this Thursday that plans are being finalized for a meeting between Japan's Prime Minister Shigeru Ishiba and US President Donald Trump in Washington on February 7.

- The European Central Bank's policy decision later today might infuse some volatility in the financial markets. Apart from this, the Advance Q4 US GDP print should provide some impetus to the USD/JPY pair.

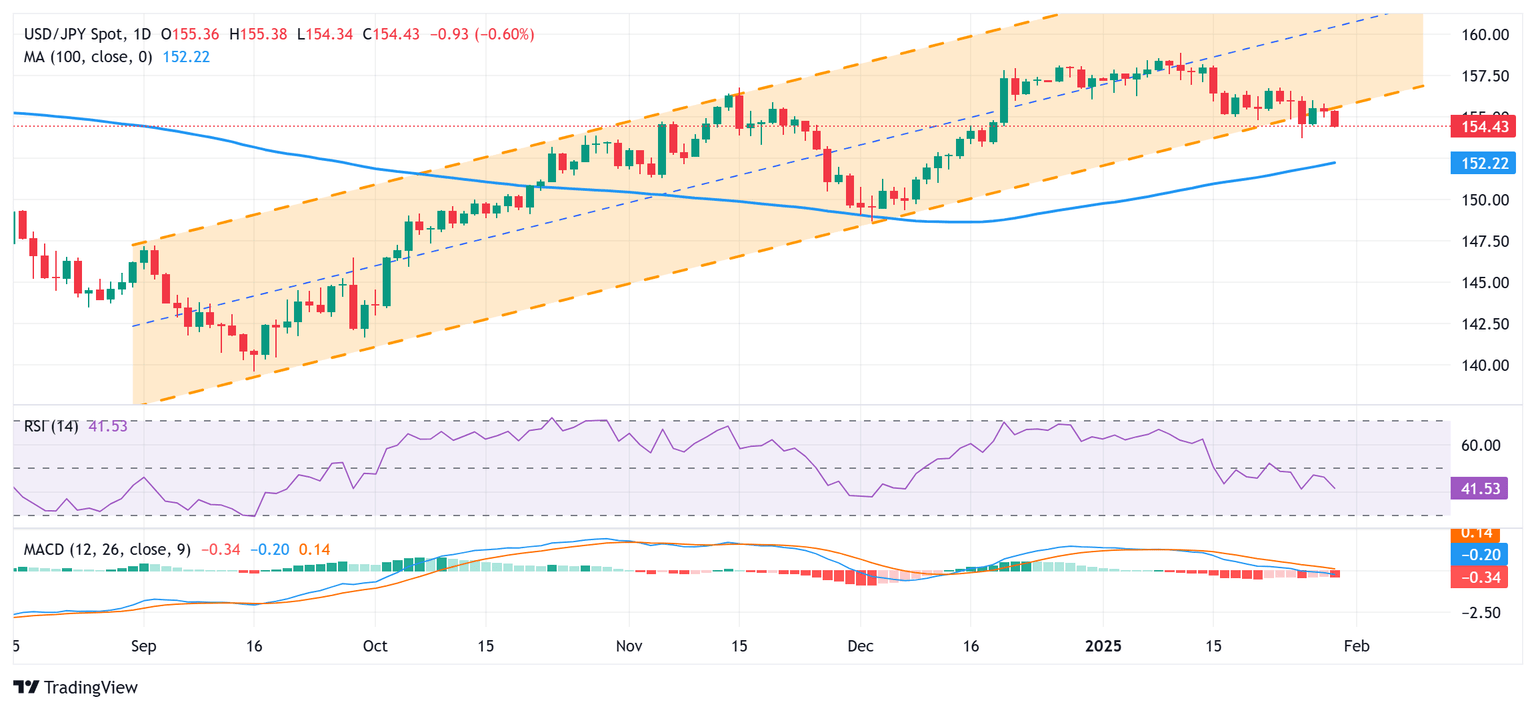

USD/JPY seems vulnerable to retest monthly low, around the 153.70 region

The emergence of fresh sellers near the 156.00 round figure and the subsequent fall below the 155.00 psychological mark confirms a breakdown through a multi-month-old ascending channel support. Moreover, oscillators on the daily chart have been gaining negative traction, suggesting that the path of least resistance for the USD/JPY pair remains to the downside. Hence, some follow-through weakness below the 154.00 mark, towards retesting a multi-week low around the 153.70 region touched on Monday, looks like a distinct possibility.

On the flip side, attempted recovery might now confront resistance near the 155.00 round figure ahead of the 155.35-155.40 region. Any further move up might still be seen as a selling opportunity and remain capped near the 156.00 mark. This is followed by the weekly top, around the 156.25 area, which should act as a key pivotal point. A sustained strength beyond the latter might trigger a fresh bout of a short-covering rally and lift the USD/JPY pair to the 156.70-156.75 region en route to the 157.00 round figure and the 157.60 horizontal barrier.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.