Grasim Industries Elliott Wave technical analysis [Video]

![Grasim Industries Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/stock-market-surge-bull-green-financial-screen-5785196_XtraLarge.jpg)

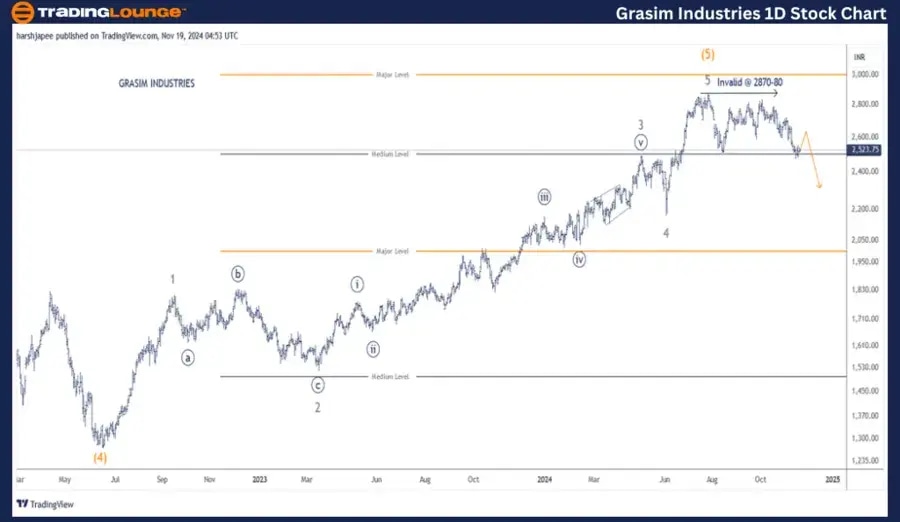

Grasim Industries – Grasim (1D chart) Elliott Wave technical analysis

Function: Counter Trend Lower (Minor Degree Grey).

Mode: Corrective.

Structure: Potential Zigzag.

Position: Still unfolding hence not labelled yet.

Details: A potential Minor degree zigzag could be underway against 2880.

The stock could pull back towards 2600-20 range near term before turning lower again.

Invalidation point: 2880.

GRASIM INDUSTRIES Daily Chart Technical Analysis and potential Elliott Wave Counts:

GRASIM INDUSTRIES daily chart indicates potential termination of its larger degree (Intermediate) uptrend around 2880 mark. The tock might be in its initial stages to mark a larger degree corrective wave as medium term target could be seen towards 2170 levels.

The stock terminated Intermediate Wave (4) around 1270 in June 2022. Since then the rally can be clearly sub divided into five waves Minor 1 through 5, which extended through 2880. If the above is correct, bears are now inclined to carve a larger degree corrective drop towards 2170 at least.

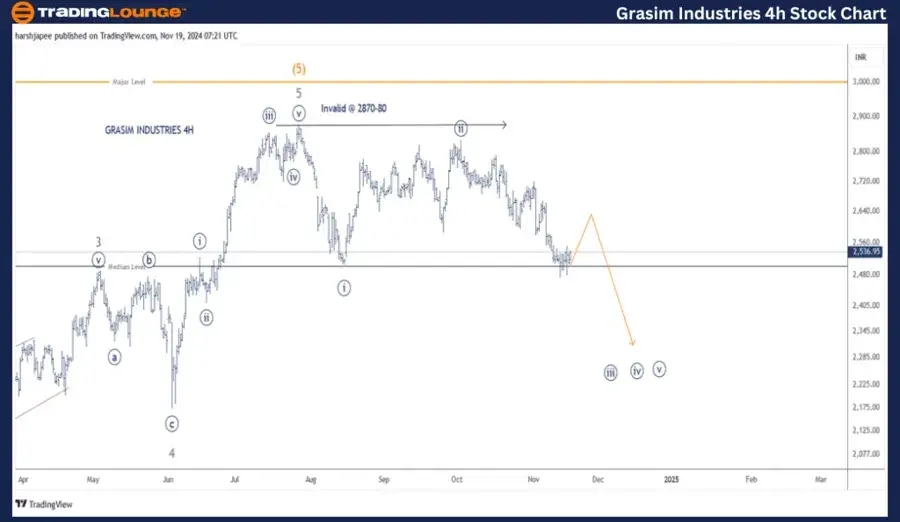

Grasim Industries – Grasim (4H chart) Elliott Wave technical analysis

Function: Counter Trend Lower (Minor Degree Grey).

Mode: Corrective.

Structure: Potential Zigzag.

Position: Minute ((ii)) Grey on 4H chart.

Details: A potential Minor degree zigzag could be underway against 2880. Please note we have labelled Minute Wave ((i)) and ((ii)) potentially complete on 4H chart. If correct, it could be Minor Wave A of the proposed zigzag. The stock could pull back towards 2600-20 range near term before turning lower again.

Invalidation point: 2880.

GRASIM INDUSTRIES 4H Chart Technical Analysis and potential Elliott Wave Counts:

GRASIM INDUSTRIES 4H chart highlights the sub waves since termination of Minor Wave 3 Grey around 2510-20 range. Minor Wave 4 was sharp (Zigzag), followed by an impulse to terminate Minor Wave 5 of (5) around 2880.

Furthermore, Minute Waves ((i)) and ((ii)) might be complete around 2500 and 2835 levels respectively (not yet marked on Daily chart). If correct, Minute ((iii)) could be underway against 2880.

Conclusion:

GRASIM INDUSTRIES might have terminated Intermediate Wave (5) Orange around 2880 and turned lower to carve a similar degree corrective wave.

Elliott Wave Analyst: Harsh Japee.

Grasim Industries – Grasim Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.