Japanese Yen declines as US Dollar remains stable due to improved yields

- The Japanese Yen inches lower as the US Dollar rebounds.

- The JPY could limit its downside as traders expect further intervention by Japanese authorities.

- The greenback may limit its upside due to the rising expectations of the Fed reducing rates in September.

The Japanese Yen (JPY) retraces its recent gains on Thursday. However, the JPY had strengthened against the US Dollar (USD) after suspected intervention by Japanese authorities drove the USD/JPY pair to a one-month low of 155.36. Traders remain alert to the possibility of further interventions.

Reuters cited Kyodo News, reporting that Japan's top currency diplomat Masato Kanda said on Wednesday he would have to respond if speculators cause "excessive" moves in the currency market and that there was no limit to how often authorities could intervene.

The US Dollar receives support from a slight improvement in US Treasury yields. However, the greenback may limit its upside due to the high likelihood of a rate-cut decision by the Federal Reserve (Fed) in its September policy meeting.

Fed Governor Christopher Waller said on Wednesday that the US central bank is ‘getting closer’ to an interest rate cut. Meanwhile, Richmond Fed President Thomas Barkin stated that easing in inflation had begun to broaden and he would like to see it continue,” per Reuters.

According to CME Group’s FedWatch Tool, markets now indicate a 93.5% probability of a 25-basis point rate cut at the September Fed meeting, up from 69.7% a week earlier.

Daily Digest Market Movers: Japanese Yen inches lower as US Dollar recovers

- Japan's Merchandise Trade Balance Total for the year ended in June climbed to a surplus of ¥224 billion against the expected deficit of ¥240 billion and ¥-1,220.1 billion prior.

- Japan's YoY Exports in June grew by 5.4%, below the forecast 6.4% and a steeper decline from the previous period's 13.5% upsurge. Meanwhile, Imports growth collapsed to 3.2%, well below the forecast 9.3% compared to the last 9.5%.

- During an interview with Bloomberg News on Tuesday, Donald Trump cautioned Fed Chair Jerome Powell against cutting US interest rates before November’s presidential vote. However, Trump also indicated that if re-elected, he would allow Powell to complete his term if he continued to "do the right thing" at the Federal Reserve.

- Data released on Tuesday showed that the Bank of Japan (BoJ) entered the foreign exchange market on consecutive trading days last Thursday and Friday. The current account balance data from the BoJ, released on Tuesday, indicates an anticipated liquidity drain of approximately ¥2.74 trillion ($17.3 billion) from the financial system on Wednesday due to various government sector transactions, according to Nikkei Asia.

- On Tuesday, Federal Reserve (Fed) Board of Governors member Dr. Adriana Kugler acknowledged that inflationary pressures have eased but emphasized that the Fed still needs additional data to justify a rate cut. Kugler indicated that if upcoming data does not confirm that inflation is moving toward the 2% target, it may be appropriate to maintain current rates for a while longer, per Reuters.

- The US Retail Sales for June stayed mostly in line with expectations. Retail Sales in the United States held steady at $704.3 billion in June, after a 0.3% gain (revised from 0.1%) in May, and are in line with market expectations.

- Fed Chair Jerome Powell mentioned on Monday that the three US inflation readings of this year "add somewhat to confidence" that inflation is on course to meet the Fed’s target sustainably, suggesting that a shift to interest rate cuts may not be far off.

