Japanese Yen seems to extend winning streak ahead of US Fed interest rate decision

- The Japanese Yen moves sideways from the ongoing hawkish sentiment surrounding the Bank of Japan interest rates outlook.

- Japan’s Shunichi Suzuki stated that the government will continue to evaluate the stronger JPY and respond as necessary.

- CME FedWatch Tool suggests odds of a 50 basis points Fed interest rate cut have surged to 62.0%.

The Japanese Yen (JPY) remains stable against the US Dollar (USD) on Tuesday, driven by the hawkish sentiment surrounding the Bank of Japan interest rates outlook. Traders await the BoJ policy decision on Friday, with expectations of keeping rates unchanged while leaving the possibility open for rate hikes in October and December.

Japanese Finance Minister Shunichi Suzuki stated on Tuesday that rapid foreign exchange (FX) fluctuations are undesirable. Suzuki emphasized that officials will closely monitor how FX movements affect the Japanese economy and people's livelihoods. The government will continue to assess the impact of a stronger Japanese Yen and respond accordingly, according to Reuters.

The US Dollar remains under pressure as expectations grow that the Federal Open Market Committee (FOMC) may opt for a significant 50 basis point rate cut on Wednesday. According to the CME FedWatch Tool, markets are pricing in a 38.0% chance of a 25 basis points Federal Reserve interest rate cut at the September meeting, while the probability of a 50 basis point cut has surged to 62.0%, up from 50.0% just a day earlier.

Daily Digest Market Movers: Japanese Yen holds ground due to dovish mood surrounding the Fed

- Rabobank economists Jane Foley and Molly Schwartz highlighted on Monday that JPY net long positions were at their highest level since October 2016. While there is minimal expectation for a rate hike by the Bank of Japan at its policy meeting on September 20, traders will be closely watching for any hints that October could potentially be a more active meeting.

- Commerzbank FX analyst Volkmar Baur anticipated that the Bank of Japan will remain on the sidelines this week. Baur noted that the Federal Reserve's actions are likely to have a greater impact on the USD/JPY pair, suggesting that the JPY could have a strong chance of falling below 140.00 per USD even without a rate hike from the BoJ.

- On Friday, Fitch Ratings' latest report on the Bank of Japan's policy outlook suggests that the BoJ might raise rates to 0.5% by the end of 2024, 0.75% in 2025, and 1.0% by the end of 2026.

- The University of Michigan’s Consumer Sentiment Index rose to 69.0 in September, exceeding the market expectations of 68.0 reading and marking a four-month high. This increase reflects a gradual improvement in consumers' outlook on the US economy after months of declining economic expectations.

- The hawkish BoJ policymaker Naoki Tamura stated on Thursday that the central bank should raise interest rates to at least 1% as early as the second half of the next fiscal year. This comment reinforces the BoJ's commitment to ongoing monetary tightening.

- The US Producer Price Index (PPI) rose to 0.2% month-on-month in August, exceeding the forecasted 0.1% increase and the previous 0.0%. Meanwhile, core PPI accelerated to 0.3% MoM, against the expected 0.2% rise and July’s 0.2% decline.

