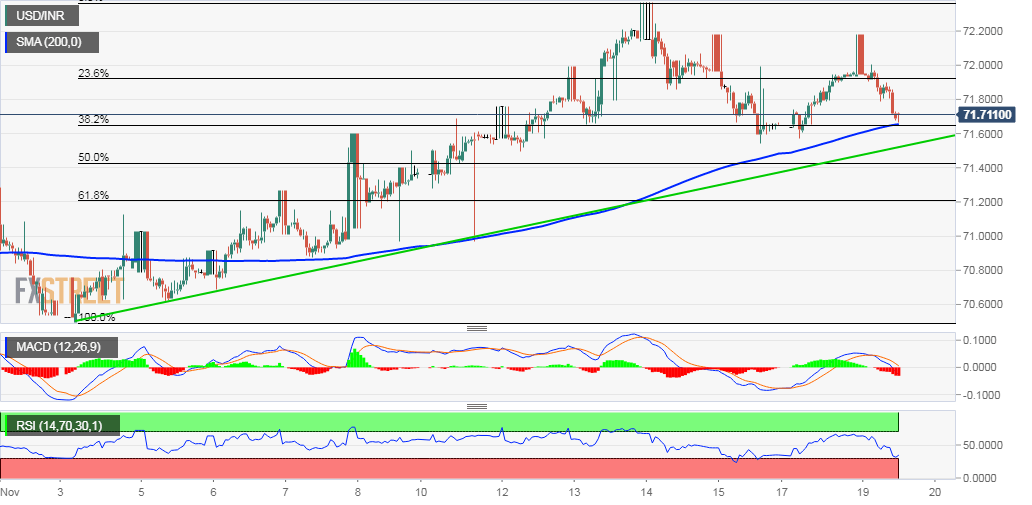

USD/INR: Bears hit 38.2% Fibo./200-hour SMA confluence

After an initial uptick to levels beyond the 72.00 handle, the USD/INR pair came under some renewed selling pressure and has now eroded a major part of the previous session's gains.

The downtick, also marking the third day of a negative move in the previous four, dragged the pair back closer to a support line marked by 38.2% Fibonacci level of the 70.53-72.37 move up. Read more…

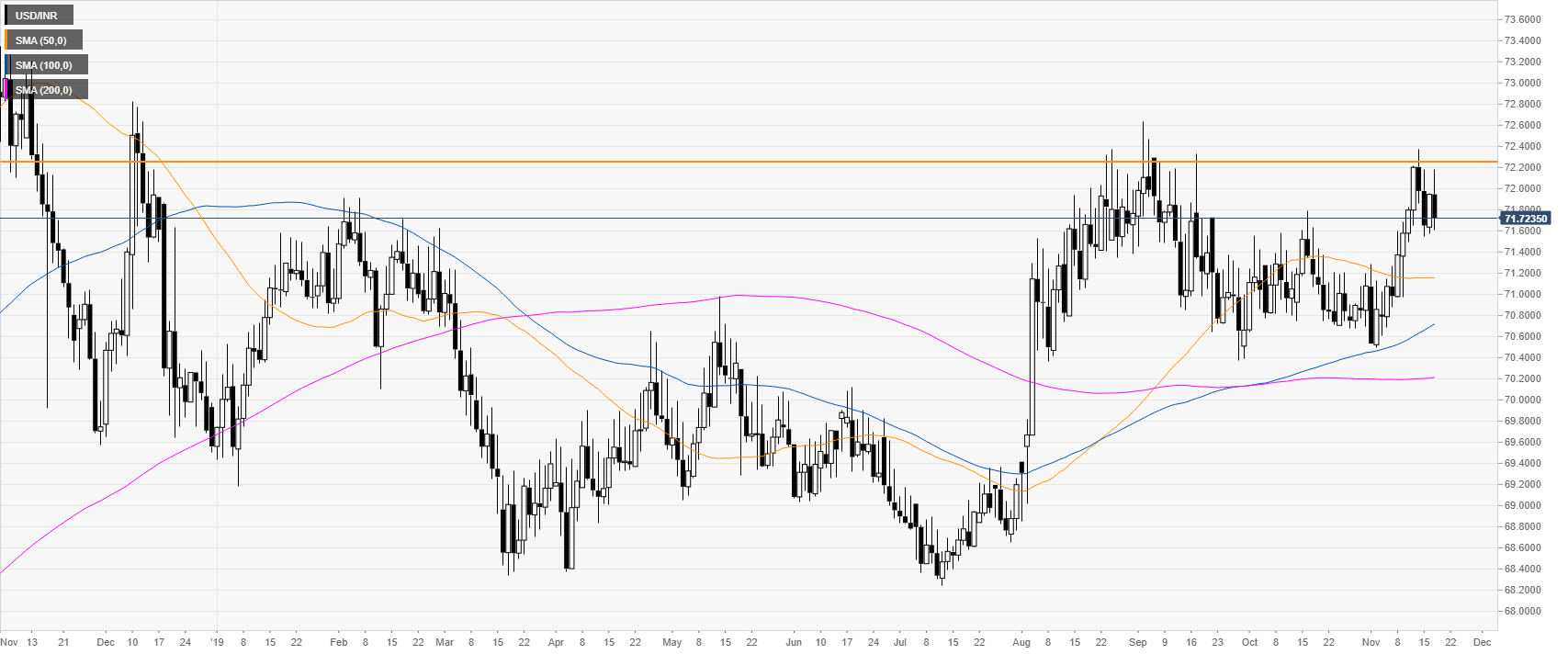

Dollar trading below 72.00 against Indian rupee

Markets are challenging 71.60 support and the 50 SMA. If the market bounces from here, the spot can revisit the 72.00 handle and possibly the 72.25 resistance if the bulls gather enough steam.

On the flip side, a break below 71.60 can see the market decline and trade towards the 71.20 level. Read more…

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains near 1.0850 after mixed PMI data

EUR/USD stays in positive territory near 1.0850 in European session Monday, following a three-day downtrend. Improving risk mood on easing concerns over US reciprocal tariffs weigh on the USD and help the pair hold its ground despite mixed German and EU PMI data.

GBP/USD holds ground near 1.2950 following UK PMIs

GBP/USD gathers recovery momentum and clings to daily gains near 1.2950 in the European session on Monday. The data from the UK showed that the business activity in the private sector expanded at a stronger pace in March than in February, supporting Pound Sterling.

Gold stabilizes as markets brace on reciprocal tariff deadline

Gold’s price stabilizes near $3,020 at the time of writing on Monday as traders assess fresh tariff headlines over the weekend. News emerging that the Trump administration will ease off on the broad scope of tariffs being imposed on April 2 brings sighs of relief in markets.

Avalanche bulls aim for double-digit rally amid increase in bullish bets

Avalanche price extends its gains by 7%, trading above $21 on Monday after rallying almost 9% the previous week. On-chain metrics suggest a bullish outlook as AVAX’s long-to-short ratio reached its highest in over a month.

Week ahead – Flash PMIs, US and UK inflation eyed as tariff war rumbles on

US PCE inflation up next, but will consumption data matter more? UK budget and CPI in focus after hawkish BoE decision. Euro turns to flash PMIs for bounce as rally runs out of steam. Inflation numbers out of Tokyo and Australia also on the agenda.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.