- NASDAQ: INO is set to extend its fall for the fourth day in a row.

- The FDA's upcoming approval of the Pfizer/BioNTech COVID-19 vaccine shows Inovio is behind.

- Bargain-seekers may want to examine Inovio Pharmaceuticals' other products.

Can a small firm compete with Big Pharma? That has always been the question for Inovio Pharmaceuticals Inc (NASDAQ: INO) – and in recent days the answer seems to be negative. Investors are selling the stock in the past three days, and Thursday will likely be a down day as well.

The Plymouth Meeting, Pennsylvania-based company is working on a COVID-19 vaccine but ran into bumps along its way. The Food and Drugs Administration (FDA) demanded clarifications from Inovio about its administering the immunization using the Cellectra 2000 device. That has delayed the full rollout of the company's INNOVATE Phase 3 trial of the INO-4800 vaccine candidate.

One of the reasons for the most recent decline comes from the FDA as well, and also correlated to coronavirus – the highly-regarded regulator is set to approve the Pfizer/BioNTech jab, following a successful Phase 3 trial. Moderna's jab will likely receive the green light next week.

Has Inovio lost the race? Not so fast.

Inovio Pharmaceuticals Stock

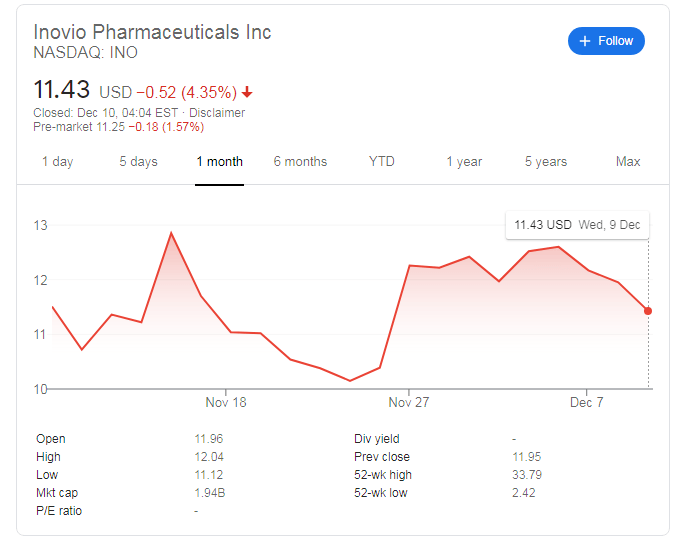

Inovcio Pharmaceutical's shares are changing hands at $11.25 in premarket trading, down another 1.57% after slipping 4.35% on Wednesday. They are down over 10% from the closing price of $12.60 on Friday but still above the late November trough of $10.15. The coronavirus-dominated year has been turbulent for INO's stock, which ranged from a low of $2.42 to $33.79 in the past 52 weeks.

NASDAQ: INO still has room to run, including on a covid vaccine. Doses can survive a full month at 37 Celsius. Pfizer's material has weak thermostability, expiring after five days in room temperature – after coming out of extremely cold -80C storage conditions.

While Moderna's thermal profile is better, it still requires cooling and a regular injection, something that Inovio's vaccine bypasses by using the special Cellectra 2000 device.

Moreover, NASDAQ: INO's recent decline may provide a buying opportunity for those seeking a longer-term investment. It is essential to note that the company run by CEO: J. Joseph Kim is focused on the promising genetic field to develop treatments for cancer and infectious diseases – not only COVID-19.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds below 0.6400 amid signs of easing US-China tensions

The AUD/USD pair trades in negative territory near 0.6390 during the early Asian session on Monday. The US Dollar edges higher against the Aussie amid signs of easing US-China tensions. China will hold a press conference about policies and measures on stabilizing employment and ensuring stable growth on Monday, which will be closely watched by traders.

USD/JPY holds steady above mid-143.00s amid Trump's uncertainty

USD/JPY kicks off the week on a subdued note and consolidates above mid-143.00s amid mixed cues. Investors push back expectations for an immediate BoJ rate hike amid rising economic risks from US tariffs, which acts as a headwind for the JPY and lends support to the pair amid a modest USD uptick.

Gold: Correction from record highs deepens on easing US-China trade tensions

Gold corrected sharply after setting a new record high at $3,500. Growing optimism about a de-escalation of the US-China trade conflict caused traders to lose interest in Gold. Employment and growth data from the US will be watched closely by market participants.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

Week ahead: US GDP, inflation and jobs in focus amid tariff mess – BoJ meets

Barrage of US data to shed light on US economy as tariff war heats up. GDP, PCE inflation and nonfarm payrolls reports to headline the week. Bank of Japan to hold rates but may downgrade growth outlook. Eurozone and Australian CPI also on the agenda, Canadians go to the polls.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.