Gold steadies underneath its fresh all-time high ahead of US trading session

- Gold this Thursday has already performed a fresh all-time high at around $2,955.

- US President Donald Trump called Ukraine a dictatorship which started the war.

- More all-time highs in Gold are possible if the Greenback weakens further and US yields drop off.

Gold’s price (XAU/USD) orbits near its fresh all-time high after already having printed one in early European trading on Thursday. The push higher comes after United States (US) President Donald Trump said that a trade deal with China could be possible. Geopolitical concerns at the same time grew after President Trump said Ukraine started the war with Russia and alluded it is time to repay the US for all the funding provided.

Meanwhile, the Federal Reserve (Fed) Minutes for the January policy meeting released on Wednesday had little impact. Only a handful of Federal Open Market Committee (FOMC) members advocated for a steady interest rate and no rush for any cuts. Considering this, chances for a June interest rate cut still stand.

Daily digest market movers: Flights to NY

- Thousands of Gold bars are being physically moved from the Bank of England's vaults to the US futures market, exposing logistical bottlenecks in the global market. The move is driven by an arbitrage opportunity created by speculation that US President Donald Trump will impose tariffs on Gold, with traders buying spot Gold in London and selling futures contracts in the US, Bloomberg reports.

- Gold Fields Ltd. said its full-year profit surged by 77% last year after the precious metal price soared, while the company started to overcome operational challenges at mines in Chile and South Africa, Reuters reports.

- The relationship between the US and Ukraine reached a new low on Wednesday, with a social media frenzy between US President Donald Trump and Ukraine’s President Volodymyr Zelenskiy. There are growing concerns that Trump could halt American support for Ukraine after Russia invaded its neighbor in 2022. The US leader said on social media on Wednesday that Volodymyr Zelenskiy should “better move fast” to reach a deal with Russia, “or he is not going to have a country left,” Bloomberg reports.

Technical Analysis: End of the road

Even with a softer tone on tariffs and a possible trade deal between the US and China, traders will still have enough reasons to push XAU/USD further up. The path to $3,000 looks set, and it is just a matter of time before Gold reaches it. As with several other asset classes, once the precious metal frenzy reaches the masses, it would be the cue to sell.

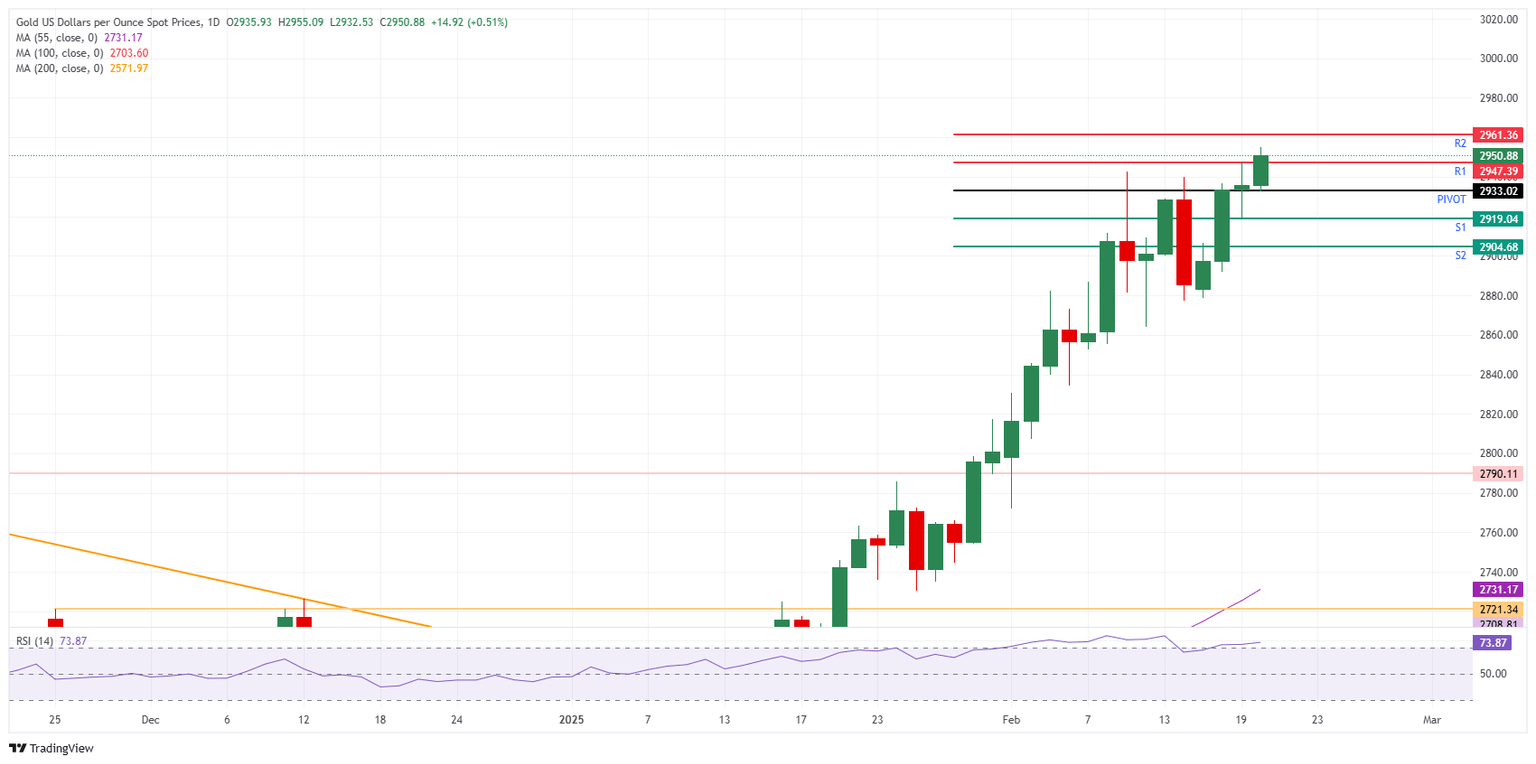

The first support for Thursday is $2,947, the Pivot Point's R1 resistance, which coincides with Wednesday’s high. Further down, the daily Pivot Point comes in at $2,933. Below that level, Wednesday's low and the S1 support converge at $2,919, which should be strong enough to support and brief selling pressure.

On the upside, the target level for Thursday is the R2 resistance at $2,961. With a light economic calendar, the level is likely to be tested later in the day. From there, the $3,000 handle comes in, although it might still be a bit too high to be tested this week.

XAU/USD: Daily Chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

(This story was corrected on February 20 at 10:19GMT to say that traders buying spot Gold in London and selling futures contracts in the US, Bloomberg reports, not "Bloomberg supports.")

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.