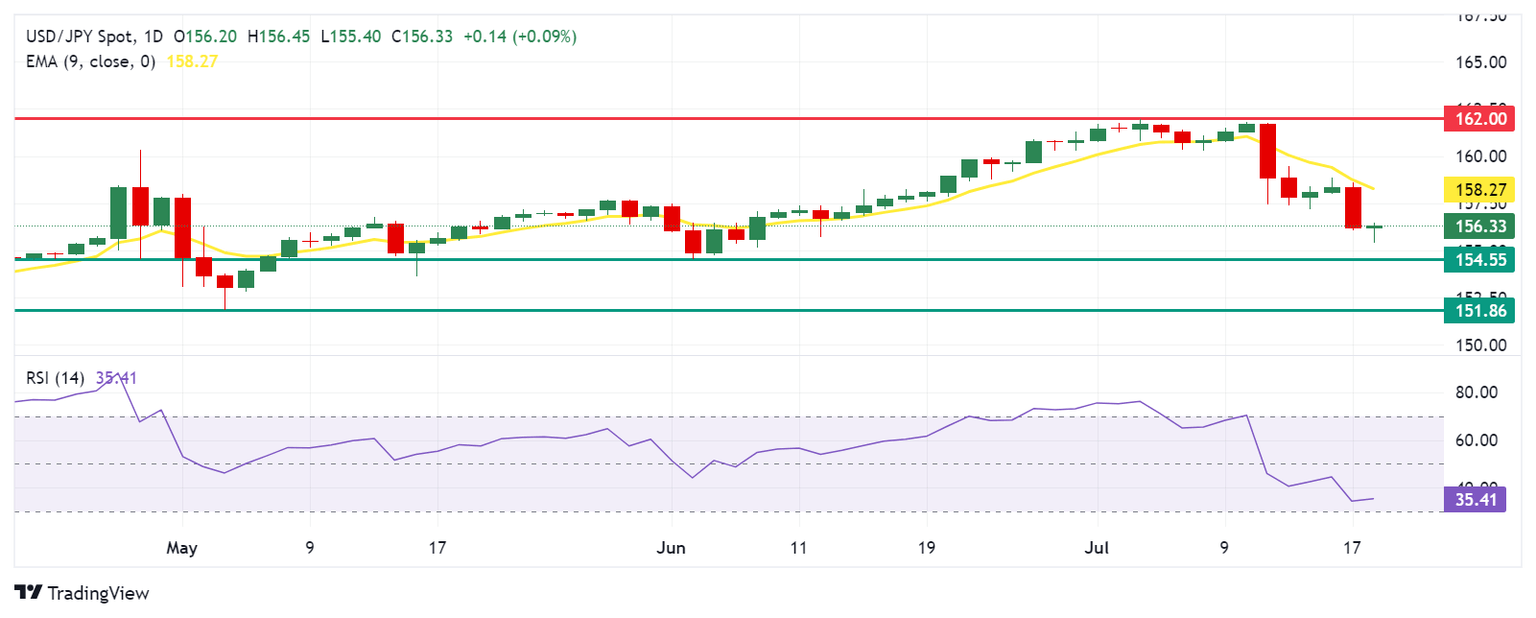

Technical Analysis: USD/JPY holds ground above 156.00

USD/JPY trades around 156.30 on Thursday. The daily chart analysis shows that the pair lies below its 9-day Exponential Moving Average (EMA), suggesting downward momentum in the short term. This signals that it may be prudent to hold off on buying until the trend shows signs of reversal. Additionally, the momentum indicator, the 14-day Relative Strength Index (RSI), is below the 50 level, suggesting a confirmation of a bearish bias.

The USD/JPY pair could find key support around June's low at 154.55. A break below this level could exert pressure on the pair to navigate the region around May’s low at 151.86.

On the upside, immediate resistance is observed around the nine-day Exponential Moving Average (EMA) at 158.27. A breakthrough above this level could lead the USD/JPY pair to revisit the pullback resistance around the psychological level of 162.00.

USD/JPY: Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.08% | 0.16% | 0.05% | -0.04% | -0.13% | 0.17% | 0.09% | |

| EUR | -0.08% | 0.07% | -0.03% | -0.12% | -0.22% | 0.09% | 0.00% | |

| GBP | -0.16% | -0.07% | -0.10% | -0.22% | -0.29% | 0.02% | -0.06% | |

| JPY | -0.05% | 0.03% | 0.10% | -0.10% | -0.17% | 0.11% | 0.06% | |

| CAD | 0.04% | 0.12% | 0.22% | 0.10% | -0.09% | 0.22% | 0.15% | |

| AUD | 0.13% | 0.22% | 0.29% | 0.17% | 0.09% | 0.32% | 0.26% | |

| NZD | -0.17% | -0.09% | -0.02% | -0.11% | -0.22% | -0.32% | -0.08% | |

| CHF | -0.09% | -0.01% | 0.06% | -0.06% | -0.15% | -0.26% | 0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.