Gold price falls and end week below $2,500 ahead of US inflation data

- Gold tumbles after failing to break $2,531 resistance, closing at $2,493 as Fed rate cut speculation intensifies.

- US Nonfarm Payrolls missed estimates, but improved figures and rising hourly earnings fueled uncertainty over a 25 or 50 bps cut.

- Despite falling Treasury yields, the US Dollar Index recovered above 101.00, pressuring Gold prices further.

Gold retreated after failing to test the all-time high of $2,531 and diving more than 0.80% late in the North American session. US economic data cast doubts on a 50 or 25-basis-point (bps) interest rate cut by the Federal Reserve (Fed) at the September meeting. The XAU/USD trades at $2,493 after hitting a high of $2,529.

The US Bureau of Labor Statistics (BLS) revealed that Nonfarm Payrolls (NFP) in August missed their estimate but improved compared to July’s downwardly revised number. Digging deep into the report, the Unemployment Rate dipped compared to the previous month, while Average Hourly Earnings rose.

According to the data, Fed interest rate probabilities fluctuated sharply. Based on CME FedWatch Tool data, at some point, traders priced a 50 bps cut with odds rising as high as 70%. Nevertheless, as the dust settled, market participants estimated that a 25 bps cut was more likely as the chances of it rose by 73%, while for a 50 bps cut they decreased to 27%.

In the meantime, Fed policymakers crossed the newswire. New York Fed President John Williams said that lowering rates soon will help to keep the labor market balanced. Fed Governor Christopher Waller echoed some of his comments at a speech at the University of Notre Dame. He said, “The time has come” to begin easing policy and revealed that he was open to any size of easing.

Recently, Chicago Fed President Austan Goolsbee was dovish, saying policymakers have an “overwhelming” consensus to reduce borrowing costs.

Given all these developments, Gold prices tumbled despite US Treasury yields falling. Lately, the Greenback recovered after sliding below 101.00 and gained over 0.15%, as shown by the US Dollar Index (DXY), which is up at 101.22.

In the geopolitical space, US Secretary of State Antony Blinken said, “90% of the Gaza ceasefire agreement is agreed upon, but critical issues remain where there are gaps; Incumbent on both parties to get to yes on remaining issues,” via Reuters.

Daily digest market movers: Gold price descends as traders ignore mixed US jobs report

- US NFP increased by 142K in August, missing the forecast of 160K. Additionally, July's figures were revised downward from 114K to 89K.

- Unemployment Rate dipped from 4.3% to 4.2%, while Average Hourly Earnings rose from 3.6% to 3.8% YoY in August.

- Data from the Chicago Board of Trade indicates that the Fed is expected to cut at least 104 basis points (bps) this year, up from 103 bps a day ago, based on the December 2024 fed funds rate futures contract.

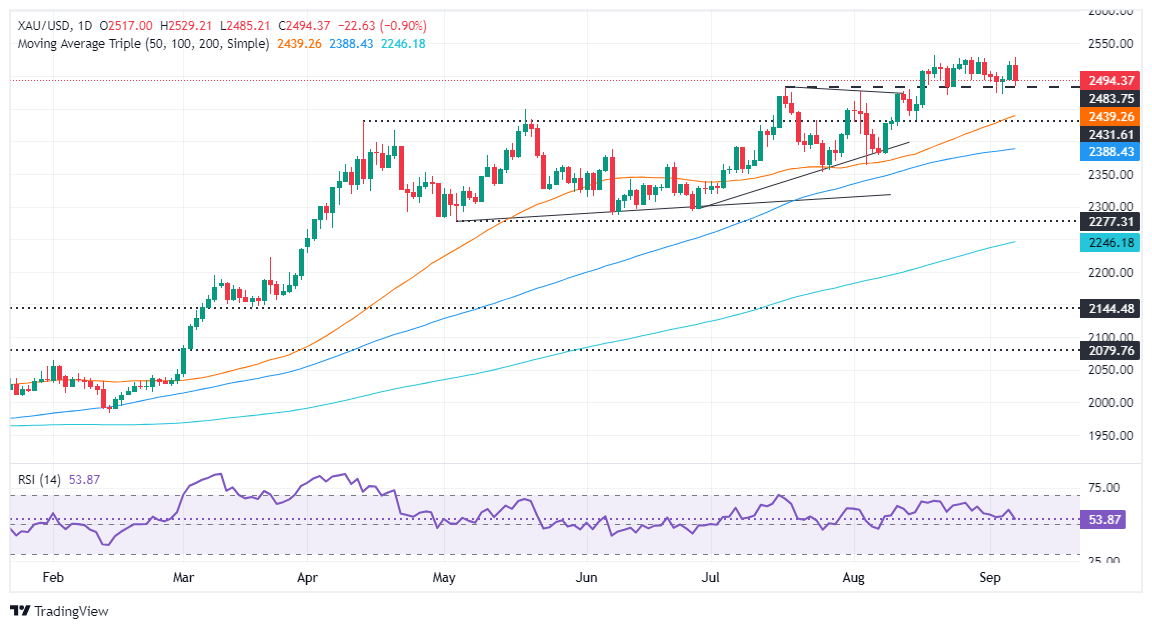

Technical outlook: Gold price tumbles below $2,500 due to USD strength

Gold prices remain upwardly biased, but in the short term they seem to have shifted negatively. After XAU/USD hit a daily peak above $2,520, it reversed its course and formed a “bearish engulfing” candle chart pattern, which opened the door for additional losses.

Momentum turned bearish as depicted by the Relative Strength Index (RSI). The RSI is about to cross below its neutral level.

If XAU/USD drops below the August 22 low at $2,470, that opens the door for further downside. The next demand zone would be the confluence of the April 12 high, which turned into support, and the 50-day Simple Moving Average (SMA) between $2,435 and $2,431.

On the other hand, if buyers lift prices above $2,500, the next resistance would be the year-to-date high at $2,531. If surpassed, the next stop would be the psychological $2,550 level, followed by the $2,600 mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.