Gold records all-time high, surpasses $2,600

- Gold surges to new all-time high above $2,600, fueled by expectations of further Fed rate cuts.

- Safe-haven demand spikes due to escalating tension between Israel and Hezbollah.

- Fed Governor Waller backs 50 bps rate cut; however, dissenting Fed member Michelle Bowman prefers a smaller cut to guard against declaring an early win on inflation.

Gold prices climbed past $2,600, recording new all-time highs amid increasing speculation that the Federal Reserve (Fed) will continue to lower borrowing costs and heightened tensions between Israel and Hezbollah in the Middle East. The XAU/USD trades at $2,621, up 1.37%.

Risk aversion is the game's name, which is portrayed by Wall Street’s three leading indices all posting losses between 0.26% and 0.31%. Fed Governor Christopher Waller stated that cutting 50 basis points was appropriate, citing expectations that the August Personal Consumption Expenditures (PCE) Price Index would be very low.

Waller added that inflation is softening more rapidly than anticipated, which is concerning to him. He also noted that the Fed could take further action if the labor market deteriorates or inflation data soften quickly.

Meanwhile, correlations are not playing a huge role as US Treasury yields rise with Gold prices and the Greenback. The US 10-year Treasury note yields 3.726%, up by one and a half basis points. The US Dollar Index (DXY), which tracks the American currency’s value against the other six, advanced some 0.08% to 100.71.

A scarce economic schedule in the US left Gold’s direction on the shoulders of additional Fed speakers. Michelle Bowman dissented to a 50 bps cut. Although it was appropriate to adjust the policy, she preferred a smaller cut, as risks on the decision could be interpreted as a “declaration of victory on inflation.”

Looking ahead into the next week, the Fed parade begins with Atlanta Fed’s Raphael Bostic, Chicago’s Austan Goolsbee, and Minnesota’s Neel Kashkari. On the data front, S&P Global Flash PMIs, along with housing data and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, will dictate the XAU/USD forward path.

Daily digest market movers: Gold price traders eye next week’s busy US schedule

- Overall weakness on the US Dollar and elevated tensions in the Middle East kept Gold’s rally underway.

- Bullion prices had risen over 27% in 2024, the biggest annual rise since 2010.

- China and India's physical demand for Gold has overshadowed anemic inflows into Gold-backed ETFs.

- The Summary of Economic Projections indicates the Fed projects interest rates to end at 4.4% in 2024 and 3.4% in 2025.

- Inflation, as measured by the Core Personal Consumption Expenditures Price Index, is estimated to reach its 2% target by 2026, with forecasts of 2.6% in 2024 and 2.2% in 2025.

- US economy will likely grow at a 2% pace in 2024 with the Unemployment Rate rising to 4.4% by the end of the year.

- December 2024 fed funds rate futures contracting suggests that the Fed might lower rates by at least 53 basis points, implying that in the following two meetings this year the market expects one 25 bps cut in November and December.

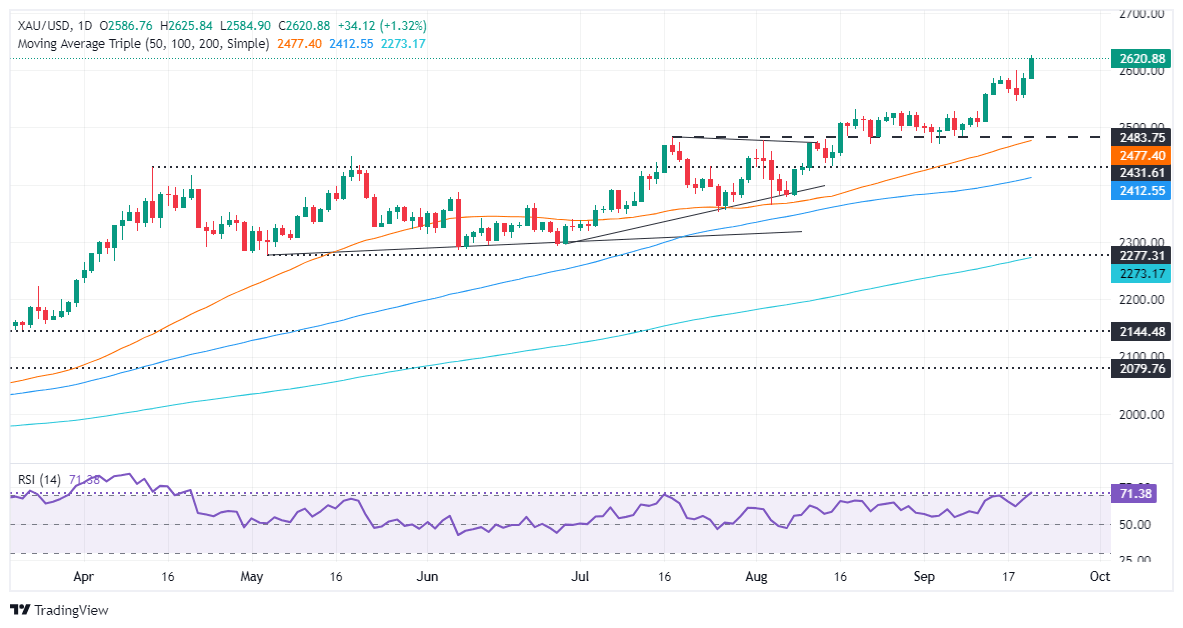

XAU/USD technical outlook: Gold price hits record highs above $2,600

Gold’s uptrend continues after hitting a new all-time high (ATH) at $2,625. Even though all the signs point upwards, the rally of the golden metal seems overextended, opening the door for a pullback before aiming to new record highs.

Momentum favors buyers. The Relative Strength Index (RSI) aims upwards in bullish territory and not in overbought territory. Therefore, the path of least resistance is tilted to the upside.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.