Gold price strengthens as Russia revises nuclear doctrine

- Gold price recovers further to nearly $2,635 on the fresh escalation in the war between Russia and Ukraine.

- Vladimir Putin has signed a decree to update the country’s nuclear doctrine.

- Fed officials refrain from forecasting the impact of Trump’s policies on the economy.

Gold price (XAU/USD) extends its recovery for a second consecutive day, trading around $2,635 in North American trading hours on Tuesday. The precious metal strengthens on fears of an escalation in geopolitical tensions as Russian President Vladimir Putin approved revision in the country’s nuclear policy revision. The move has escalated fears of a nuclear war, prompting investors to flee towards safe-haven assets such as Gold.

The nuclear doctrine "concerns the fact that the Russian Federation reserves the right to use nuclear weapons in the event of aggression with the use of conventional weapons against it" where that is deemed to have created "a critical threat to sovereignty or territorial integrity,” Dmitry Peskov, Press Secretary of the President of the Russian Federation, told TASS on Tuesday. Peskov also stated that Russia acknowledges US President Joe Biden’s approval of the supply of missiles to Ukraine as an intent to prolong the conflict, which is unacceptable and could lead to a third world war.

Putin's clearance to updation of nuclear doctrine appeared to be an answer to the United States (US) for backing Ukraine’s military strength by allowing Kyiv to use Washington-supplied ATACMS missiles to attack Russia’s Kursk region.

According to reports from local media RBC citing a source from the Ukrainian Armed Forces, Ukraine had already launched US-made ATACMS ballistic missiles into Russia. Historically, the safe-haven appeal of precious metals such as Gold increases at times of uncertainty or heightened geopolitical risks.

Leading investment banking firm Goldman Sachs is bullish on the Gold price for a year-long horizon and sees it rising to $3,000 by 2025 on multiple tailwinds. “The structural driver of the forecast is higher demand from central banks, while a cyclical lift would come from flows to exchange-traded funds as the Federal Reserve cuts (interest rates).”

Daily digest market movers: Gold price recovers strongly as geopolitical risks deepen

- Gold price has recovered almost 38% of the losses seen in the first half of November amid increasing geopolitical worries. The precious metal faced an intense sell-off as the US Dollar (USD) and bond yields strengthened on expectations that changes in fiscal and external policies promised by President-elected Donald Trump in his election campaign would be implemented smoothly, given his victory in both houses.

- Trump has vowed to raise import tariffs by 10% universally and lower taxes. This scenario is expected to boost inflation and economic growth, which could result in slower and fewer interest rate cuts by the Federal Reserve (Fed). However, Fed officials, including Chair Jerome Powell, have avoided commenting on the possible repercussions of Trump’s policies on the economy.

- The impact of Trump’s victory is visible in market expectations for the Fed's interest rate path. According to analysts at Nomura, the Fed is expected to leave interest rates unchanged in the December meeting. "We currently expect tariffs will drive realized inflation higher by the summer, and risks are skewed towards an earlier and more prolonged pause,” analysts at Nomura said.

- At the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, surrenders its intraday gains and falls back to near the key support of 106.00.

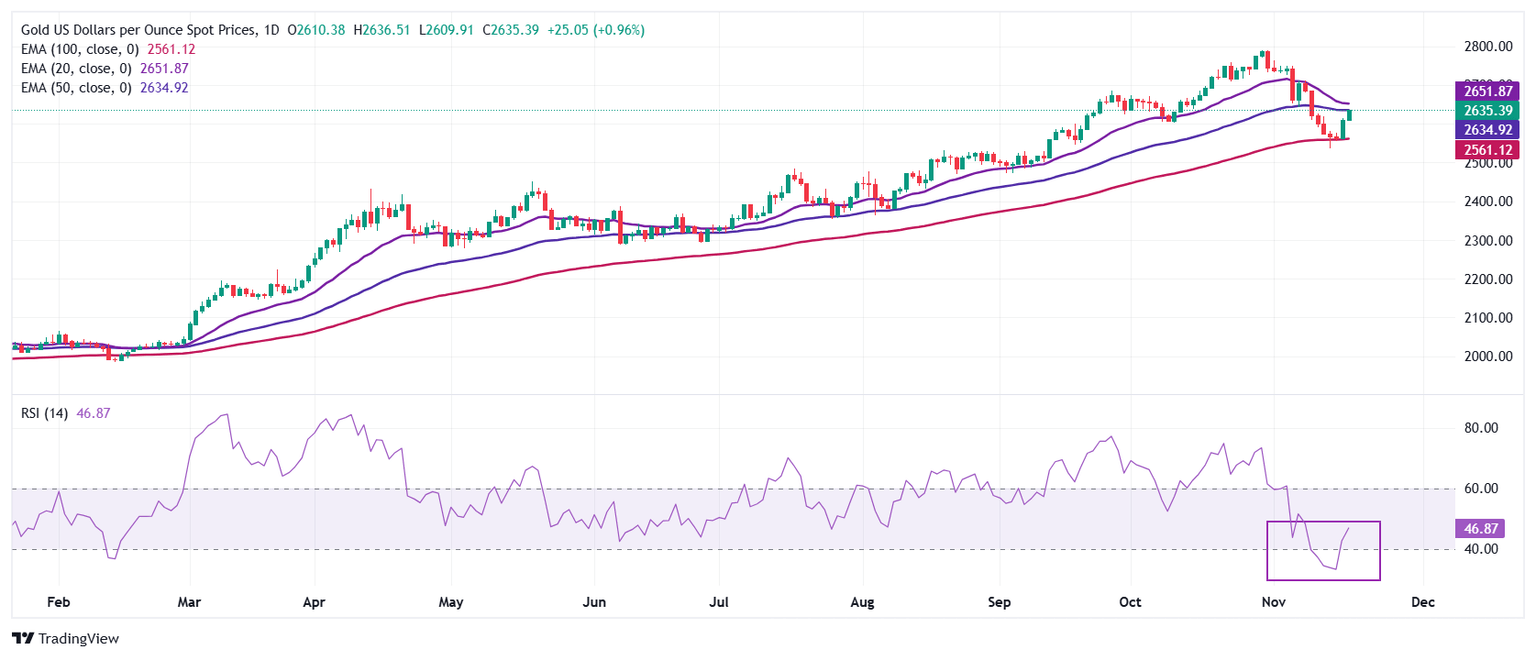

Technical Analysis: Gold price revisits 50-day EMA near $2,635

Gold price bounces back strongly after discovering support near the 100-day Exponential Moving Average around $2,535. The precious metal has recovered to near the 50-day Exponential Moving Average (EMA) around $2,635.

The 14-day Relative Strength Index (RSI) has rebounded above 40.00, suggesting that the bearish momentum is over.

Going up, the 20-day EMA around $2,650 will be a key barrier to the Gold price bulls. On the downside, the 100-day EMA will be a major support.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.