How this change of character bar marked a key shift in market dynamics [Video]

![How this change of character bar marked a key shift in market dynamics [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Candlesticks/stock-market-graph-and-bar-chart-price-display-75053099_XtraLarge.jpg)

Watch the video from the WLGC session on 24 Dec 2024 to find out the following:

-

Insights into potential scenarios, including prolonged trading ranges and increased choppiness in the market.

-

How a single bearish bar can reverse weeks of upward momentum and what it means for traders

-

How does the change of character bar impact the broader market trend and potential volatility

-

and a lot more...

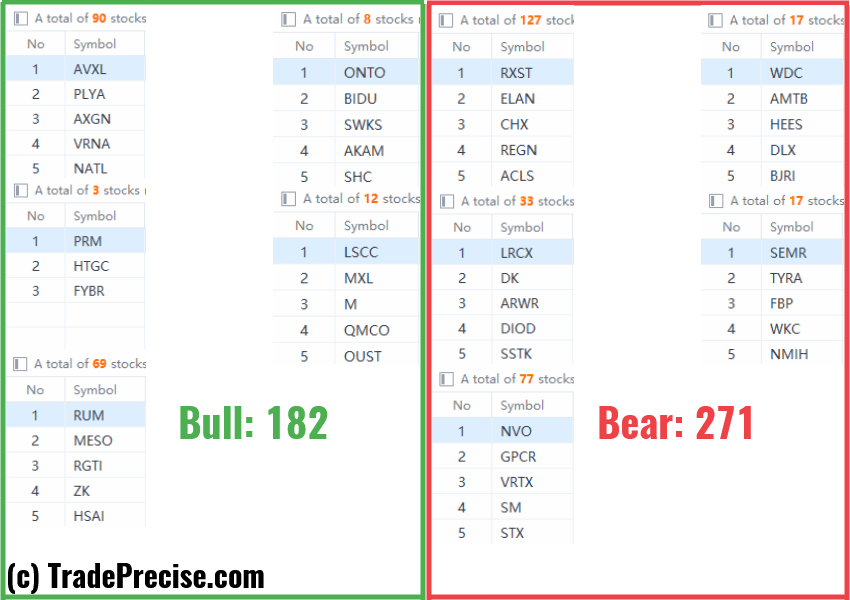

Market environment

The bullish vs. bearish setup is 182 to 271 from the screenshot of my stock screener below.

