HKD Stock Forecast: AMTD Digital trades flat while rival TOP Financial Group soars higher

- NYSE:HKD fell by 1.65% during Thursday’s trading session.

- TOP Financial Group rises 52% while MEGL stock slumps lower.

- Treasure Global stock IPOs on the NASDAQ and gains 345%.

NYSE:HKD has now gone two straight days without any major swings as the Hong Kong-based fintech stock remains heavily inflated. On Thursday, shares of HKD dipped by 1.65% and closed the trading session at $214.00. Stocks cooled off following Wednesday’s rally, as all three major indices started the day hot but tapered off into the closing bell. The enthusiasm that followed a better than expected CPI report from July had mostly dissipated during Thursday’s trading. Overall, the Dow Jones gained 27 basis points, while the S&P 500 and the NASDAQ dropped lower by 0.07% and 0.58% respectively during the session.

Stay up to speed with hot stocks' news!

While AMTD Digital took a back seat on Thursday, one of its other rivals was surging higher yet again. Another Hong Kong-based financial company, TOP Financial Group (NASDAQ:TOP) gained 52.41% and closed the trading day at $19.25. TOP, AMTD Digital, and Magic Empire Global Limited have been involved in a surprising squeeze involving recently IPO’d Asian-based stocks. AMTD Digital made mainstream headlines with its 21,000% gain that pushed the company’s valuation up to nearly $500 billion in market capitalization. Shares of MEGL continued lower on Thursday and fell by 11.38%.

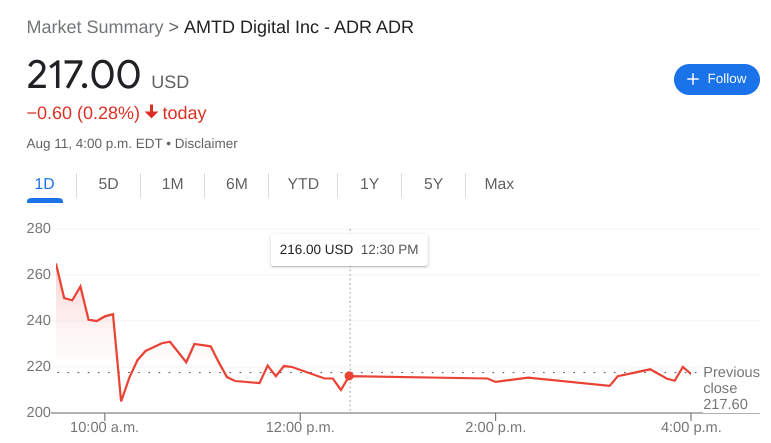

HKD stock price

Just as we thought that this squeeze had ended, a new player IPO’d on the NASDAQ exchange on Thursday. Malaysia-based Treasure Global (NASDAQ:TGL) saw its stock gain a staggering 345.5% during its first day of trading. The company fits the criteria of recent squeeze targets like AMTD Digital, Magic Empire, and TOP Financial Group. It is an Asian-baseed financial company that has a low share float and had a recent IPO.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet