HDFC Life Insurance India stocks Elliott Wave technical analysis [Video]

![HDFC Life Insurance India stocks Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/ApparelDurables/pic-pexels-stanislav-kondratiev-2908975-637435311769887876_XtraLarge.jpg)

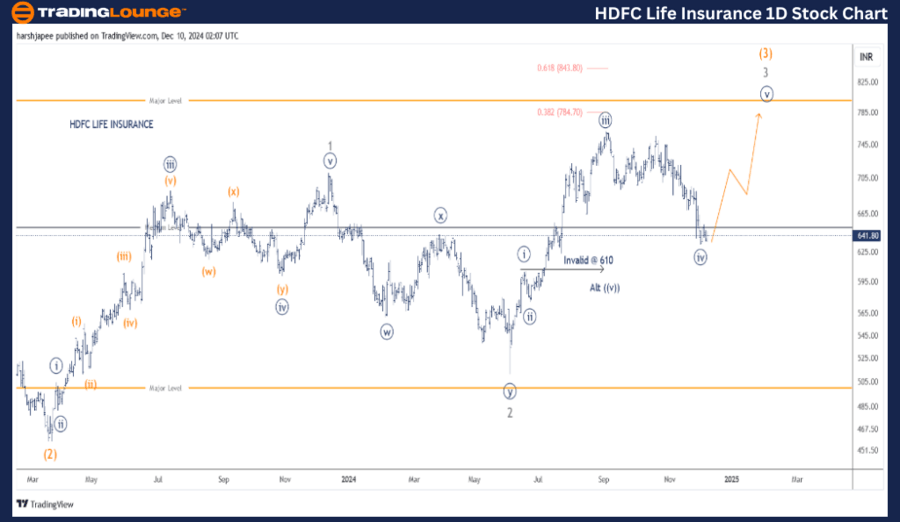

HDFC Life Insurance (1D chart) Elliott Wave technical analysis

Function: Larger Trend Higher (Intermediate degree Wave (3), orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((iv)) Navy.

Details: Minute Wave ((iv)) Navy is looking potentially complete around 640 within Minor Wave 3 Grey of Intermediate Wave (3) Orange. Potential upside target is seen towards 843 mark.

Invalidation point: 610.

HDFC LIFE INSURANCE Daily Chart Technical Analysis and potential Elliott Wave Counts:

HDFC LIFE INSURANCE daily chart is indicating a progressive rally, which could be unfolding Minute Wave ((v)) of Minor Wave 3, within Intermediate Wave (3) against 610 mark. A major support is seen around 510, which is Minor Wave 2 termination, and prices must stay higher to keep bullish count intact.

The stock had earlier dropped through 458 lows around March 2023, which is marked as Intermediate Wave (2) Orange. An impulse rally towards 710 is marked as Minor Wave 1, while Wave 2 unfolded as a combination.

If the above holds well, prices should ideally stay above 610 mark to keep the impulse structure intact as Intermediate Wave (3) unfolds.

HDFC Life Insurance (four-hour chart) Elliott Wave technical analysis

Function: Larger Trend Higher (Intermediate degree Wave (3), orange).

Mode: Motive.

Structure: Impulse.

Position: Minute Wave ((iv)) Navy.

Details: Minute Wave ((iv)) Navy is looking potentially complete around 640 within Minor Wave 3 Grey of Intermediate Wave (3) Orange. Potential upside target is seen towards 843 mark. A drop below 610 might require a re-assessment though.

Invalidation point: 610.

HDFC LIFE INSURANCE 4H Chart Technical Analysis and potential Elliott Wave Counts:

HDFC LIFE INSURANCE 4H chart is highlighting the sub waves since Minor Wave 2 Grey terminated around 510 in June 2024. Minute Wave ((iii)) of 3 carried through 760 mark and Minute Wave ((iv)) might be complete around 635-40 range. If correct, prices should turn higher from here.

Alternatively, if prices continue to drop below the 610 mark, we would consider changing the proposed wave degree against Minor Wave 2 lows.

Conclusion:

HDFC LIFE INSURANCE is now progressing higher within Minute Wave ((v)) of Minor Wave 3 within the Intermediate Wave (3) Orange against 610 lows.

Elliott Wave analyst: Harsh Japee.

HDFC Life Insurance Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.