Watch the video extracted from the WLGC session before the market opens on 27 Aug 2024 to find out the following:

-

How do we interpret low trading volume in the S&P 500 and its implications for future price movements?

-

How to interpret the market reaction from the Jackson Hole symposium and Fed minutes and what to expect next.

-

The importance of monitoring supply spikes and what the absence of such spikes indicates about the market’s strength.

-

The key level to watch out for a pullback in the S&P 500.

-

And a lot more.

Market environment

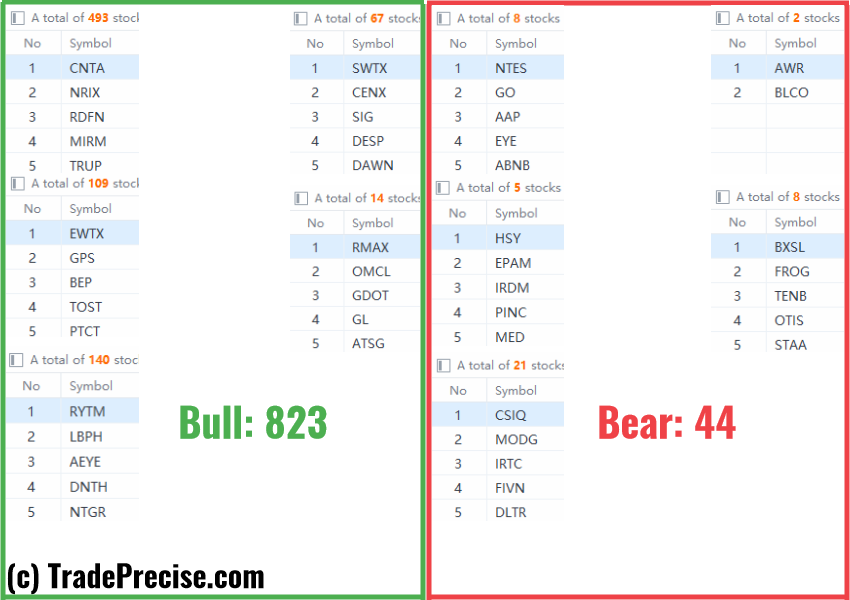

The bullish vs. bearish setup is 823 to 44 from the screenshot of my stock screener below.

The short-term market breadth was hitting the overbought level at 80 suggesting the resuming of the upside momentum. This is confirmed by the follow-through of many setups as discussed last week.

The bear was given opportunities to attack the market last Thursday and Friday but the supply level was mediocre as discussed in the video.

Three stocks ready to soar

3 “low-hanging fruits” trade entries setups INSG, VTR + 22 actionable setups such as ONON were discussed during the live session before the market open (BMO).

INSG

ZETA

ONON

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD stays pressured near 1.1150 on US Dollar resurgence

EUR/USD remains under moderate selling pressure near 1.1150 in European trading on Wednesday. The pair holds the correction from yearly highs, in the face of resurgent US Dollar demand, as risk sentiment sours ahead of Fedspeak and Nvidia earnings report.

GBP/USD keeps losses below 1.3250 amid US Dollar recovery

GBP/USD is keeping the red below 1.3250 in the European session on Wednesday, undermined by a broad US Dollar rebound. Markets turn anxious ahead of speeches from the BoE and the Fed policymakers later in the day.

Gold pulls back to $2,500 as USD recovers

Gold exchanges hands just above $2,500 on Wednesday after sliding lower due to a rebound in the US Dollar (USD). Given Gold is mainly priced in USD, any strength in the Greenback tends to weigh on its price.

FLOKI price is poised for a rally after breaking above the descending trendline

FLOKI price broke above the descending trendline and rallied 10%. At the time of writing on Wednesday, it continued its ongoing rally and trades 4.4% at $0.00015. Additionally, the suggestion of on-chain data supports the bullish trend, as evidenced by active, dormant wallets.

Three fundamentals for the week: Focus on the fragility of the US economy Premium

US Consumer confidence data will provide a gauge of how consumers are feeling. Jobless claims are in focus after Fed Chair Powell's dovish speech. Investors will look to the core PCE index to confirm that inflation is falling.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.