Gold extends range despite US PCE inflation data miss

- Gold extends its mini-range on Friday despite US Core Personal Consumption Expenditures inflation data falling below estimates.

- Technically, XAU/USD trends sideways, with odds still favoring an eventual break higher given the broader uptrend.

Gold (XAU/USD) trades mixed on Friday, edging down to trade in the $2,510s after the release of US inflation data in the form of the US Personal Consumption Expenditure (PCE) Index for July. The precious metal started the day mildly weaker after market sentiment turned positive following the release of surprisingly upbeat data from the US, which suggested the economy is unlikely to be heading for a hard landing.

US Core PCE data for July showed an annual increase in prices of 2.6% which was below the 2.7% forecast but the same as the 2.6% of the previous month. The monthly data showed prices rising 0.2% in line with estimates and up from the 0.1% of June, according to the US Bureau of Economic Analysis.

Headline PCE rose 2.5% which was below the 2.6% forecast but the same as the reading in June.

The expectation would normally be for a lower-than-expected result to support Gold as it suggests interest rates will decline in the US, lowering the opportunity cost of holding Gold, which is a non interest-bearing asset, however, this was not the case on Friday.

Gold meanders after US data

Gold treads water under key resistance at $2,531, the August and new all-time high, after the release of US PCE data for July. On Thursday the release of annualized Gross Domestic Product (GDP) growth was revised up to 3.0% in Q2 from 2.8% in the preliminary reading. That, and the slight fall in Initial Jobless Claims below estimates, helped dispel concerns the US economy was heading into a recession.

The data suggests the Federal Reserve (Fed) will probably take a more gradual approach to cutting interest rates, although markets are still pricing in around 100 basis points (1.00%) of cuts before year end. The expectation of interest rates falling is positive for Gold because it reduces the opportunity cost of holding the non-interest paying asset, making it more attractive to investors.

China could hold key to Gold price outlook

Gold saw some support after data from the World Gold Council (WGC) released Tuesday showed overall Chinese Gold imports rose by a net 17% in July, the first month of increases since March. North American funds also noted a modest increase in net inflows of 8 metric tons ($403 million) last week, according to the WGC.

Indeed, the long-term outlook for Chinese demand looks positive, according to research by advisory service Capital Economics. A slowdown in the economy will make Gold a more attractive safe-haven asset for investors and the People’s Bank of China (PBoC), already a major buyer, will probably increase its Gold reserves which remain relatively low in comparison to other countries (3% versus 9% for India, for example). Efforts by the BRICS to de-Dollarize, with Gold as the most likely replacement, is a further factor likely to increase long-term demand.

That said, Capital Economics does not see increased demand from China in the short term.

“A combination of cyclical factors point towards gold demand in China weakening in the near term,” Capital Economics warns. “Higher prices are already weighing heavily on jewelry demand, fiscal stimulus should provide a much-needed lift to the economy, and we expect stock market performance to pick up given that local equities seem lowly valued to us.”

Traders are now looking ahead to the release of the Fed’s preferred gauge of inflation, the Personal Consumption Expenditures (PCE) Price Index. Economists expect the core PCE inflation gauge to rise to 2.7% in July from 2.6% in June YoY. Any divergence from this estimate will likely impact Gold price: higher inflation will weaken Gold by suggesting the Fed needs to keep interest rates elevated for longer; the opposite would be the case from a lower-than-expected result.

Another risk to Gold price in the near-term is extreme long positioning in the derivatives market, according to Daniel Ghali, Senior Commodity Strategist at TD Securities, who claims the long trade is now overcrowded.

“Downside risks are now more potent. The ship is crowded. In fact, it has scarcely been as crowded as it is today. Do you have a slot secured on the lifeboat?” adds the strategist.

On Thursday, TD Securities announced they are entering a tactical short position in the commodity, with an entry at $2,533, a target at $2,300, and a stop loss at $2,675.

