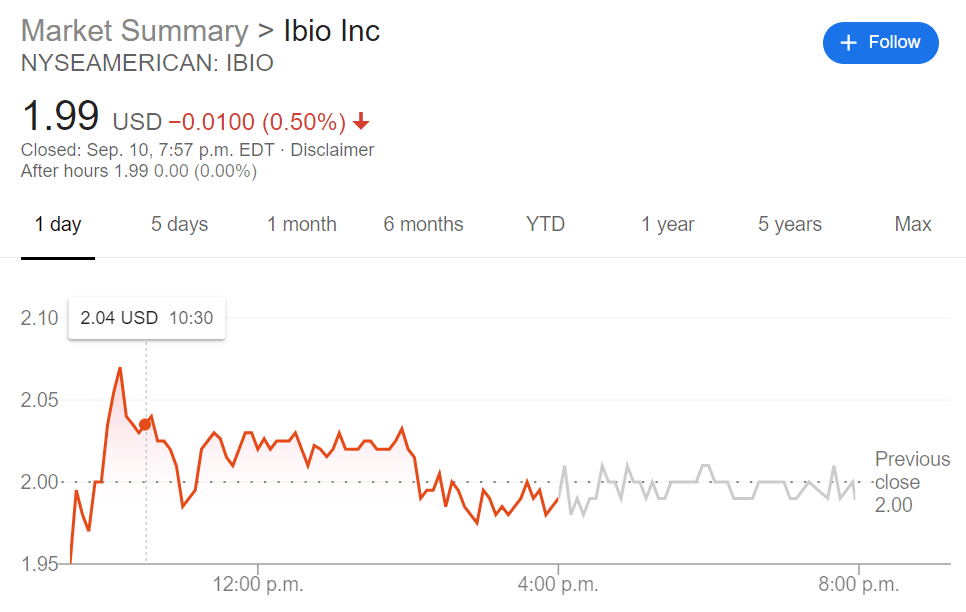

IBIO Stock Price: iBio Inc. edges slightly lower after three consecutive days of big gains

- NYSEAMERICAN:IBIO falls by 0.50% on Thursday after three straight days of gains at the start of the week.

- iBIO has finally decided on IBIO-201 as its coronavirus vaccine of choice.

- The entire COVID-19 biotech industry gained this week after AstraZeneca’s leading vaccine trial was halted.

NYSEAMERICAN:IBIO finally fell on Thursday alongside broader markets as the fallout from AstraZeneca halting its coronavirus vaccine study finally levelled off. iBIO has been a popular biotech penny stock amongst bargain investors that are targeting these micro-cap firms as potential industry disruptors. The stock has performed admirably thus far this year up 212.50% during the past 52-weeks – although shares are down over 70% from its 52-week highs of $7.45.

IBIO is more than just a coronavirus vaccine candidate though and investors know that the New York-based company has some more aces up its sleeve. Even if IBIO-201 is not chosen as the one the vaccines used to combat COVID-19, iBIO Inc. is well-positioned to be a global manufacturer of vaccine components with its FastPharming facility located in Bryan, Texas. The world is going to need upwards of 7 billion vaccines at some point and it may inevitably be a combination of biotech firms that band together to conquer the novel coronavirus.

IBIO Stock News

iBIO also has its hands in other sectors as it is developing IBIO-100 as well, which is a fusion protein for the treatment of fibrotic diseases. The recent selloff leading up to the AstraZeneca news has battered the stock down to levels where bargain investors should once again take notice. The race for the COVID-19 vaccine is wide open as other firms continue to fail and other companies have the chance to step up to the plate. While ultimately IBIO may not be the vaccine that is chosen, it certainly has a chance of carving out a role in the manufacturing of vaccines for global use.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet