Key points

-

Strong outlook for holiday spending: A soft landing, rising wages, and robust consumer confidence set the stage for record holiday spending.

-

Stock opportunities across sectors: Retail giants, e-commerce, specialty stores, travel companies, and gaming firms could be primed for growth this season.

-

ETFs for diversification: Explore thematic ETFs to capture gains in retail, leisure, and e-commerce trends.

A Merry outlook for holiday spending

As the holiday season kicks into high gear, the U.S. economy is setting a strong foundation for robust spending. A resilient consumer, paired with improving macroeconomic conditions, is driving optimism for 2024's holiday shopping period. Here’s why this season could deliver record-breaking numbers:

Soft landing on the horizon: The U.S. economy has navigated the challenges of inflation and interest rates remarkably well. With expectations of potential rate cuts in 2024, the outlook for growth has improved significantly.

Resilient consumers: Rising real wages and a wealth effect from stock market gains and home-price appreciation have bolstered purchasing power. Consumer confidence remains robust, even amid higher borrowing costs.

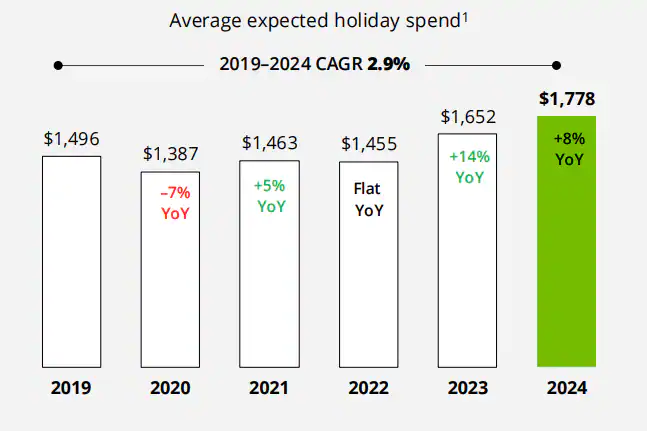

Record holiday spending: The National Retail Federation predicts a 3% increase in holiday sales over last year, reflecting sustained consumer demand despite a shortened shopping season. Deloitte’s survey shows that consumers plan to spend an average of $1,778 this year, up 8% from 2023, with experiences prioritized over gifts.

Early shopping trends: Nearly half of holiday shoppers started before November, a trend reflecting greater consumer planning and demand for seasonal deals.

Strong company guidance: Positive earnings reports are boosting confidence for the season, with Walmart hitting a record high. Abercrombie & Fitch, Gap, and Williams-Sonoma report strong starts, while Airbnb and United Airlines forecast strong holiday demand, particularly in travel and experiences.

Source: Deloitte

Stock playbook for the holiday season

From retail to travel, here’s a breakdown of sectors and stocks expected to benefit from holiday spending:

Retail giants

Walmart (WMT): Captures holiday demand with affordable essentials and gifts.

Amazon (AMZN): Dominates with its Prime ecosystem and Black Friday sales.

Costco (COST): Appeals to bulk shoppers for holiday feasts and gifts.

Best Buy (BBY): Benefits from strong demand for electronics and tech gadgets.

Specialty retail

Ralph Lauren (RL): High-end apparel and accessories for holiday gifting.

Tapestry (TPR): Owner of Coach and Kate Spade, capitalizing on luxury trends.

Abercrombie & Fitch (ANF): Trend-driven clothing for younger shoppers.

Urban Outfitters (URBN): Unique offerings for Millennial and Gen Z shoppers.

Lululemon (LULU): Popular athleisure brand with loyal customers.

Gap (GAP): Affordable, stylish apparel attracts premium holiday shoppers.

Travel and leisure

Delta Air Lines (DAL): Increased travel demand drives higher ticket revenues.

United Airlines (UAL): Stands to gain from the uptick in holiday travelers.

Expedia (EXPE): Increased bookings for flights, hotels, and vacation packages.

Marriott International (MAR): Popular for family reunions and holiday vacations.

Airbnb (ABNB): Strong demand for unique stays during the holidays.

Booking Holdings (BKNG): Robust bookings for global holiday travel.

Carnival Cruise Lines (CCL): Experiential gifts boost cruise bookings.

Toys and gaming

Hasbro (HAS): Popular toys like Monopoly and Nerf drive seasonal sales.

Mattel (MAT): Barbie and Hot Wheels remain top holiday picks.

Electronic Arts (EA): Video games like FIFA are perennial favorites.

Roblox (RBLX): Immersive gaming platform loved by kids and teens.

Streaming and entertainment

Netflix (NFLX): Tyson fight exclusive and strong original content should drive subscriptions.

Disney (DIS): New movie releases and Disney+ offerings could boost revenue. Holiday travels could also boost theme parks.

Credit cards and payments

Visa (V): Higher transaction volumes during peak shopping.

Mastercard (MA): Benefits from global holiday spending trends.

American Express (AXP): Strong demand among affluent shoppers.

PayPal (PYPL): E-commerce transactions surge during the holidays.

Affirm (AFRM): Buy Now, Pay Later services drive holiday sales.

Health and personal care

CVS Health (CVS): Positioned to benefit from increased demand for wellness products.

Walgreens Boots Alliance (WBA): Continued demand for pharmacy and personal care.

Bath & Body Works (BBWI): Holiday scents and gift sets boost sales.

Procter & Gamble (PG): Household and personal care products see increased demand.

Estée Lauder (EL): Holiday gifting boosts sales of premium skincare and cosmetics.

ETF ideas for broader exposure

For investors looking to diversify, these ETFs provide targeted exposure to sectors poised to benefit from holiday spending:

SPDR S&P Retail ETF (XRT): Tracks top U.S. retail stocks.

iShares US consumer staples ETF (IYK): Covers consumer staple goods.

VanEck video gaming and eSports UCITS ETF (ESPO): Focused on the gaming and esports industry.

Invesco Leisure and Entertainment ETF (PEJ): Offers exposure to travel and leisure.

Global X E-commerce ETF (EBIZ): Captures the online retail boom.

Read the original analysis: Holiday stock picks: Playbook for the season of cheer

The Saxo Bank Group entities each provide execution-only service and access to Analysis permitting a person to view and/or use content available on or via the website. This content is not intended to and does not change or expand on the execution-only service. Such access and use are at all times subject to (i) The Terms of Use; (ii) Full Disclaimer; (iii) The Risk Warning; (iv) the Rules of Engagement and (v) Notices applying to Saxo News & Research and/or its content in addition (where relevant) to the terms governing the use of hyperlinks on the website of a member of the Saxo Bank Group by which access to Saxo News & Research is gained. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Saxo News & Research or as a result of the use of the Saxo News & Research. Orders given and trades effected are deemed intended to be given or effected for the account of the customer with the Saxo Bank Group entity operating in the jurisdiction in which the customer resides and/or with whom the customer opened and maintains his/her trading account. Saxo News & Research does not contain (and should not be construed as containing) financial, investment, tax or trading advice or advice of any sort offered, recommended or endorsed by Saxo Bank Group and should not be construed as a record of our trading prices, or as an offer, incentive or solicitation for the subscription, sale or purchase in any financial instrument. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws.

Recommended content

Editors’ Picks

EUR/USD recovers toward 1.0500 after mixed US PMI data

EUR/USD rebounds toward 1.0500 in the American session on Friday after the data from the US showed that the business activity in the private sector expanded at a softer pace than anticipated in early February. The pair remains on track to end the week with little changed.

GBP/USD rises above 1.2650, looks to post weekly gains

GBP/USD regains its traction and trades above 1.2650 in the second half of the day on Friday. The data from the US showed that the S&P Global Services PMI dropped into the contraction territory below 50 in February, causing the US Dollar to lose strength and helping the pair edge higher.

Gold holds above $2,930 as US yields edge lower

Gold holds above $2,930 after correcting from the record-high it set above $2,950 on Thursday. Following the mixed PMI data from the US, the benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and allows XAU/USD to hold its ground.

Crypto exchange Bybit hacked for $1.4 billion worth of ETH

Following a security breach first spotted by crypto investigator ZachXBT, crypto exchange Bybit announced that it suffered a hack where an attacker compromised one of its ETH wallets.

Money market outlook 2025: Trends and dynamics in the Eurozone, US, and UK

We delve into the world of money market funds. Distinct dynamics are at play in the US, eurozone, and UK. In the US, repo rates are more attractive, and bills are expected to appreciate. It's also worth noting that the Fed might cut rates more than anticipated, similar to the UK. In the eurozone, unsecured rates remain elevated.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.