- NASDAQ: IDEX has surged by over 23% on Wednesday, closing at $1.56.

- Ideanomics Inc is battling accusations of misleading shareholders but has defied short-sellers.

- Rival Workhorse is trading at around four times IDEX's value, providing hope for bulls.

NASDAQ: IDEX has continued defying gravity – and the wrath of some interested parties. Robbins LLP, a law firm specializing in shareholder rights, has officially filed a class action complaint against Ideanomics for allegedly violating the Securities Exchange Act of 1934 and misleading investors.

According to the filing, Ideanomics said that its Mobile Energy Global center in Qingdao has a capacity of 18,000 vehicles. However, Hindenburg Research later showed that the firm manipulated photos to suggest it owns and operates the facility – for the sole purpose of pushing the stock price higher.

Shares indeed jumped on the hopes and dropped amid the revelations, but this week's lawsuit seems to have done little to deter investors.

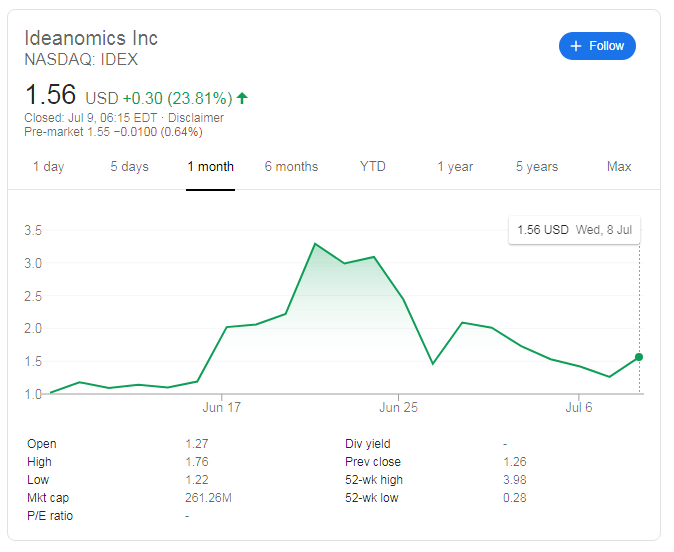

Ideanomics Inc stock

NASDAQ: IDEX bounced from the lows and closed at $1.56 on Wednesday, up some 23%. Pre-market trading on Thursday suggests a minor drop of two cents after that surge.

The entire Electric Vehicle sector is experiencing a wild ride. The coronavirus crisis has accelerated the demand for private cars and delivery vans – as people prefer avoiding public transport. The trend to go green has also been steady in recent years and Elon Musk's Tesla garnered interest.

Several rivals have popped up, and one of them is Workhorse Group Inc. (NASDAQ: WKHS) which is worth around $1.18 billion, even after the recent decline from the highs – despite the CFO calling Workhorse's valuation cheap.

Ideanomics Inc's market capitalization is only 261.26 million – around a quarter of its rival. While comparing the total values of these EV companies is too simplistic, the search for a quick surge may convince traders to jump on NASDAQ: IDEX.

At $1.56, shares are down more than 50% from the 52-week high of $3.98.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trades deep in red below 1.0300 after strong US jobs report

EUR/USD stays under bearish pressure and trades below 1.0300 in the American session on Friday. The US Dollar benefits from the upbeat jobs report, which showed an increase of 256,000 in Nonfarm Payrolls, and forces the pair to stay on the back foot heading into the weekend.

GBP/USD drops toward 1.2200 on broad USD demand

GBP/USD extends its weekly slide and trades at its weakest level since November 2023 below 1.2250. The data from the US showed that Nonfarm Payrolls rose by 256,000 in December, fuelling a US Dollar rally and weighing on the pair.

Gold ignores upbeat US data, approaches $2,700

Following a drop toward $2,660 with the immediate reaction to strong US employment data for December, Gold regained its traction and climbed towards $2,700. The risk-averse market atmosphere seems to be supporting XAU/USD despite renewed USD strength.

Sui bulls eyes for a new all-time high of $6.35

Sui price recovers most of its weekly losses and trades around $5.06 at the time of writing on Friday. On-chain metrics hint at a rally ahead as SUI’s long-to-short ratio reaches the highest level in over a month, and open interest is also rising.

Think ahead: Mixed inflation data

Core CPI data from the US next week could ease concerns about prolonged elevated inflation while in Central and Eastern Europe, inflation readings look set to remain high.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.