Indian Rupee trades flat after India’s PMIs accelerate in July

- The Indian Rupee remains steady in Wednesday’s European session.

- India's business activity accelerated at three-month highs in July, fueled by a jump in services and a pickup in manufacturing.

- Finance Minister Nirmala Sitharaman announced raising the capital gains tax, which exerted selling pressure on the INR.

- Investors will monitor the preliminary US PMI data for July, which is due on Wednesday.

The Indian Rupee (INR) trades on a flat note on Wednesday despite the modest recovery of the Greenback. The business activity in India for July rose in both manufacturing and services sectors. The advanced reading of the country’s HSBC Manufacturing PMI data climbed to 58.5 in July from 58.3 in June. Meanwhile, the Services PMI improved to 61.1 in the same reported period from 60.5 in June. However, the stronger reports fail to boost the INR against the Greenback.

The upside of INR remains capped after India's finance minister Nirmala Sitharaman announced on Tuesday at the Budget Session of Parliament to raise capital gains tax from equity investments and equity derivative trades. However, the possibility that the Reserve Bank of India (RBI) will intervene in the market to prevent the local currency from depreciating and the fall in crude oil prices could help the INR’s losses.

Investors will watch the preliminary US S&P Global Purchasing Managers Index (PMI) for July, which is due later on Wednesday. The Manufacturing PMI is expected to improve slightly to 51.7 in July from 51.6 in June, while the Services PMI is forecast to ease to 54.4 from 55.3 in the same report period.

Daily Digest Market Movers: Indian Rupee’s potential upside might be limited amid multiple headwinds

- "The Flash Composite Output Index signalled continued robust growth in India's private sector," said Pranjul Bhandari, chief India economist at HSBC.

- India's benchmark equity indexes, the BSE Sensex and Nifty 50, experienced significant losses on Tuesday, ending slightly lower after falling more than 1% earlier in the day.

- India’s Finance Minister Nirmala Sitharaman said at the Budget Session of Parliament on Tuesday that the Securities transaction tax on futures and options will be raised to 0.02% and 0.01%, respectively.

- Sitharaman stated that long-term capital gains on all financial and non-financial assets will be taxed at 12.5%. In addition, the limit of exemption for capital gains will be set at Rs 1.25 lakh.

- The government will reduce customs duty on gold, and silver to 6%, and platinum to 6.4%, said Nirmala Sitharaman.

- The Indian government is set to promote the Indian Rupee for overseas investments, noting that the rules and regulations for EDI will be simplified.

- India's budget struck a balance between higher spending on job creation and rural development, and a reduced fiscal deficit objective, according to Reuters. The Indian government reduced its fiscal deficit target to 4.9% of GDP, down from 5.1% in the February interim budget.

- The US Existing Home Sales dropped by 5.4% MoM in June from 4.11M to 3.89M, worse than expected. Meanwhile, the Richmond Fed Manufacturing Index came in at -17 in July versus -10 prior.

- Traders are now pricing in nearly a 96% possibility of a Fed rate cut in September, according to the CME FedWatch Tool.

