Goldman Sachs(GS Stock) – Putting its money where its reputation is

Arguably, Goldman Sachs is the most prestigious investment bank in the world. It has a reputation for thriving in the worst of times. This reputation proved itself during the great recession of 2008. Since then, the company has gone from strength to strength, expanding its portfolio and tapping into the consumer market. However, the company has still found it challenging to compete in the callous market conditions post-pandemic and had to raise entry-level salaries to attract new talent. So, are the good times over? Or will Goldman once again rise in the face of adversity?

A push for the future

Until 2008, Goldman Sachs was your typical investment bank. It had two main divisions: Underwriting and Trading. However, it seems that the financial crisis has opened the bank’s eyes to the risk it holds if it continues to operate only a business-facing institution.

As such, it has been trying to broaden its horizons ever since. It has done this mainly by entering consumer-facing businesses, where each of its clients contributes a lot less than their previous partners, but the number of clients is exorbitantly higher.

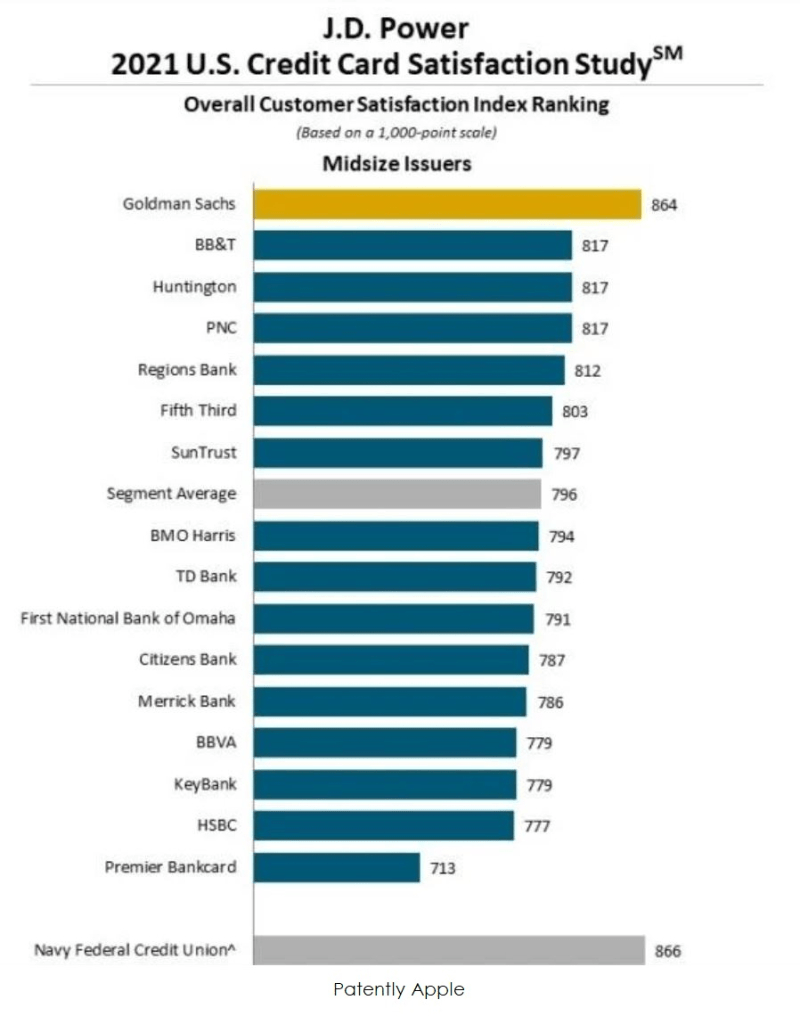

Its strategy for retail banking was simple: Leverage the Goldman Sachs brand name to entice people to use their products. In 2019, the company partnered with Apple, another company known for having the strongest brand in its industry (maybe even the world), to launch the Apple Card.

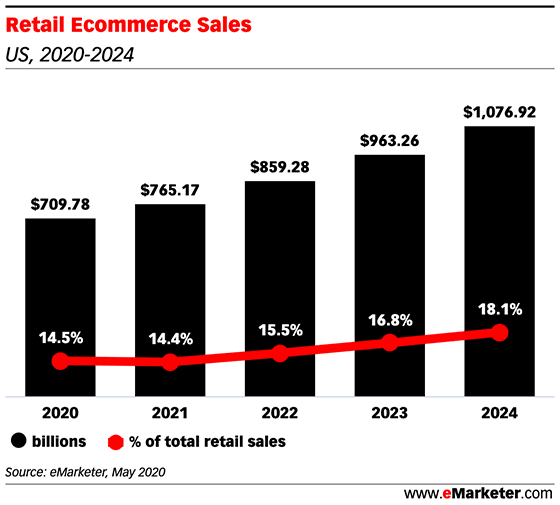

The Apple Card has been a resounding success, more than doubling its total users within a year. Now, Goldman plans to launch Apple Pay Later, a service that will try to tap into the gargantuan BNPL market. The BNPL market was around $710 billion in 2020 and is expected to be over $1070 billion by 2024.

We think Goldman has found the perfect partner in Apple. Apple has a loyal customer base that prefers to use Apple products above all else. Goldman should be able to leverage that to capture a substantial portion of the BNPL market.

Not your average financial services company

With a market cap of less than $150 billion, we wouldn’t be surprised if people thought Goldman Sachs was small fish. However, Goldman is a company that has access to resources that few other companies have, even those valued at over $1 trillion.

What we love about the expansion is that Goldman is sticking to industries it already knows. As such, the company finds it very easy to move into adjacent businesses. Apart from retail banking, the company’s venture capital arm is also beginning to pick up steam. For example, it recently led a series C funding round worth $110 million for DealerPolicy, a fintech company focusing on automobile insurance. Marcus by Goldman Sachs was added to the company's consumer banking portfolio in 2016. Marcus is an online bank that offers high-yield savings accounts, CDs, and no-fee personal loans. Marcus had $96 billion in deposits as of October 2020. According to The Smart Investor, Marcus is one of the top online savings accounts, with some of the best personal loans available.

As such, it is no surprise that analysts expect the company to do reasonably well over the next few years. Consensus estimates show revenues jumping from $44.5 billion in FY20 to $55.1 billion in FY21, followed by $45 billion over the next couple of years. This is, of course, due to the hefty profits that the company’s assets are expected to generate through capital appreciation. We do not expect similar earnings from the trading division from FY22 onwards, so the revenue is expected to decline.

On the other hand, net income is expected to be up on account of a higher net margin. COVID helped streamline many major corporations, Goldman being one of them. Analysts expect a net margin of between 25-30% from here onwards, instead of 20-25 % previously. As such, the P/E ratio, at 10.7 in FY20, is expected to drop to 7.82 in FY21 and go back up to 10.3 by FY23. Not great, but not bad either for an investment bank.

Gearing up for a profitable tomorrow

Goldman is not a company that consistently increases its quarterly dividend. In fact, the dividend had been stuck at $1.25 per share for a while. However, the company announced in June that it would increase its dividend to $2.00 per share, an increase of around 60%. The change will take place from the quarter ending September 2021.

This, coupled with everything mentioned above, makes Goldman Sachs a much better investment opportunity than other banks. We have always been apprehensive of investment banks and financial institutions during bull markets. Still, all data points to Goldman being a reasonable purchase for the value investor.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Baruch Silvermann

The Smart Investor

Baruch Silvermann is a personal finance expert, investor for more than 15 years, digital marketer and founder of The Smart Investor.