Japanese Yen languishes near one-week low against USD; focus remains on US CPI

- The Japanese Yen continues losing ground amid worries about Trump’s trade tariffs.

- Fed’s hawkish stance revives the USD demand and lends support to the USD/JPY pair.

- Rising bets for another BoJ rate hike in March could limit any further JPY decline.

The Japanese Yen (JPY) remains heavily offered for the third successive day on Wednesday amid worries about the economic fallout from US President Donald Trump's levies on commodity imports and reciprocal tariffs. Apart from this, a positive risk tone is seen as another factor undermining the safe-haven JPY. This, along with the emergence of some US Dollar (USD) buying, assists the USD/JPY pair to stick to its strong gains above mid-153.00s heading into the European session.

Meanwhile, Federal Reserve (Fed) Chair Jerome Powell's hawkish remarks on Tuesday tempered hopes for a sharp narrowing of the US-Japan rate differential. This further contributes to driving flows away from the lower-yielding JPY, though bets that the Bank of Japan (BoJ) would raise interest rates again warrant caution for bearish traders. Traders might also refrain from placing aggressive bets around the USD/JPY pair and opt to wait for the release of the US consumer inflation figures.

Japanese Yen continues to be weighed down by Trump-related anxieties

- US President Donald Trump signed executive orders to impose 25% tariffs on steel and aluminum imports from March 12. Trump also signaled he would look at imposing additional tariffs on automobiles, pharmaceuticals, and computer chips, and promised broader reciprocal tariffs to match the levies other governments charge on US products.

- The announcement raises the risk of a further escalation of global trade tensions and threatens to negatively affect the Japanese economy. This, in turn, is seen weighing heavily on the Japanese Yen and assists the USD/JPY pair to build on a one-week-old goodish recovery move from sub-151.00 levels, or a near two-month low touched last week.

- Japan's Finance Minister, Katsunobu Kato said earlier this Wednesday that he will assess the impact of US tariffs on the Japanese economy and respond appropriately. Separately, Japan industry minister Yoji Muto requested the US to exclude Japan from steel and aluminum tariffs. This, however, does little to provide any respite to the JPY bulls.

- Federal Reserve Chair Jerome Powell, in remarks before the Senate Banking Committee on Tuesday, struck a more hawkish tone and called the economy strong overall with a solid labor market. Powell added that inflation is closer to the 2% goal but still somewhat elevated and signaled that policymakers aren’t in a rush to push interest rates lower.

- Bank of Japan Governor Kazuo Ueda reiterated earlier today that the central bank will conduct monetary policy appropriately in order to achieve the 2% inflation target. Moreover, the recent wage growth data and the broadening inflationary pressures in the economy back the case for another BoJ rate hike move at the March policy meeting.

- Traders now look forward to the release of the latest US consumer inflation figures, which, along with Powell's congressional testimony, will drive the US Dollar and the USD/JPY pair. The headline US Consumer Price Index is seen rising 2.9% YoY in January and the core CPI (excluding food and energy prices) coming in at a 3.1% YoY rate.

