Iron Ore (SGX TSI Index Futures) Elliott Wave analysis [Video]

![Iron Ore (SGX TSI Index Futures) Elliott Wave analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/DiversifiedFinancials/new-opportunity-open-door_XtraLarge.jpg)

Iron Ore (SGX TSI Index Futures) Elliott Wave Analysis.

SGX TSI Iron Ore Index Elliott Wave analysis

The SGX TSI Iron Ore Index is a critical benchmark for the iron ore market, providing valuable insights for traders, miners, and steelmakers involved in contract settlements and price risk management. The index's performance is derived from actual transactions in the iron ore spot market, offering a reliable reflection of market conditions.

The SGX TSI Iron Ore Index reached an all-time high of approximately $233 per dry metric ton in May 2021, driven by strong demand from China and supply disruptions among major producers. This peak marked the beginning of a significant correction, with the index plummeting over 68% to $73 by October 2022. A recovery phase followed, pushing the index up to $143.5 by December 2023. However, after a strong rebound in April and May 2024, the index has reversed course, continuing the downtrend that started in January 2024.

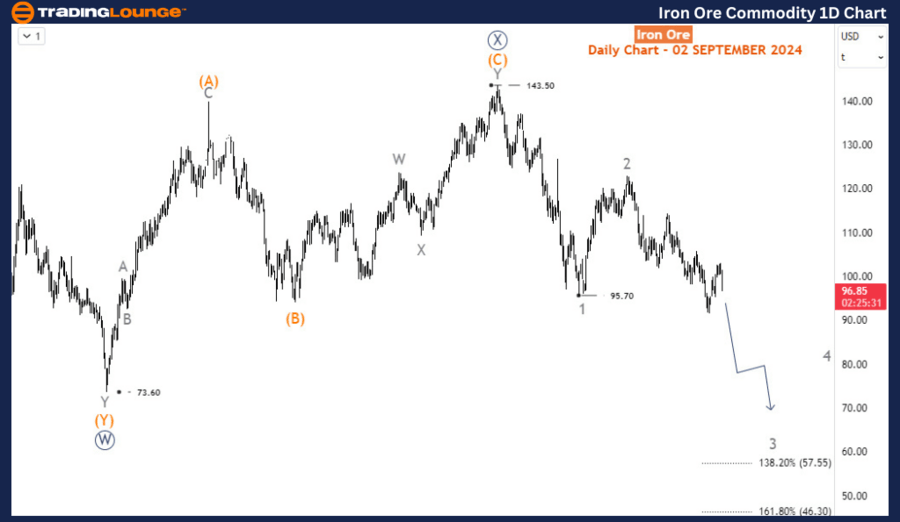

Long-term Elliott Wave analysis

In May 2021, the index entered a bearish corrective phase, forming a primary W-X-Y wave pattern at the primary degree. The first leg, wave W (circled), was completed at the October 2022 low, and wave X (circled) culminated at the January 2024 high of $143.5. The ongoing wave Y (circled) began from this January 2024 peak and is projected to develop into a 3-wave structure consisting of intermediate degree waves (A)-(B)-(C).

Currently, the index is unfolding wave 3 of (A), which could potentially extend the price down to $45, suggesting a bearish long-term outlook. This wave structure indicates that the broader trend remains negative, with further downside expected as wave Y completes its formation.

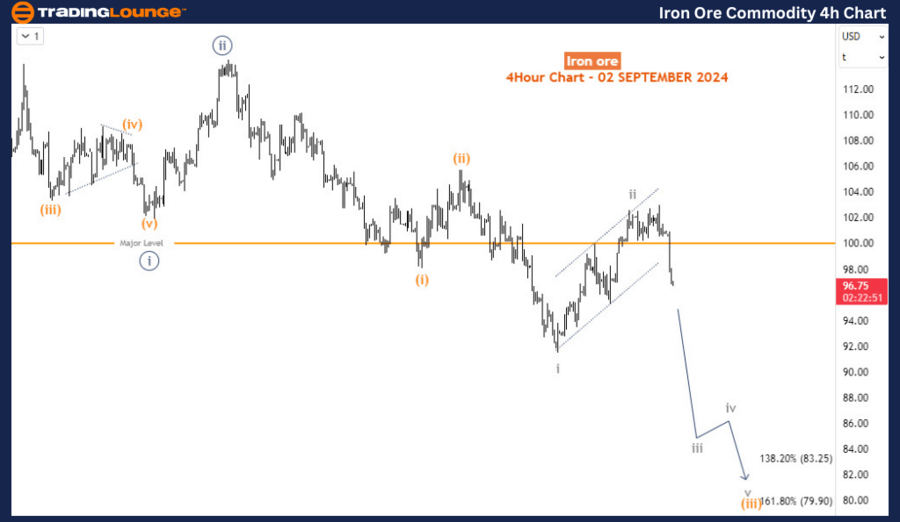

H4 chart analysis

Zooming into the H4 chart, wave 3 started at $122.9 and is now advancing through its 3rd sub-wave, wave iii (circled) of 3. Within this, the price is progressing through wave (iii) of iii (circled) of 3. Near-term projections suggest that wave (iii) could drive the index down to $85 before encountering a corrective bounce in wave (iv). Following this brief retracement, the downward trend is expected to resume, aligning with the broader bearish outlook suggested by the long-term Elliott Wave structure.

Technical analyst: Sanmi Adeagbo.

SGX TSI Iron Ore Index Elliott Wave analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.