Gold rises as US Dollar dips on Rusia-Ukraine concerns

- Gold prices rally over 1.80%, boosted by geopolitical developments and a dip in the US Dollar Index to 106.27.

- Recent US support for Ukraine escalates tensions, influencing safe-haven assets and impacting the Greenback.

- Traders adjust Fed rate cut expectations, with a decrease in the likelihood of a December adjustment from 82% to 62%.

Gold price rallied over 1.80% at the beginning of the week and climbed above $2,600 after falling to a two-month low of $2,536. An escalation of the Russia-Ukraine conflict, along with a weak US Dollar, opened the door for Gold’s leg up on Monday. At the time of writing, XAU/USD trades at $2,610.

Wall Street sentiment is mixed. Two of the four largest US equity indices trade with gains, while the other two fluctuate. Geopolitics continued to drive the bullion’s price action after Russia’s massive attack on Ukraine triggered a reaction by the White House.

Recently, two officials revealed that US President Joe Biden authorized Ukraine's use of long-range missiles inside Russia, CNN revealed. The decision comes as a reaction to thousands of North Korean troops being deployed in support of Moscow’s war effort.

This weighed on the Greenback, which, according to the US Dollar Index (DXY) that tracks the buck's performance against a basket of six currencies, dropped some 0.38% to 106.27.

Nevertheless, former US President Donald Trump’s victory bolstered the Greenback on fears that tariffs and lower taxes are seen as potential drivers of inflation and might slow the Fed’s easing cycle.

The Fed is expected to lower borrowing costs for the third straight meeting in December. Nevertheless, recent data has witnessed investors trimming the odds from an 82% chance of an imminent cut of 25 basis points (bps) to 62%, according to CME FedWatch Tool data.

Ahead of this week, the US economic schedule will feature housing data, Initial Jobless Claims, S&P Global Flash PMIs, and the University of Michigan (UoM) final reading of Consumer Sentiment for November.

Gold price soars amid a weak US Dollar

- Gold prices recover as US real yields, which inversely correlate against bullion, fall three basis points to 2.088%.

- US Treasury bond yields were also pressured ahead of the weekend, with the 10-year benchmark rate down two basis points to 4.42%.

- Boston Fed Susan Collins said the US central bank does not urgently need to lower rates. Lastly, Chicago’s Fed Austan Goolsbee kept the central bank options open regarding December’s meeting, adding, “The dispute on neutral rate could support slower cuts.”

- According to data from the Chicago Board of Trade via the December fed funds futures contract, investors are pricing in 24 basis points of Federal Reserve rate cuts by the end of 2024.

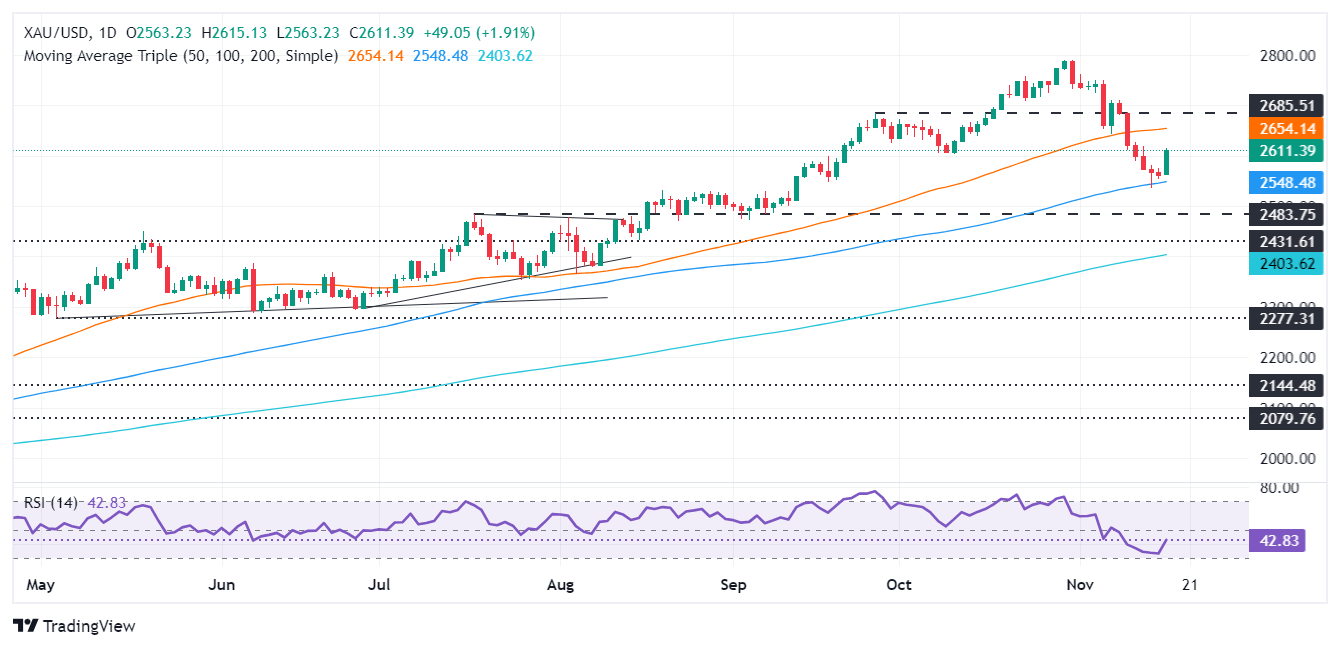

Gold price recovers as buyers target 50-day SMA

Gold price resumed its upside as expected, following November 14, once a ‘hammer’ was formed, which opened the door for a rebound. Once XAU/USD has risen above the October 10 swing low of $2,603, buyers emerged and eyed the 50-day SMA at $2,653, with further resistance around $2,700. Exceeding this could pave the way to the November 7 high of $2,710.

On the other hand, further losses are seen below the November 14 swing low of $2,536, but firstly, traders will face the 100-day Simple Moving Average (SMA) at $2,547. Once those two levels are taken, Gold’s next support would be $2,500.

The Relative Strength Index (RSI) has moved away from its neutral line, indicating bearish momentum that could lead to further declines in XAU/USD.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.