Here's how Fed's decision could rock the S&P 500 [Video]

![Here's how Fed's decision could rock the S&P 500 [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse4-637299025173341169_XtraLarge.jpg)

Watch the video from the WLGC session before the market opens on 17 Sep 2024 to find out the following:

- The “ideal” scenario based on the Fed’s announcement to form the expected “patterns”.

- The 2 key factors you need to watch that will impact the S&P 500.

- How to detect the exhaustion of the upside momentum with hidden supply.

Market Environment

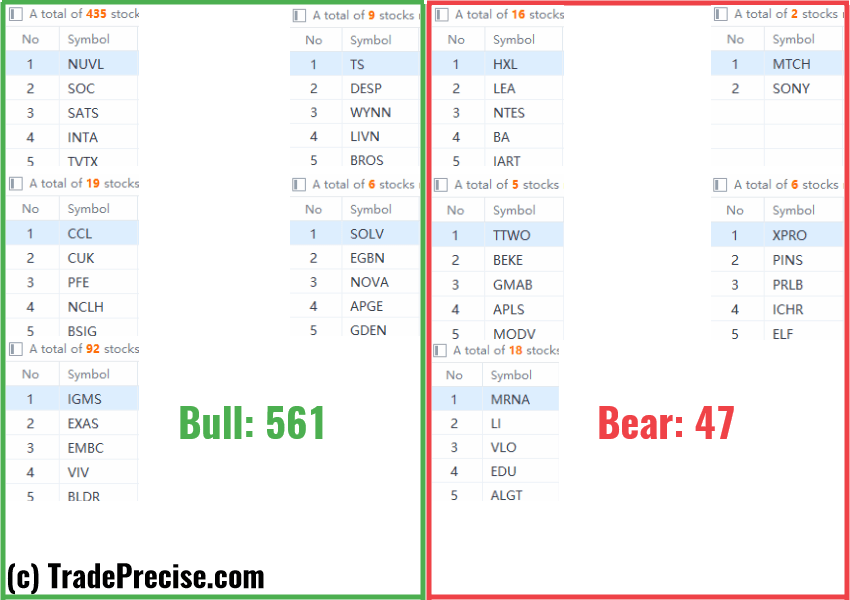

The bullish vs. bearish setup is 561 to 47 from the screenshot of my stock screener below.

Three stocks ready to soar

Six “low-hanging fruits” trade entries setups and 15 actionable setups were discussed during the live session before the market open (BMO).

There is no shortage of the bullish setups. In fact, there is complacency in the market as reflected in the bullish vs. bearish setups above (ratio of more than 10:1).

The priority is on managing the existing positions such as tighten the stop loss and scale out to lock in the profit.

It is essential to continue to monitor those outperforming stocks especially during market pullback. These stocks will likely to sustain the rally and continue to beat the market.

These are the stocks I am paying attention to and looking for triggers from the setups, such as EAT, SE, NOVA.

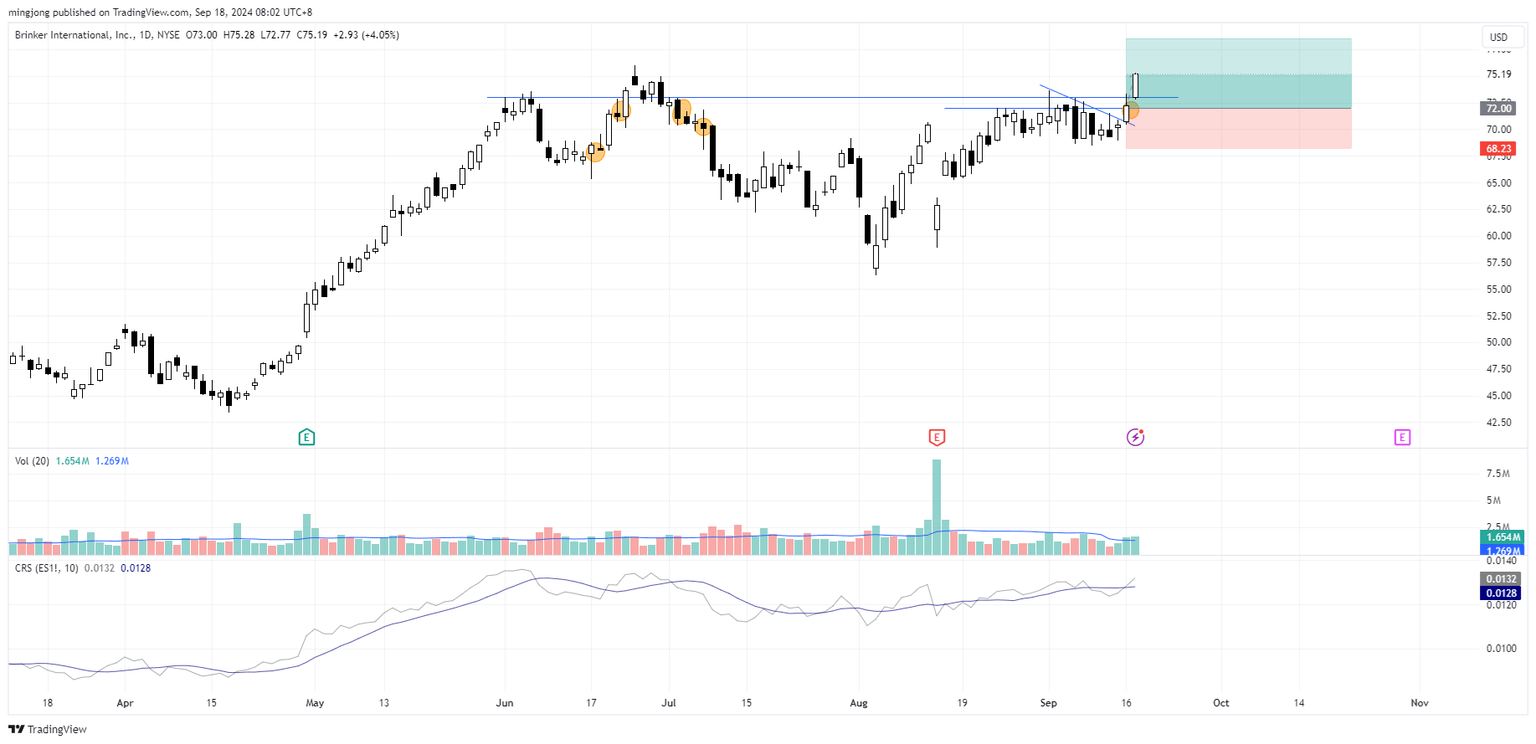

EAT

SE

NOVA

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.