- NASDAQ: GLSI has surged by 13% on Tuesday and is set to fall by 10% on Wednesday.

- Greenwich Lifesciences' shares may provide a "buy the dip" opportunity.

- Advances in treating breast cancer treatments may push the equity higher, despite competition.

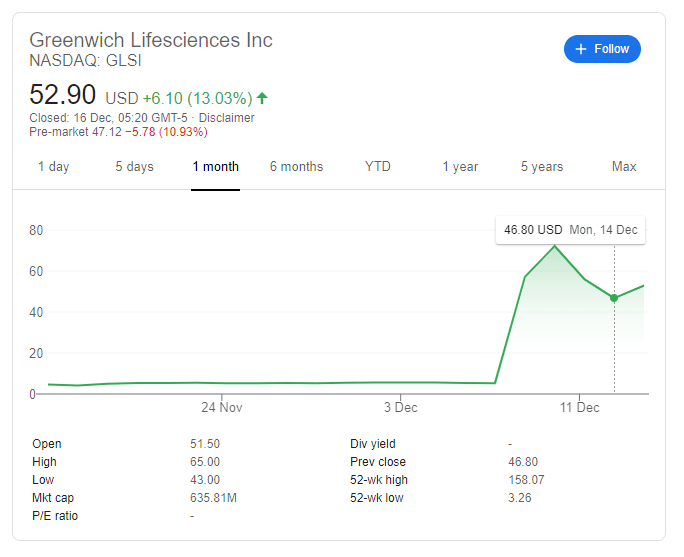

After jumping nearly 1,000% in one day, calm was never unlikely to return to Greenwich Lifesciences Inc (NASDAQ: GLSI). The Stafford, Texas-based company's shares floated on the stock market only in September and immediately tumbled down to around $5. After a period of autumn hibernation, GLSI shot from $5.20 to $57.10 on December 9.

Why did Greenwich Lifesciences jump? The company formerly known as Norwell announced it is beginning a Phase 3 trial design for its GP2 treatment. The drugs aim to prevent breast cancer from recurring. The news broke out in the form of a poster presentation at a neighboring San Antonio Symposium about the disease which kills some 42,000 women in the US every year.

GP2 has the potential to fully prevent a return of the illness, thus making it promising. It is essential to note that other firms are also competing in this field, with shares gaining traction.

See VERU Stock Price And News: Set to hit 26-year high after promising cancer treatment results

Since that leap, shares hit a closing price of $72.20 – albeit less than half of the levels after the Initial Public Offering. Is NASDAQ: GLSI still a buy?

GLSI Stock Price

After leaping by over 13% on Tuesday, a downfall of over 10% is on the cards for Wednesday according to premarket trading. The move may provide a buying opportunity. Apart from changing hands well below the IPO price, Greenwich LifeSciences' valuation is below $1 billion – a small market capitalization for a pharma firm.

The world will soon move away from COVID-19 whle other diseases prevail. Funds could shift to other life-saving ventures, especially those with high potential and low valuations.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds the bounce toward 0.6250 after China's Caixin Services PMI

AUD/USD sustains the rebound toward 0.6250 in the Asian session on Monday after China's Caixin Services PMI beat estimates with 52.2 in December. China's stimulus optimism and a subdued US Dollar offset increased bets for early RBA rate cuts, reviving the demand for the Aussie.

USD/JPY: Upside remains capped below 158.00 amid cautious mood

USD/JPY is consolidating the upside below 158.00 in Asian trading on Monday. The pair feels the heat from a cautious risk tone and a broadly subdued US Dollar but the divergent Fed-BoJ policy expectatations help keep it afloat in the Nonfarm Payrolls week.

Gold buyers stay hopeful whilst above 21-day SMA support

Gold price finds support and looks at $2,650 as the US Nonfarm Payrolls week begins. The US Dollar corrects further despite firm US Treasury bond yields and a cautious mood. Technically, daily indicators continue to paint a bullish picture for Gold price.

Bitcoin, Ethereum and Ripple show signs of bullish momentum

Bitcoin’s price is approaching its key psychological level of $100,000; a firm close above would signal the continuation of the ongoing rally. Ethereum price closes above its upper consolidation level of $3,522, suggesting bullish momentum. While Ripple price trades within a symmetrical triangle on Monday.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.