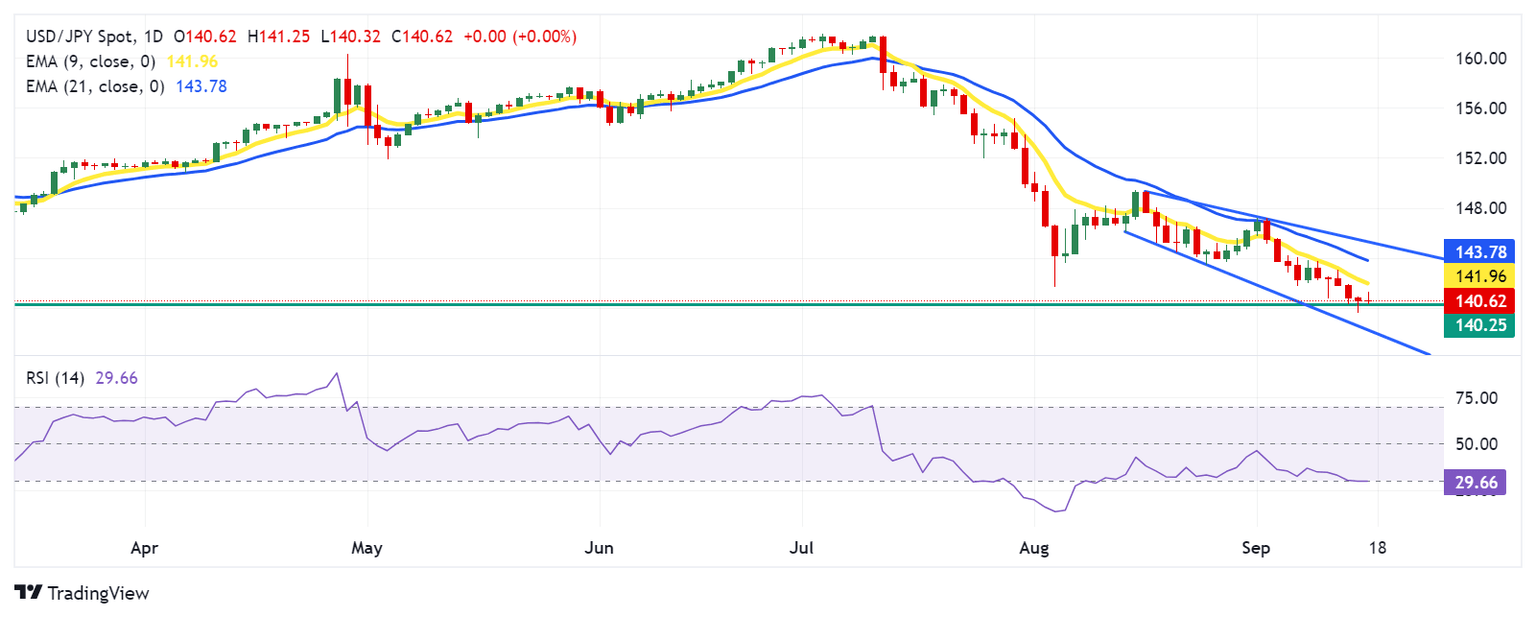

Technical Analysis: USD/JPY remains tepid around 140.50 amid 14-month lows

USD/JPY trades around 140.60 on Tuesday. An analysis of the daily chart showed the USD/JPY pair moves downward within a descending channel, indicating a confirmed bearish bias. The 14-day Relative Strength Index (RSI), a momentum indicator, is positioned below the 30 level, suggesting an oversold situation for the pair and a potential for an upward correction soon.

In terms of support, the USD/JPY pair is testing 140.25, which is the lowest level since July 2023, followed by the psychological level of 140.00. A successful breach below this level could reinforce the bearish bias and put pressure on the pair to test the lower boundary of the descending channel at the level of 138.30.

On the upside, the USD/JPY pair might first encounter a barrier at the nine-day EMA around 141.95 level, followed by the 21-day EMA at 143.78 level. A break above these EMAs might weaken the bearish sentiment and push the pair to test the upper boundary of the descending channel at the 145.40 level.

USD/JPY: Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.07% | 0.05% | -0.14% | -0.01% | -0.16% | -0.04% | -0.07% | |

| EUR | -0.07% | -0.01% | -0.22% | -0.12% | -0.23% | -0.11% | -0.13% | |

| GBP | -0.05% | 0.01% | -0.19% | -0.07% | -0.21% | -0.09% | -0.14% | |

| JPY | 0.14% | 0.22% | 0.19% | 0.12% | -0.02% | 0.10% | 0.06% | |

| CAD | 0.01% | 0.12% | 0.07% | -0.12% | -0.14% | -0.01% | -0.06% | |

| AUD | 0.16% | 0.23% | 0.21% | 0.02% | 0.14% | 0.11% | 0.06% | |

| NZD | 0.04% | 0.11% | 0.09% | -0.10% | 0.00% | -0.11% | -0.05% | |

| CHF | 0.07% | 0.13% | 0.14% | -0.06% | 0.06% | -0.06% | 0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.