Gold holds firm above $2,600 as geopolitical jitters, dovish Fed fuels demand

- Gold price remains steady at $2,637 amid thin Thanksgiving trading.

- Trump's tariff threats weigh on Gold, but easing rhetoric towards Canada and Mexico offers some relief.

- Market eyes 70% chance of a 25 bps Fed rate cut, supporting gold as Treasury yields stay subdued.

Gold price consolidated around $2,630 on Thursday amid thin liquidity trading as US markets are closed for Thanksgiving. Geopolitics continued to drive the price of non-yielding metal, which dwindled during the last three trading days. The XAU/USD trades at $2,637, virtually unchanged.

Market mood improved on Thursday, partly due to Israel and Lebanon's 60-day ceasefire. However, the escalation of the Russia-Ukraine conflict could keep Bullion prices firmly above $2,600.

US President-elect Donald Trump's tariff threats on China, Canada, and Mexico limited the advance of the golden metal, with traders flying towards the safety of the Greenback. Sources cited by Reuters said, “It did increase a bit of concern about the possible repercussions from these two countries. So that continues to remain an important support factor for gold.”

Following Trump’s remarks, Gold tumbled due to risks linked to his threats. However, recent developments suggest that the US President-elect has eased his rhetoric to Canada and Mexico.

Gold recovered after the report and as market participants eyed another 25 basis point interest rate cut by the Federal Reserve at the upcoming December meeting.

The swaps market sees a probability of 70% of such a decision, according to the CME FedWatch Tool, as the odds improved from around 55% at the beginning of the week.

This would keep US Treasury bond yields depressed, which could undermine the Greenback.

Ahead this week, the US economic docket is absent, barring a surprise of a Federal Reserve speaker in the media. Next Monday, the schedule will be busy with the release of S&P Global and ISM Manufacturing PMI, and Fed Governor Christopher Waller crossing the wires.

Daily digest market movers: Gold prices fluctuate near $2,630

- Gold prices recovered as US real yields remained unchanged at 1.9906%.

- US data released on Wednesday showed the economy growing 2.8% in Q3, below estimates but unchanged from the preliminary estimate.

- This, along with the latest Core PCE Price for October coming at 2.8% YoY up from estimates of 2.7%, suggests the disinflation process has stalled and that the Fed might begin to pause cutting rates.

- Data from the Chicago Board of Trade, via the December fed funds rate futures contract, shows investors estimate 24 bps of Fed easing by the end of 2024.

Technical outlook: Gold price advances modestly, clings to $2,630

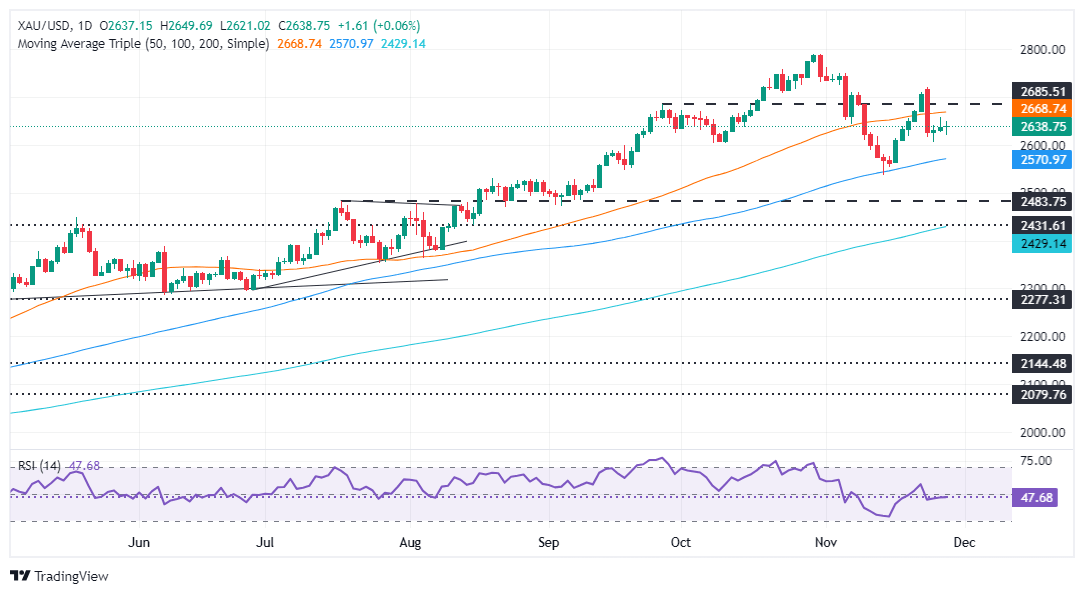

Gold price is consolidated within the 50 and 100-day Simple Moving Averages (SMAs), each at $2,668 and $2,572, respectively. Nevertheless, some upside in the short term is seen due to Gold’s being slightly pressed toward the former, but buyers need to clear key resistance levels.

If Gold clears the 50-day SMA, the next stop would be the $2,700 figure. A breach of the latter will expose the psychological $2,750, and the all-time high at $2,790.

Conversely, If bears push prices below $2,600, it will open the door to testing the 100-day SMA of $2,572, immediately followed by the November 14 swing low of $2,536.

Oscillators like the Relative Strength Index (RSI) have shifted bearishly, indicating sellers are in charge.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.