In early August of this year, stock market indices saw significant declines across the board. Once again, so-called experts started predicting doom. However, we maintained the same outlook we’ve held for months. Our members at Elliottwave Forecast understood our position. We consistently believed that indices should remain within the long-term bullish cycle. We anticipated counter moves would develop as corrective pullbacks in a sequence of 3, 7, or 11 swings. These pullbacks should end at the equal leg, setting up for the next rally. And that’s precisely what happened. Major indices hit their extremes on August 5th, 2024, ending the corrective pullback that began in June 2024 with 3, 7, or 11 swings.

Prices have since recovered from the sharp early August decline. While the experts spread fear, we encouraged our traders to buy indices at the extremes. The IBEX 35 was one of the indices our members successfully traded.

IBEX 35 H4 chart 08.03.2024

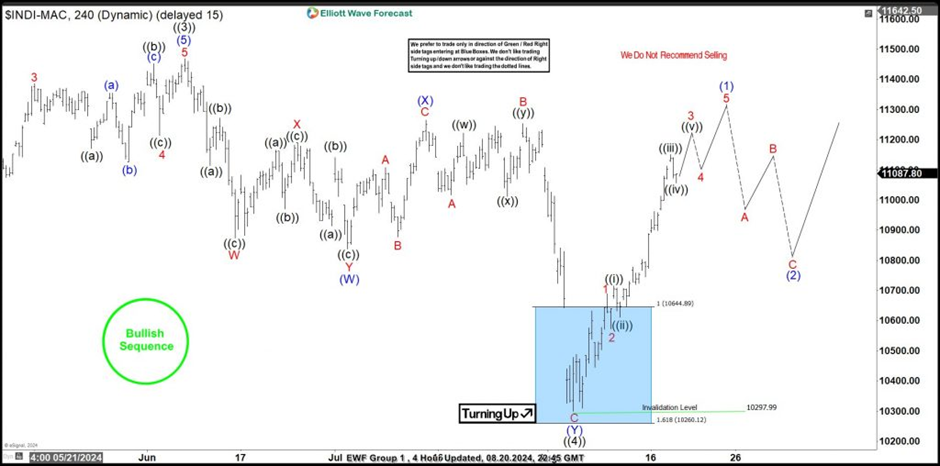

We shared the IBEX 35 H4 chart with members on August 3rd, 2024. The decline from the June 2024 high was completing a zigzag structure. We identified the extreme zone at 10,643 to 10,260 with a blue box. Members entered LONG positions within the blue box, with stops placed below 10,260. Although we found the initial LONG entry using the H4 chart, we continued managing the shorter cycles on the H1 chart several times a day.

IBEX 35 H4 chart 08.21.2024

The chart above shows how the IBEX 35 found fresh buyers in the blue box. We shared this chart with members on August 21st, 2024. The rally advanced with an impulse structure, reaching a risk-free zone. The end of wave ((4)) is now confirmed. We identify the impulse rally from the blue box as wave (1) of ((5)). A pullback in wave (2) is expected to hold above the 10,297.99 invalidation level. Afterward, the long-term bullish trend should resume. Therefore, we aim to remain buyers from the extremes of 3, 7, or 11 swings pullbacks across all the indices we cover.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.