Gold set to close off this week at a fresh all-time high

- Gold price rallies over 0.7% and ekes out a fresh all-time high at $3,086.

- Markets are heading into safe-haven Gold while Equities and Cryptocurrencies drop.

- Gold traders are now targeting $3,100 in the near term.

Gold price (XAU/USD) is printing another record performance this Friday, hitting $3,086 as the new all-time high for now and trading around $3,077 at the time of writing. Bullion sees another wave of safe-haven inflow, this time from investors that are exiting Equity and Crypto positions. From here, the next big psychological target and level to beat will be $3,100.

The US Personal Consumption Expenditures (PCE) data for February came in. The monthly core PCE came in higher at 0.4% against the expected 0.3%, while the headline figure remained cemented at 0.3% as well.

These past few days, inflation concerns in the United States (US) have been picking up as the impact of the United States (US) President Donald Trump’s tariff implementations on inflation is hard to measure. The risks of the US economy heading into recession or stagflation are major concerns for investors and could bring moves in Equity and Bond markets, and see Gold extending further.

Daily digest market movers: Reciprocal tariffs on their way

- Inflation in France and Spain undershot expectations this Friday, supporting calls for more interest rate cuts by the European Central Bank (ECB). The French headline Consumer Price Index year-on-year grew steadily by 0.9% this month, defying analyst predictions for an uptick. In Spain, it slowed by 2.2%, a much deeper deceleration than expected, and is the first country that approaches the ECB’s target of 2%, Bloomberg reports.

- Some fair-value modeling reveals that Gold is 13% overvalued, suggesting that further policy uncertainty regarding US tariff execution is already factored in. A peace deal for Ukraine could see the precious metal give up some gains as geopolitical risk perceptions ease, Reuters reports.

- On Thursday, US President Donald Trump signed a proclamation to implement a 25% tariff on auto imports and pledged harsher punishment on the EU and Canada if they join forces “to do economic harm” against the US, while April 2nd approaches fast for the so-called reciprocal tariff implementation, Bloomberg reports.

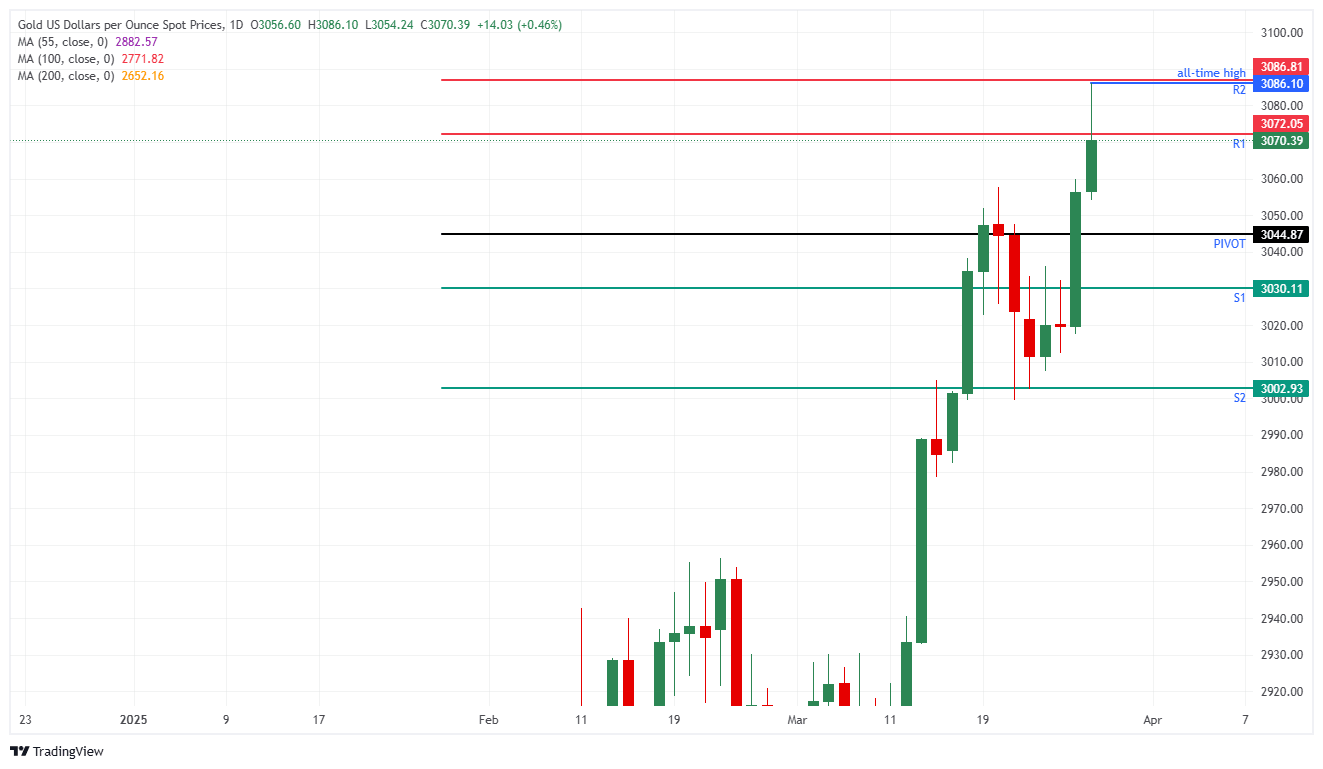

Gold Price Technical Analysis: Not giving up

Traders are starting to throw in the towel on Equities and Crypto, with Gold being the hottest place in town. More and more analysts are revising their calls for Gold to higher levels, which means that a crucial point of being ‘overbought’ is starting to grow. Taking part in the rally still makes sense, but at least paying attention to specific levels will make the trade more manageable on where to get in, where to take profit, or when to stop it out.

On the upside, the daily R1 resistance for XAU/USD comes in at $3,072 and has already been tested earlier this Friday. Further up, the R2 resistance at $3,086 coincides with the fresh all-time high. Once from there the $3,100 mark looks far off, but still, it could see the rally at least move in that direction.

On the downside, the first support to be considered is the daily Pivot Point at $3,044, followed by the intraday S1 support at $3,030. Further down, the S2 support comes in at $3,002, which roughly coincides with the $3,000 mark psychological level.

XAU/USD: Daily Chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

BRANDED CONTENT

Not all brokers provide the same benefits for Gold trading, making it essential to compare key features. Knowing each broker’s strengths will help you find the ideal fit for your trading strategy. Explore our detailed guide on the best Gold brokers.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.