Technical Analysis: Mini-range extends but overall trend remains bullish

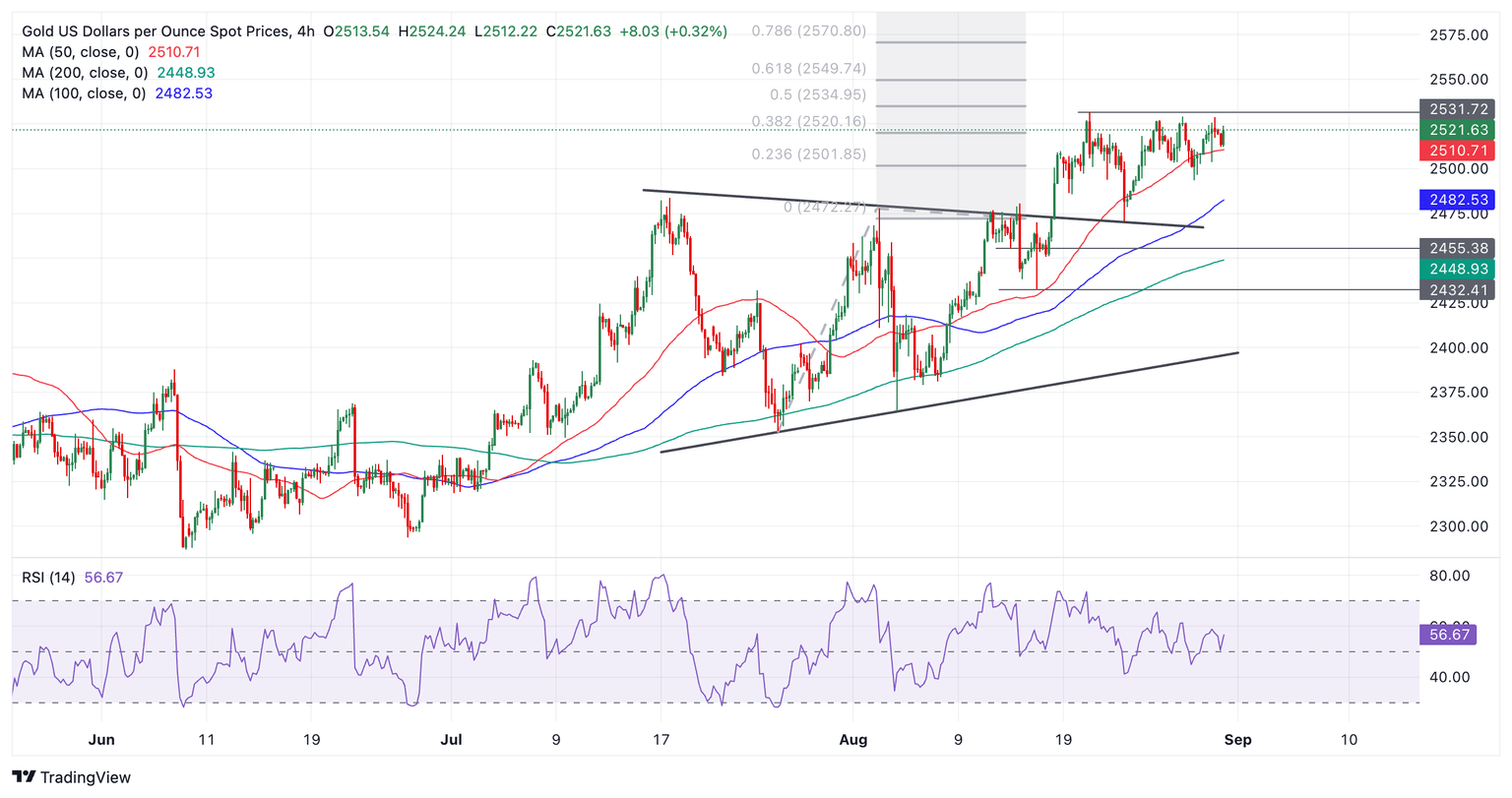

Gold (XAU/USD) continues trading within a mini-range above its prior range. The short-term trend could now probably be characterized as “sideways” and therefore more likely than not to continue oscillating until a breakout occurs to break the pattern.

Gold’s medium and long-term trends remain bullish, which given “the trend is your friend,” means the odds favor an eventual breakout higher materializing.

XAU/USD 4-hour Chart

The breakout from the prior range (which also resembles an incomplete triangle pattern) that occurred on August 14 generated an upside target at roughly $2,550, calculated by taking the 0.618 Fibonacci ratio of the range’s height and extrapolating it higher. This target is the minimum expectation for the follow-through from a breakout based on principles of technical analysis.

A break above the $2,531 August 20 all-time high would provide confirmation of a continuation higher towards the $2,550 target.

Alternatively, a break back inside the range would negate the upside projected target. Such a move would be confirmed on a daily close below $2,470 (August 22 low). It would change the picture for Gold and suggest the commodity might be starting a short-term downtrend.

Economic Indicator

Gross Domestic Product Annualized

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation’s overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Thu Aug 29, 2024 12:30 (Prel)

Frequency: Quarterly

Actual: 3%

Consensus: 2.8%

Previous: 2.8%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.