Gores Guggenheim Stock News and Forecast: GGPI soars on Hertz partnership deal

- GGPI stock closes up over 11% on Monday to $12.82.

- Gores Guggenheim stock spikes on news of a partnership deal with Hertz.

- GGPI will take EV maker Polestar public via the SPAC deal.

Gores Guggenheim (GGPI) stock soared on Monday as news of a partnership deal with Hertz (HTZ) broke. GGPI soared up to $13.30 before falling back a bit by the close, but it still gained nearly 12% on the day. Gores Guggenheim is due to take EV maker Polestar public via a SPAC deal this year. The exact date is not yet finalized but it is expected to be in the first half of the year. Polestar is a Volvo and Geely-backed electric vehicle maker. The company already has a presence in most European countries but is building more slowly in the US. The cars look similar to Volvo models with sleek Scandinavian influences.

Gores Guggenheim (GGPI) stock news

Monday was big for GGPI as news broke of a major order for Polestar. Hertz is moving with the times and announced a 5-year partnership with Polestar to purchase up to 65,000 electric vehicles. This announcement is a follow-up from the deal announced in October last year with Tesla when HTZ announced it was to buy 100,000 Tesla vehicles. This sent the TSLA price skyrocketing by about 11%. GGPI also gained over 11% on Monday in a neat bit of symmetry.

The deal will first target the Polestar 2 with Hertz saying Polestar will be available for rental in Europe by Spring 2022, so that means now by my calendar! The Polestar 2 is a fastback vehicle with a range of up to 540km according to Polestar.

Stephen Scherr, CEO of Hertz, said “By working with EV industry leaders like Polestar, we can help accelerate the adoption of electrification while providing renters, corporate customers, and rideshare partners a premium EV product, exceptional experience, and lower carbon footprint.”

Polestar is competing in a crowded field alongside the likes of Tesla (TSLA), Mullen (MULN), Rivian (RIVN), and Lucid (LCID) and that is before we even consider legacy automakers switching to EV. Polestar will use Volvo's manufacturing and service network though, which appears to give it an advantage. It does not need large capital expenditure to build out manufacturing sites.

Gores Guggenheim (GGPI) stock forecast

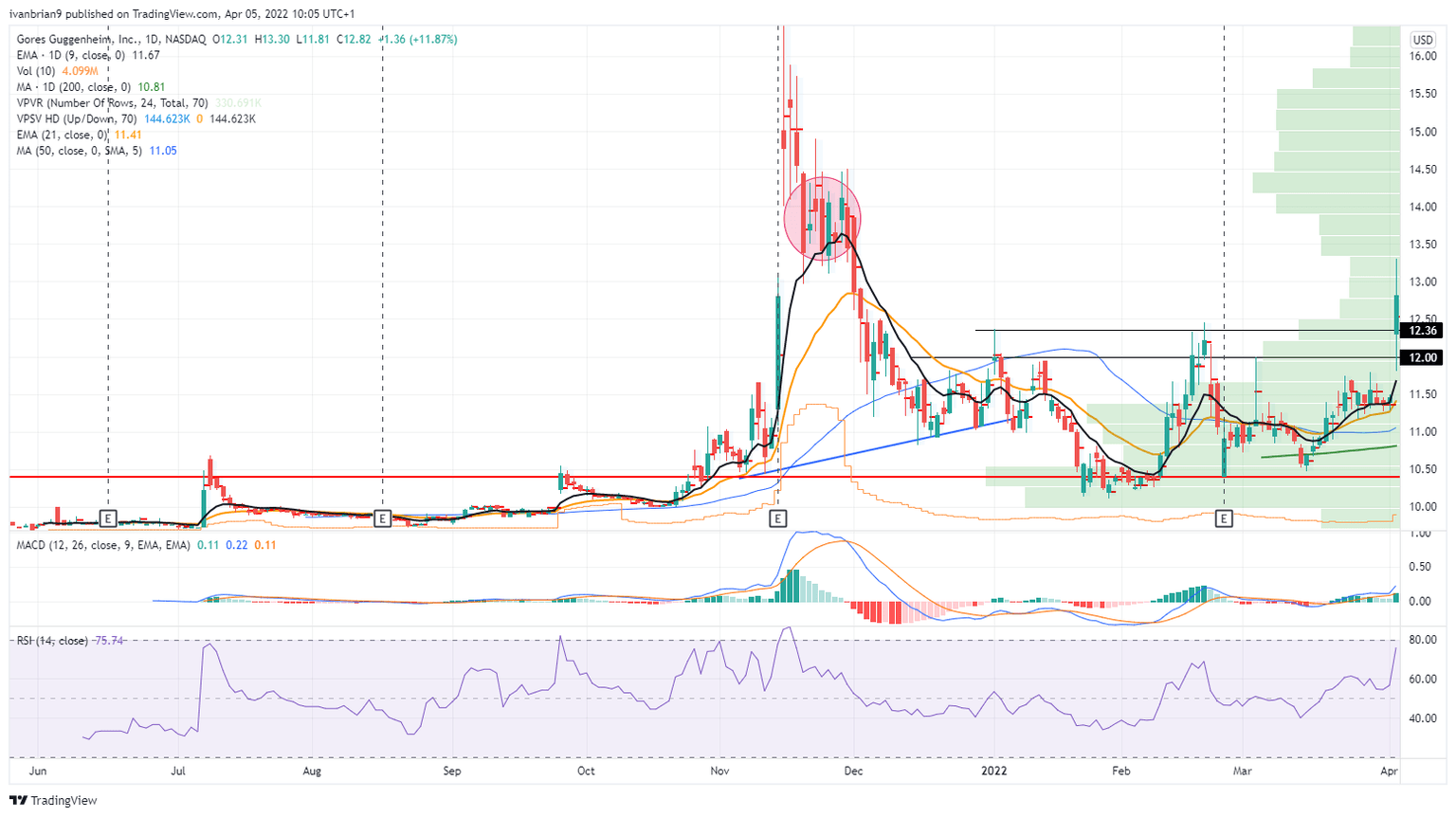

The move on Monday has taken GGPI stock above strong resistance at $12 and $12.36. These levels now become support if GGPI is to consolidate and begin a long-term uptrend. Resistance comes into play around $15 from the previous consolidation phase on the way down in November and December last year.

GGPI does not get as much attention from retail traders due to Polestar not yet being that visible in the US. This could see the stock fall back once newsflow slows. However, there should be further news in the first half of the year about the SPAC deal so that would be the next catalyst. In the meantime, we would not like to see GGPI break the now support zone at $12-$12.36, which would trigger a correction.

GGPI chart, daily

The author is long GGPI.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.