Indian Rupee drifts higher, eyes on possible RBI intervention, US GDP data

- The Indian Rupee rebounds in Thursday’s early European session.

- The Indian government's decision to raise the tax rate on capital gains dampened market sentiment, weighing on the INR.

- The first reading of the US second-quarter GDP growth number will be the highlight for Thursday.

The Indian Rupee (INR) recovers some lost ground on Thursday amid the softer US Dollar (USD). The INR fell to an all-time closing low on Wednesday, pressured by the decline in Indian equities after the government's decision to raise capital gains tax from equity investments and equity derivative trades. Investors' weak appetite for riskier assets and the renewed Greenback demand might cap the upside for local currency in the near term. Nonetheless, the decline in crude oil prices and the potential intervention from the Reserve Bank of India (RBI) could help the INR’s losses.

Looking ahead, the first reading of the US Gross Domestic Product (GDP) for the second quarter is due on Thursday. The attention will shift to the Personal Consumption Expenditures (PCE) Price Index data for June on Friday. Any further signs of cooler inflation might spur the rate cut expectation by the US Federal Reserve (Fed) and could exert some selling pressure on the USD.

Daily Digest Market Movers: Indian Rupee recovers amid multiple headwinds

- Benchmark Indian equity indices extended losses to a fourth straight session. The BSE Sensex fell 280 points, or 0.35%, to 80,149. The Nifty 50 dropped 65 points, or 0.27%, to 24,413 on Wednesday.

- The advanced reading of India’s HSBC Manufacturing PMI data climbed to 58.5 in July from 58.3 in June. Meanwhile, the Services PMI improved to 61.1 in the same reported period from 60.5 in June.

- The US S&P Global Composite PMI improved to 55.0 in July from 54.8 in June. Additionally, the S&P Global Manufacturing PMI dropped to 49.5 from 51.6 in the same period, weaker than the 51.7 expected. Finally, the Services PMI rose to 56.0 from 55.3.

- The advanced US Goods Trade Balance came in at $-96.0 billion in June, compared to $-99.4 billion in May, below the estimate.

- The preliminary US Gross Domestic Product (GDP) is estimated to grow at an annualized rate of 2.0% in the second quarter, which is higher than the previous quarter of 1.4%.

