Watch the free-preview video above extracted from the WLGC session before the market opens on 4 Jun 2024 to find out the following:

-

What the change of character bar with increasing supply indicates about market sentiment.

-

How does the key confirmation level act as a confirmation point for market movements

-

This outperforming industry group that is holding up the index.

-

The divergence signal prompts a red flag as the index turns higher.

-

And a lot more...

Market environment

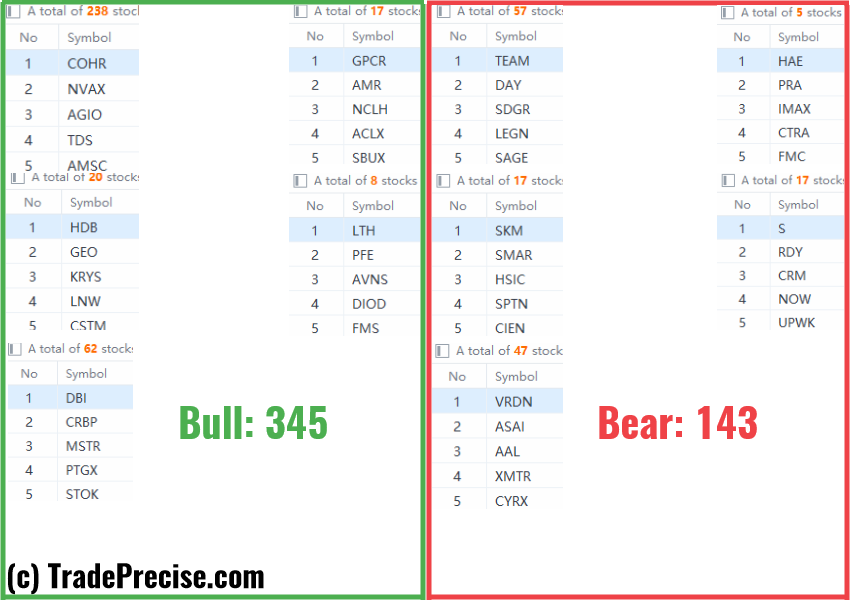

The bullish vs. bearish setup is 345 to 143 from the screenshot of my stock screener below.

Both the long-term and short-term market breadth have been decreasing compared to last week and …

Only limited theme/industry groups show strength despite the index moving higher.

I highlighted my favourite in the email update 1 day before the live session.

Three stocks ready to soar

5 “low-hanging fruits” (AMD, GDDY) trade entries setups + 11 actionable setups (COIN) were discussed during the live session before the market open (BMO).

AMD

GDDY

COIN

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD paused its rally despite the cautious RBA

AUD/USD halted its three-day recovery on the back of the firmer US Dollar and despite the hawkish cut by the RBA, although it managed well to keep the trade above the 0.6300 barrier.

EUR/USD looks vulnerable below 1.0500

EUR/USD increased its weekly correction and dropped to three-day lows near 1.0430 in response to the resurgence of the bid bias in the Greenback, while investors get ready for the release of the FOMC Minutes on Wednesday.

Gold approaches record highs

Gold prices advance to two-day highs around $2,930 per ounce troy amid the resumption of tariff concerns and despite the tepid rebound in the Geenback and an acceptable move higher in US yields across the curve.

RBNZ set to cut interest rate for fourth meeting in a row amid weak economic growth

The Reserve Bank of New Zealand is widely expected to lower the Official Cash Rate by another 50 basis points from 4.25% to 3.75% when it announces its interest rate decision on Wednesday at 01:00 GMT.

Rates down under

Today all Australian eyes were on the Reserve Bank of Australia, and rates were cut as expected. RBA Michele Bullock said higher interest rates had been working as expected, slowing economic activity and curbing inflation, but warned that Tuesday’s first rate cut since 2020 was not the start of a series of reductions.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.