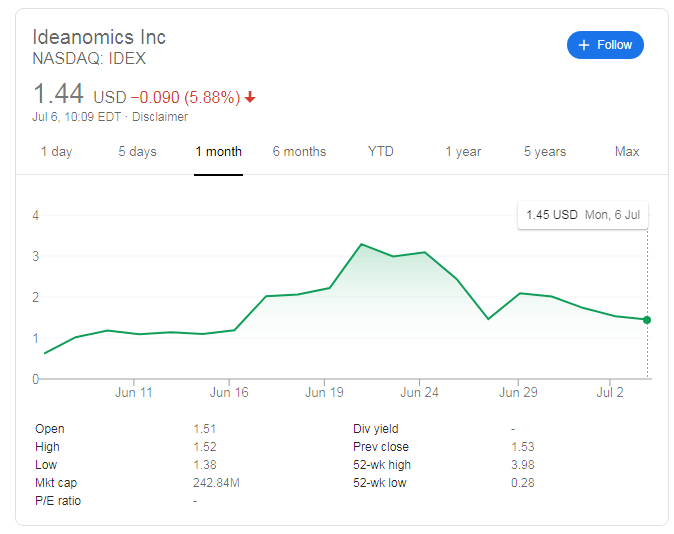

- NASDAQ: IDEX is trading at around $1.44, close to the late-June low.

- Ideanomics Inc. is struggling with short-sellers that cast doubt about its finances.

- Collaboration with charging firm Blink or with others in the EV industry could help.

NASDAQ: IDEX is on the back foot as short-sellers seem to be getting their way. Those that have doubts about Ideanomics Inc's financials – despite denials and records showing it delivered EVs – are pushing the stock lower.

The Delaware-registered firm operating in Asia has tough competition from firms such as Workhorse Group Inc. – which remains in the limelight. Ideanomic may also collaborate with Blink, which owns and/or operates charging of vehicles running on electricity. The synergies are there, but will both firms join forces?

Other competitors include Nikola and of course Elon Musk's Tesla – whose worth has surpassed that of Toyora, the world's No. 1 carmaker in the world. As Tesla's price may feel rich for some investors, small companies such as IDEX may find its feet.

Ideanomics Inc stock

NASDAQ: IDEX is trading around $1.44, down around 6% from the level it closed on Thursday, ahead of the long Independence Day weekend. It is far above the 52-week low of $0.28 or from penny-stock territory it had experienced in early June.

However, it is also off the peak of $3.98 recorded in mid-June, when the hype around it soared. At current levels, the $1.45 closing level of June 26 is critical support. The dip below that line is yet to be confirmed – and technical traders will watch the close. If shares end trading above that line, it would serve as a higher low and a bullish sign. Conversely, closing below that level would mean a lower low and a bearish sign.

Broader stock markets are encouraged by China's push into stocks. Local media has touted the time for recovery, including in equities, and searches for "open-stock account" roared higher. It is also supporting shares in the US. Will NASDAQ: IDEX move up?

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD under pressure below 1.0600 as mood sours

EUR/USD stays under selling pressure and trades below 1.0600 on Tuesday. The US Dollar finds fresh haven demand on escalating geopolitical tensions amid reports that Kremlin is threatening a nuclear response on Ukraine's use of Western missiles against Russia.

GBP/USD stays below 1.2650 after BoE Governor Bailey testimony

GBP/USD trades in the red below 1.2650 on Tuesday. Although BoE Governor Bailey said a gradual approach to removing policy restraint will help them observe risks to the inflation outlook, the sour mood doesn't allow the pair to gain traction.

Gold extends recovery toward $2,640 as geopolitical risks intensify

Gold price builds on Monday's gains and rises toward $2,640 as risk-aversion grips markets amid intensifying geopolitical tensions between Russia and Ukraine. Meanwhile, the 10-year US Treasury bond yield is down more than 1% on the day, further supporting XAU/USD.

Canada CPI expected to rise 1.9% in October, bolstering BoC to further ease policy

The Canadian Consumer Price Index is seen ticking higher by 1.9% YoY in October. The Bank of Canada has reduced its policy rate by 125 basis points so far this year. The Canadian Dollar navigates multi-year lows against its American counterpart.

The week ahead: Powell stumps the US stock rally as Bitcoin surges, as we wait Nvidia earnings, UK CPI

The mood music is shifting for the Trump trade. Stocks fell sharply at the end of last week, led by big tech. The S&P 500 was down by more than 2% last week, its weakest performance in 2 months, while the Nasdaq was lower by 3%. The market has now given back half of the post-Trump election win gains.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.