Technical analysis: Indian Rupee remains vulnerable in the longer term

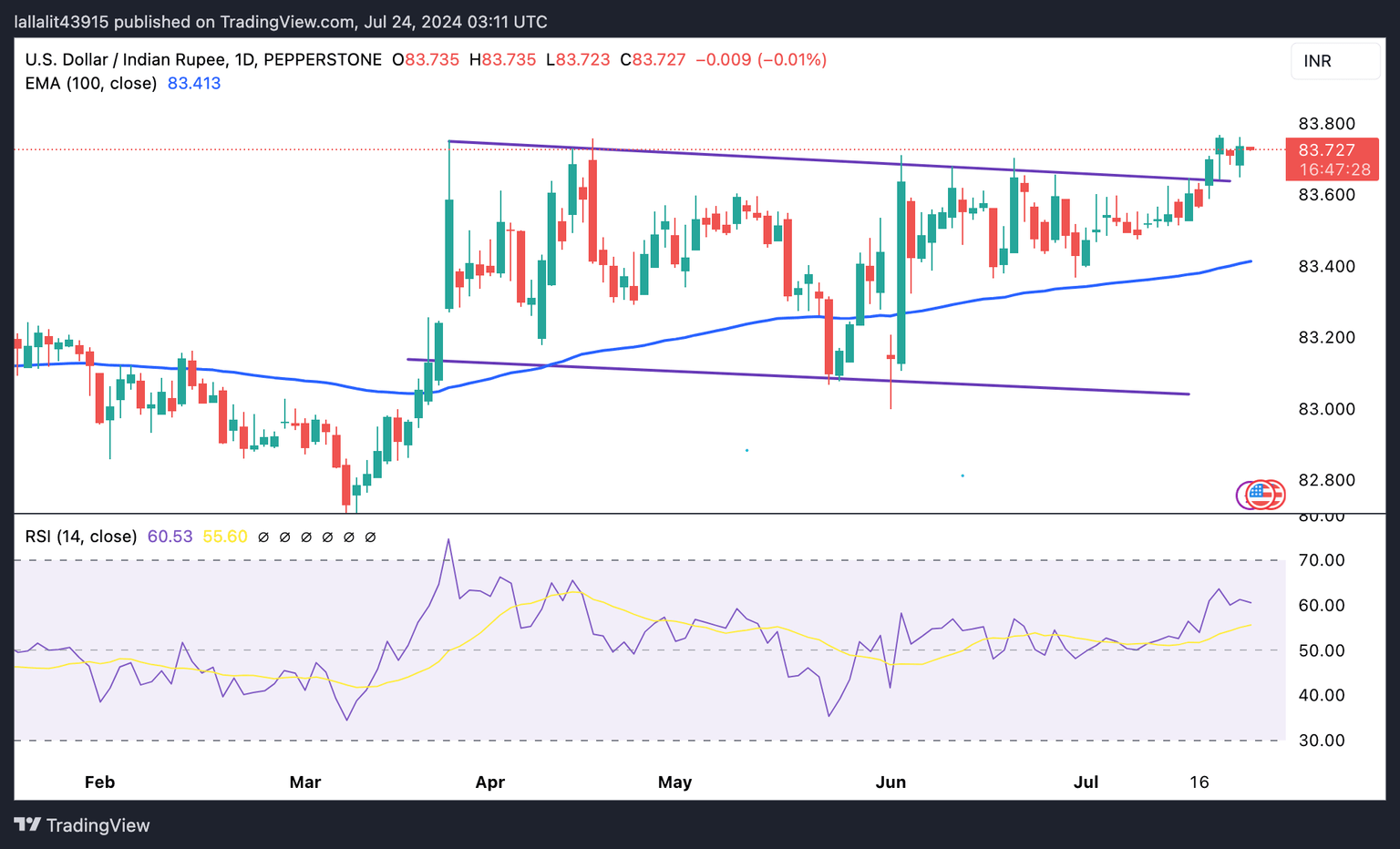

The Indian Rupee posts modest gains on the day. The USD/INR pair has been making higher highs and higher lows, while holding above the key 100-day Exponential Moving Average (EMA) on the daily chart, confirming a bullish structure. Additionally, the 14-day Relative Strength Index (RSI) stands in a bullish zone around 63.00, suggesting that there is room for further upside.

The first upside target to watch is the all-time high of 83.79. Bullish candlesticks and consistent trading above this level could push the pair to the 84.00 psychological level.

If USD/INR trades consistently below 83.65 (low of July 23), the pair could drop back down to 83.51 (low of July 12). Further south, the next contention level is seen at 83.42, the 100-day EMA.

US Dollar price in the last 7 days

The table below shows the percentage change of US Dollar (USD) against listed major currencies in the last 7 days. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.98% | 0.94% | 1.08% | 2.79% | -1.96% | 2.72% | 0.05% | |

| EUR | -0.99% | -0.05% | 0.10% | 1.82% | -2.95% | 1.75% | -0.96% | |

| GBP | -0.93% | 0.05% | 0.15% | 1.86% | -2.92% | 1.81% | -0.89% | |

| CAD | -1.09% | -0.10% | -0.14% | 1.72% | -3.08% | 1.66% | -1.04% | |

| AUD | -2.85% | -1.84% | -1.90% | -1.75% | -4.85% | -0.06% | -2.81% | |

| JPY | 1.90% | 2.85% | 2.78% | 2.94% | 4.62% | 4.53% | 1.92% | |

| NZD | -2.80% | -1.78% | -1.83% | -1.67% | 0.07% | -4.78% | -2.76% | |

| CHF | -0.08% | 0.93% | 0.88% | 1.05% | 2.73% | -1.98% | 2.66% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

RBI FAQs

The role of the Reserve Bank of India (RBI), in its own words, is '..to maintain price stability while keeping in mind the objective of growth.” This involves maintaining the inflation rate at a stable 4% level primarily using the tool of interest rates. The RBI also maintains the exchange rate at a level that will not cause excess volatility and problems for exporters and importers, since India’s economy is heavily reliant on foreign trade, especially Oil.

The RBI formally meets at six bi-monthly meetings a year to discuss its monetary policy and, if necessary, adjust interest rates. When inflation is too high (above its 4% target), the RBI will normally raise interest rates to deter borrowing and spending, which can support the Rupee (INR). If inflation falls too far below target, the RBI might cut rates to encourage more lending, which can be negative for INR.

Due to the importance of trade to the economy, the Reserve Bank of India (RBI) actively intervenes in FX markets to maintain the exchange rate within a limited range. It does this to ensure Indian importers and exporters are not exposed to unnecessary currency risk during periods of FX volatility. The RBI buys and sells Rupees in the spot market at key levels, and uses derivatives to hedge its positions.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.