Three stocks ready to soar

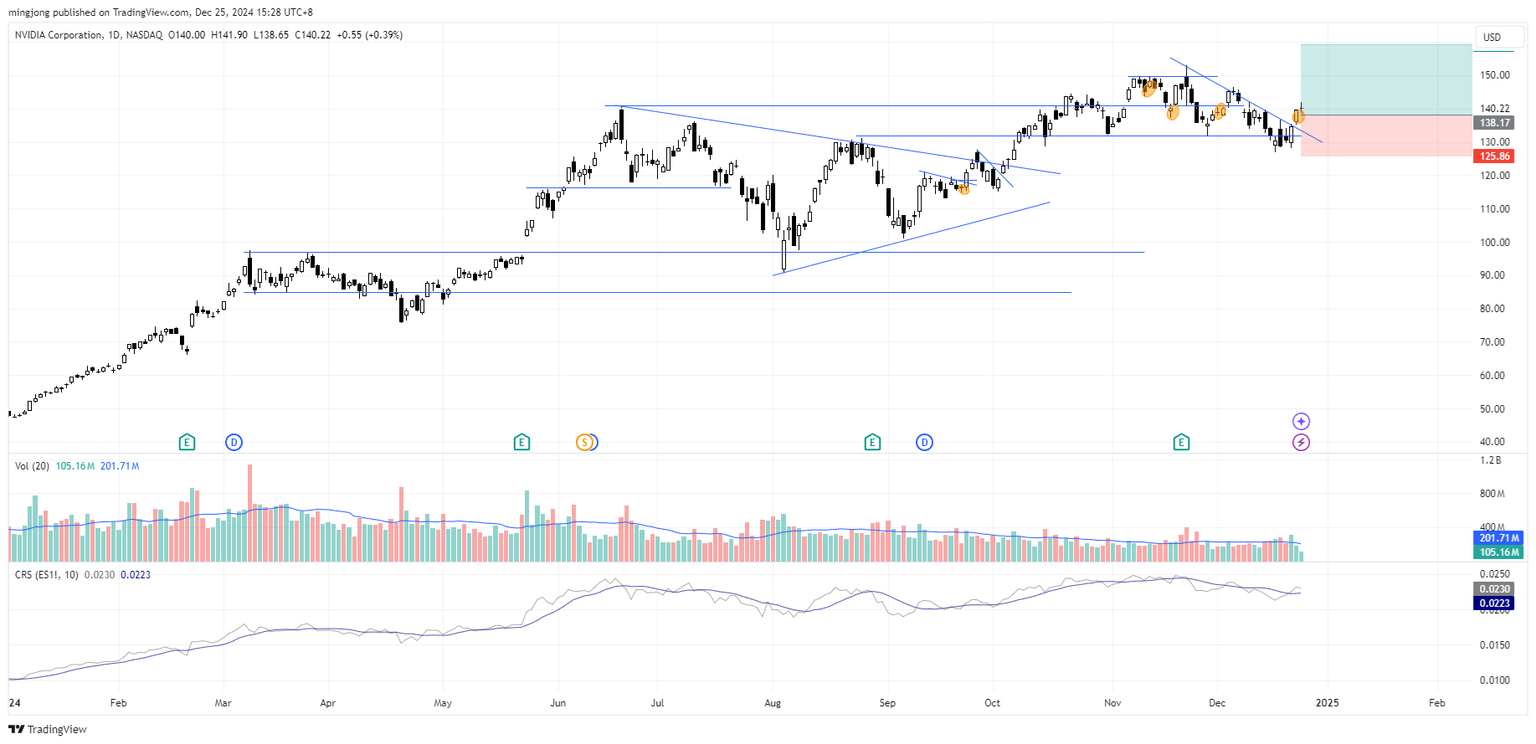

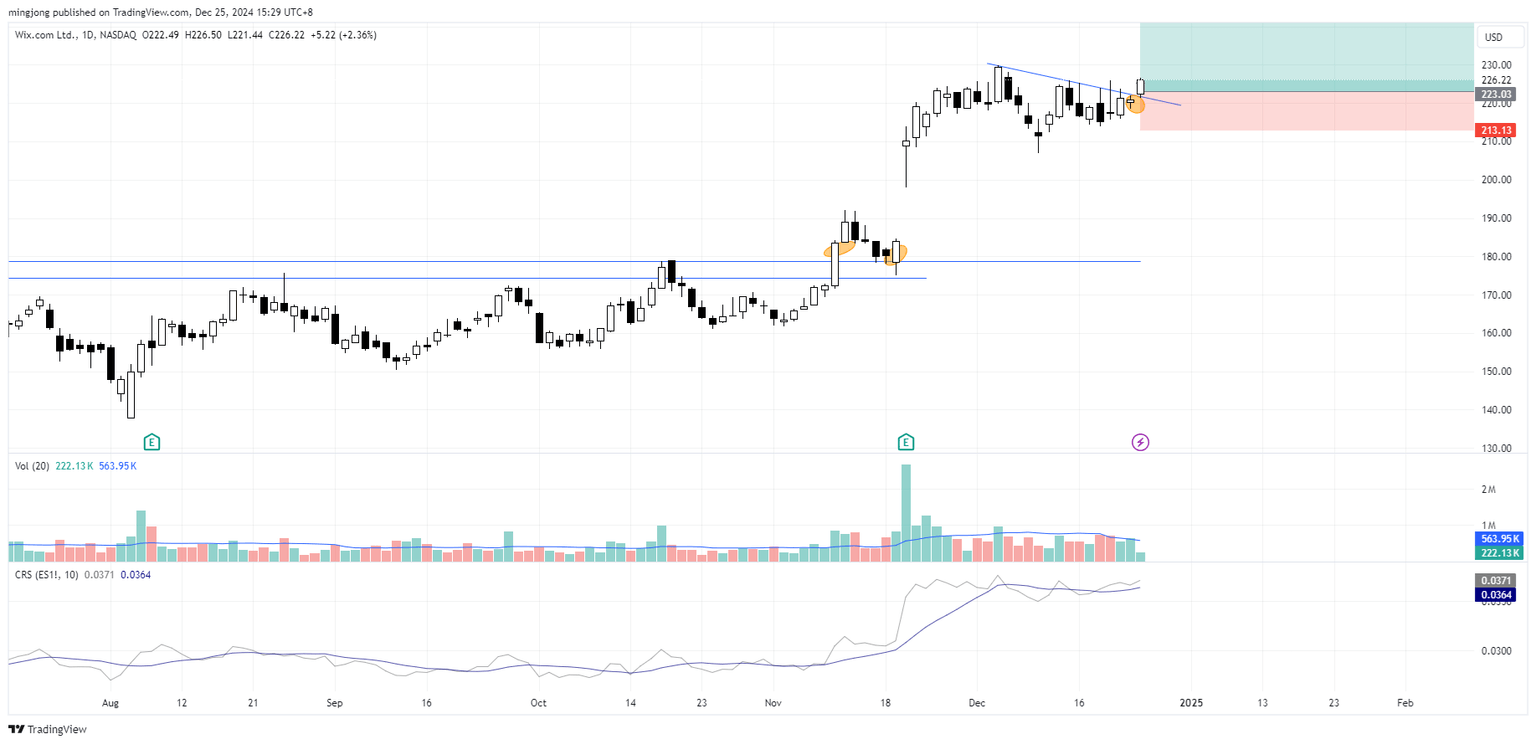

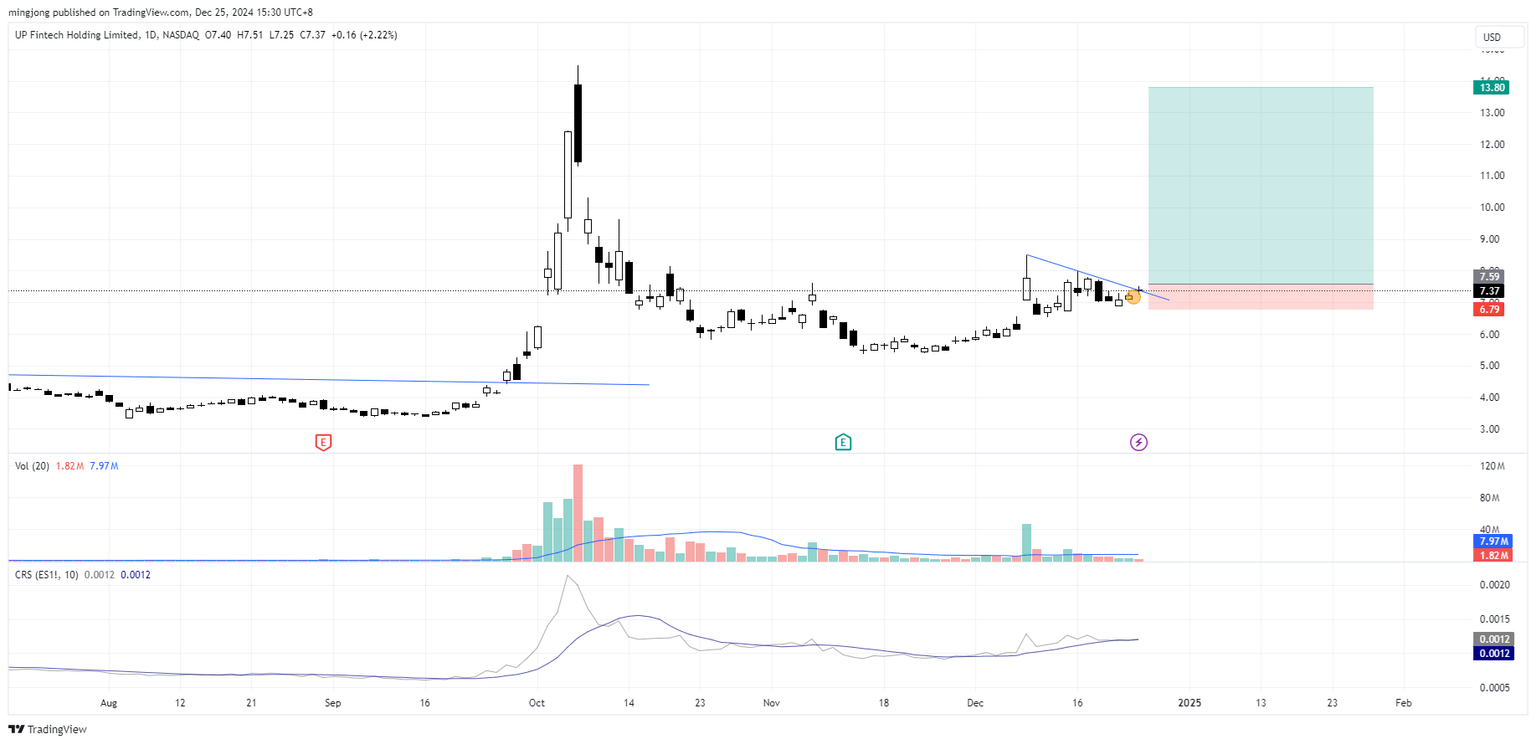

23 actionable setups such as NVDA, WIX<, TIGR were discussed during the live session before the market open (BMO).

NVIDIA (NVDA)

Wix.com (WIX)

UP Fintech (TIGR)

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.