GX Uranium ETF Elliott Wave technical analysis [Video]

![GX Uranium ETF Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DowJones/bloomberg-app-on-iphone-4-with-market-data-17118657_XtraLarge.jpg)

GX URA Elliott Wave analysis

The Global X Uranium ETF (GX URA) provides investors exposure to the uranium sector, tracking companies engaged in uranium mining, exploration, and production globally. As nuclear energy gains traction as a cleaner power source, uranium demand could rise, positioning the GX URA ETF as an appealing opportunity for investors interested in the sector's potential growth.

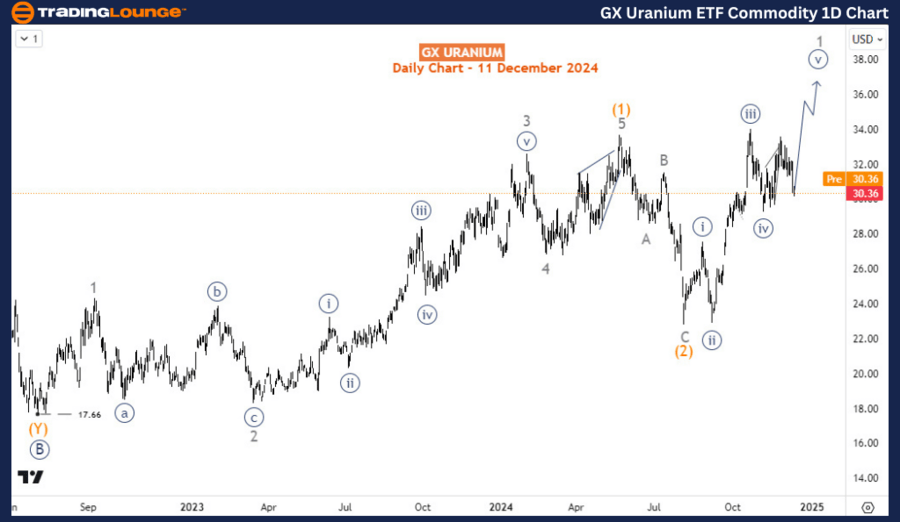

Daily chart analysis

The GX URA ETF remains bullish from March 2020 when it began an impulse wave structure that finished in November 2021. We identified this rally as wave ((A)) of ((1)). A pullback followed from the top of November 2021 and finished a double zigzag structure at 17.66 in July 2022. We can identify this pullback as wave ((B)) or ((2)). Therefore, wave ((C))/((3)) started at 17.66 and should develop into an impulse structure toward $42-$57.3.

Meanwhile, as the daily chart shows, the commodity has completed waves (1) and (2) of ((C))/((3)) and is now in wave (3).

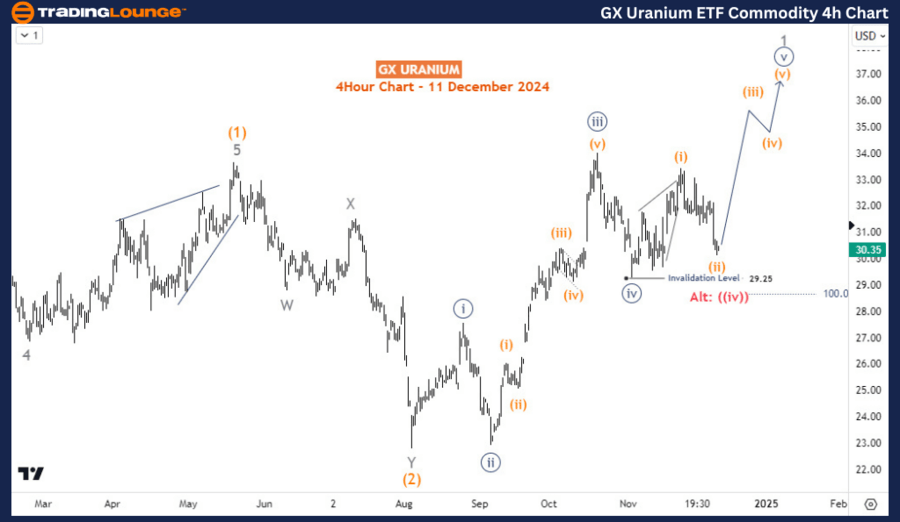

Four-hour chart analysis

It appears wave 1 of (3) is incomplete yet. On the h4 chart, wave ((iv)) of 1 finished at 29.25 and thus, the current dip is expected to be wave (ii) of ((v)) if 29.25 continues to hold. A breach of that level will see us counting for a lower ((iv)) to 28.27 or even wave 2. In either case, price action favors upside continuation from the dip in both the short-term and long-term outlook.

GX Uranium ETF Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.