Technical analysis: Indian Rupee maintains a bearish picture in the longer term

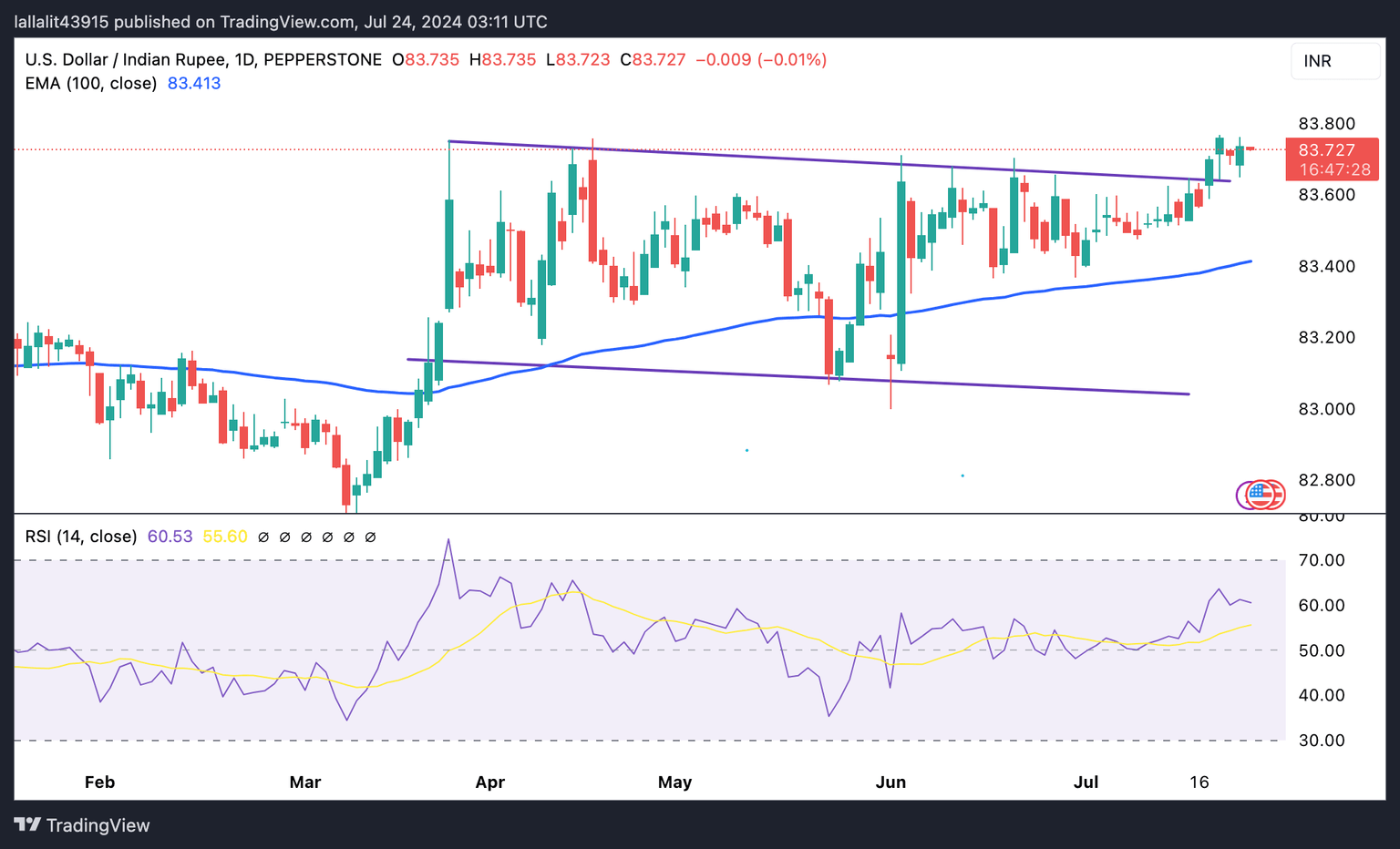

The Indian Rupee holds steady on the day. The constructive stance of the USD/INR pair remains intact as it confirms a breakout above the month-long trading range and holds above the key 100-day Exponential Moving Average (EMA). The upward momentum is supported by the 14-day Relative Strength Index (RSI), which stands in the bullish zone around 60.00.

The immediate resistance level for the pair is seen at the all-time high of 83.77. A bullish breakout above this level will see a rally to the 84.00 psychological level.

In the bearish case, any follow-through selling below the resistance-turned-support level at 83.65 might pave the way to 83.51, a low of July 12. The additional downside target to watch is 83.41, the 100-day EMA.

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.06% | 0.12% | 0.07% | 0.24% | -0.82% | 0.42% | -0.11% | |

| EUR | -0.05% | 0.04% | 0.03% | 0.17% | -0.86% | 0.34% | -0.16% | |

| GBP | -0.12% | -0.03% | -0.02% | 0.15% | -0.90% | 0.33% | -0.19% | |

| CAD | -0.07% | -0.02% | -0.01% | 0.14% | -0.89% | 0.32% | -0.17% | |

| AUD | -0.22% | -0.14% | -0.10% | -0.17% | -1.04% | 0.20% | -0.33% | |

| JPY | 0.81% | 0.82% | 0.86% | 0.84% | 1.05% | 1.19% | 0.67% | |

| NZD | -0.42% | -0.33% | -0.31% | -0.31% | -0.16% | -1.23% | -0.53% | |

| CHF | 0.10% | 0.15% | 0.22% | 0.17% | 0.34% | -0.75% | 0.52% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Indian economy FAQs

The Indian economy has averaged a growth rate of 6.13% between 2006 and 2023, which makes it one of the fastest growing in the world. India’s high growth has attracted a lot of foreign investment. This includes Foreign Direct Investment (FDI) into physical projects and Foreign Indirect Investment (FII) by foreign funds into Indian financial markets. The greater the level of investment, the higher the demand for the Rupee (INR). Fluctuations in Dollar-demand from Indian importers also impact INR.

India has to import a great deal of its Oil and gasoline so the price of Oil can have a direct impact on the Rupee. Oil is mostly traded in US Dollars (USD) on international markets so if the price of Oil rises, aggregate demand for USD increases and Indian importers have to sell more Rupees to meet that demand, which is depreciative for the Rupee.

Inflation has a complex effect on the Rupee. Ultimately it indicates an increase in money supply which reduces the Rupee’s overall value. Yet if it rises above the Reserve Bank of India’s (RBI) 4% target, the RBI will raise interest rates to bring it down by reducing credit. Higher interest rates, especially real rates (the difference between interest rates and inflation) strengthen the Rupee. They make India a more profitable place for international investors to park their money. A fall in inflation can be supportive of the Rupee. At the same time lower interest rates can have a depreciatory effect on the Rupee.

India has run a trade deficit for most of its recent history, indicating its imports outweigh its exports. Since the majority of international trade takes place in US Dollars, there are times – due to seasonal demand or order glut – where the high volume of imports leads to significant US Dollar- demand. During these periods the Rupee can weaken as it is heavily sold to meet the demand for Dollars. When markets experience increased volatility, the demand for US Dollars can also shoot up with a similarly negative effect on the Rupee.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.