Gores Guggenheim Stock News and Forecast: Is GGPI a buy now?

- Gores Guggenheim stock is stable and needs a catalyst event.

- GGPI will take Polestar public via the SPAC deal.

- GGPI stock is due to trade under ticker PSNY after the SPAC deal.

Gores Guggenheim's (GGPI) stock remains in a holding pattern as investors remain cautious about the lesser known EV maker. This appears to be largely a case of an unknown identity as it lags other EV makers in terms of brand awareness and stock awareness among US investors. This may be because Polestar is a Swedish EV maker and so is currently more visible in Europe. The company did attempt to change that with a noted Super Bowl ad, taking a dig at Tesla (TSLA) in the process.

Gores Guggenheim is due to take Polestar public via its SPAC deal this year. Polestar as mentioned is a Swedish EV maker with Volvo as the main backer. Volvo itself is owned by China's Geely, and so Polestar has backing here too. This makes it more well-established. The company will piggyback on Volvo's existing manufacturing capabilities to avoid the need for massive investment in manufacturing plants. This gives it an edge over other competitors such as Mullen Automotive (MULN), Lucid (LCID) and Rivian (RIVN) in our view.

Gores Guggenheim Stock News

Polestar currently has two models available, the Polestar 1 and Polestar 2. Both are sleek and Scandinavian-looking with sleek elegant lines. Build quality appears sound. With Volvo's expertise it should be. At the last investor day, Polestar said it aims to be profitable by 2024, which is likely much sooner than other start-up EV makers.

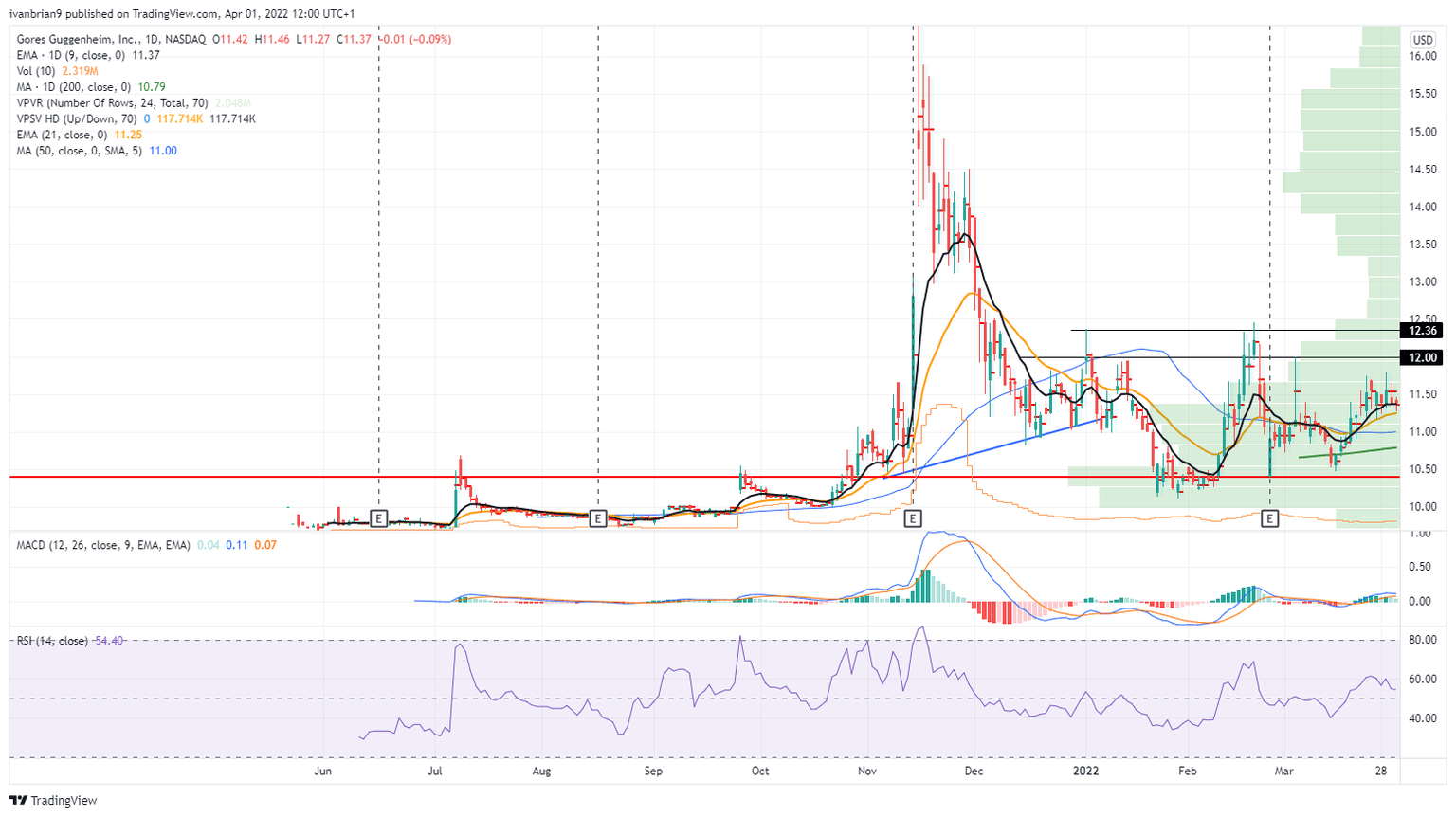

With the backing and scale from Volvo's manufacturing plants and Geely in China, it seems well-positioned to avoid supply chain issues and scale that have recently hit valuations of other EV carmakers. This looks to be a better bet with a more stable future, so why the relative underperformance then? The stock has barely moved from the $11-$12 range for the past six months. Some of this is pure ignorance of the Polestar model as it is yet to be seen in the US. The Superbowl ad attempted to change this and did result in a big price spike, but it did not hold as markets turned lower across the board.

Gores Guggenheim Stock Forecast

With $10 as a fallback, any purchases near that level at least give some form of protection. SPACs keep $10 in cash to return to shareholders in the event of the deal not proceeding, so there is a level of comfort here. The SPAC deal is due for completion in the first half of this year, but no firm date has been set. Once this is done it may begin to see interest grow.

GGPI stock chart, daily

The author is long GGPI stock.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.