USD/JPY approaches 154.00 pivotal hurdle amid a bearish technical setup

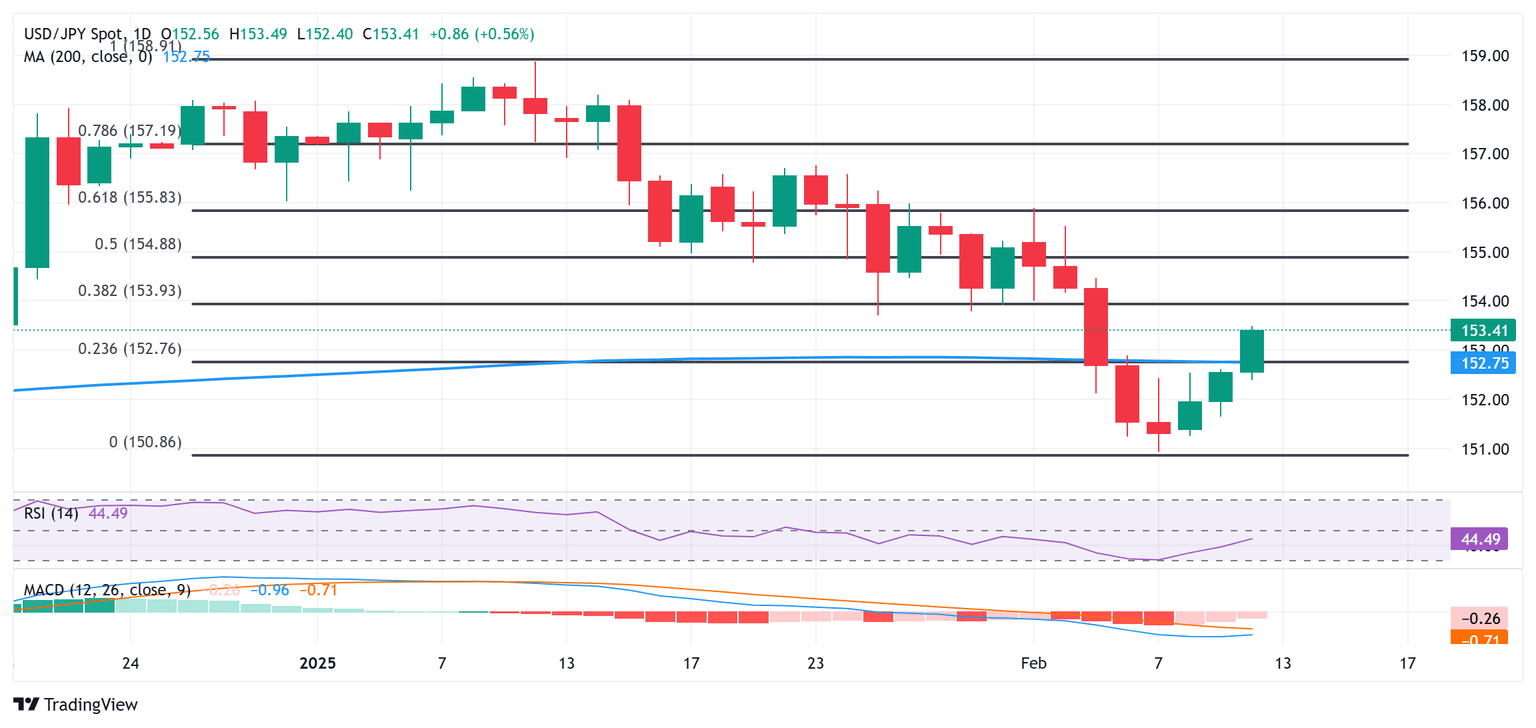

From a technical perspective, a sustained breakout above the 152.75 confluence hurdle could be seen as a key trigger for bullish traders and support prospects for a further intraday appreciating move. The said area comprises the 23.6% Fibonacci retracement level of the January-February decline, the 200-day Simple Moving Averages (SMA), which, in turn, should act as a pivotal point for the USD/JPY pair.

Meanwhile, oscillators on the daily chart – though they have been recovering – are still holding in negative territory. This, in turn, suggests that any subsequent move-up is likely to attract fresh sellers and remain capped near the 154.00 mark. The latter coincides with the 38.2% Fibo. level, above which the USD/JPY pair could accelerate the recovery towards the 154.70-154.75 region en route to the 155.00 psychological mark.

On the flip side, the 153.00 round figure, followed by the 152.75 confluence now seems to protect the immediate downside. A convincing break below the latter would reaffirm the near-term negative outlook and drag the USD/JPY pair back below the 152.00 mark, towards the next relevant support near the 151.30-151.25 region. Spot prices could eventually drop to sub-151.00 levels, or a near two-month low touched last Friday.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Feb 12, 2025 13:30

Frequency: Monthly

Consensus: 2.9%

Previous: 2.9%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.